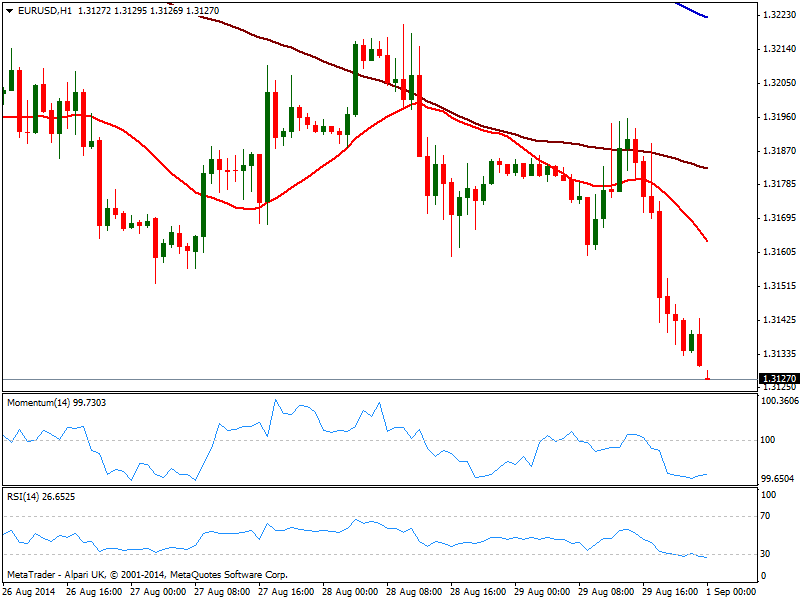

EUR/USD Current price: 1.3127

View Live Chart for the EUR/USD

USD dollar continues to be the leader of the forex board, starting the week maintaining its strong foot particularly against weaker EUR and JPY. The common currency trades at its lowest level in 11-month, with September last year low at 1.3105, immediate support. Ahead of a quite busy week that will include ECB meeting, local GDP and Services PMI readings, not much action should be expected Monday, with US on holidays due to Labor Day.

Technically the hourly chart shows price at fresh lows, with momentum flat in negative territory, and RSI entering oversold levels, while 20 SMA heads lower above current price, all of which supports a steady decline. In the 4 hours chart momentum heads strongly south with RSI also in oversold territory and 20 SMA offering dynamic resistance around 1.3180 in case of a recovery, supporting the shorter term view.

Support levels: 1.3105 1.3090 1.3050

Resistance levels: 1.3145 1.3180 1.3215

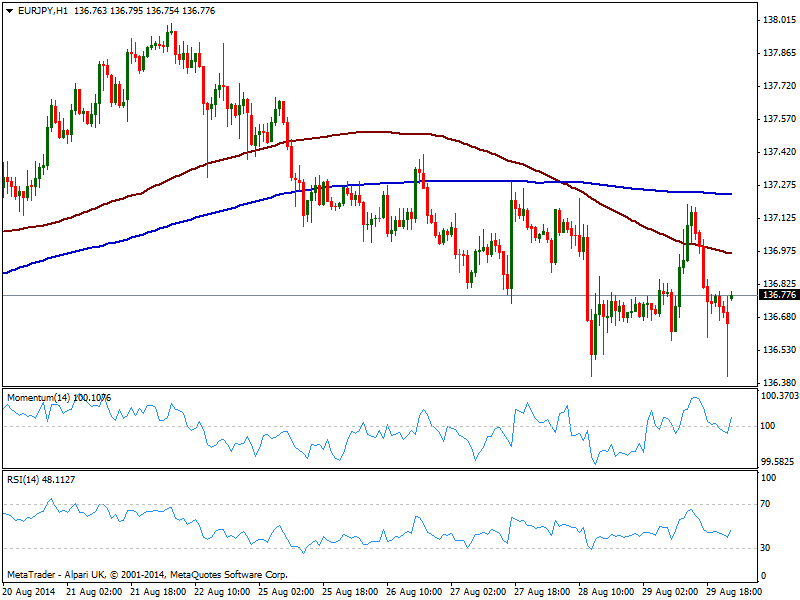

EUR/JPY Current price: 136.77

View Live Chart for the EUR/JPY

Despite both being weak against the greenback, JPY outperforms EUR, with the pair presenting an overall bearish stance, having established past August a year low of 135.72. The short technical picture however, shows the pair gapping slightly higher at the opening, with the hourly indicators crossing their midlines to the upside, yet price well below 100 SMA currently around 136.90, while 200 one stands above it, at 137.30, both acting as intraday resistances. In the 4 hours chart however indicators remain below their midlines, while moving averages converge in the 137.00/10 area suggesting upward movements will remain limited: price needs to establish at least above the 136.90 level to be able to extend its gains, quite unlikely at the time being.

Support levels: 136.40 136.00 135.70

Resistance levels: 136.90 137.30 137.60

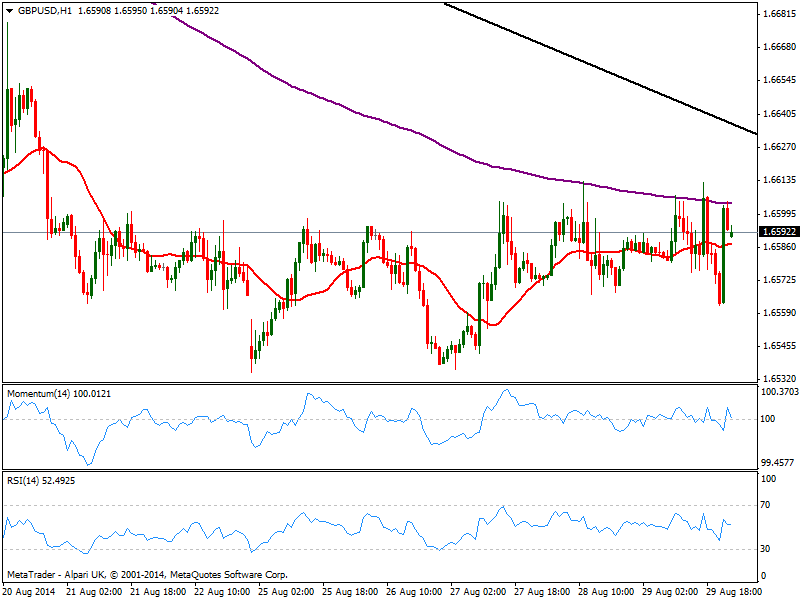

GBP/USD Current price: 1.6592

View Live Chart for the GBP/USD

The GBP/USD shows little change from latest updates, trading steadily below the 1.6600 level. Late Friday the pair surged around 40 pips up to the level, probably on some Pound demand coming from EUR/GBP that trades barely above 0.7900. As for the GBP/USD hourly chart, price stands right above a flat 20 SMA while indicators turned south above their midlines, holding in neutral territory. In the 4 hours chart the technical picture is also strongly neutral, with the daily descendant trend line coming from this year high today at 1.6630: it will be only above this last the pair will be able to advance further, while the risk of a bearish move increases on a break below 1.6540 strong support.

Support levels: 1.6540 1.6490 1.6465

Resistance levels: 1.6600 1.6630 1.6650

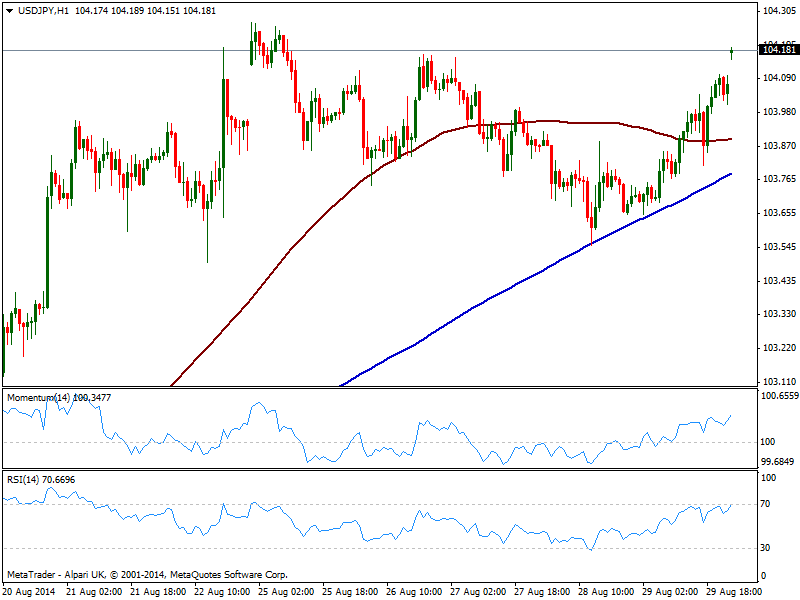

USD/JPY Current price: 104.18

View Live Chart for the USD/JPY

Dollar gaps higher against the yen trading a few pips below past week high of 104.26, and with the hourly chart showing a strong upward momentum coming from technical indicators, as price extends above moving averages, supporting a continued advance. In the 4 hours chart indicators also aim higher above their midlines as price develops well above moving averages, supporting the shorter term view. Dips down to 103.50/60 area will likely attract buyers rather than signal a downward continuation, with a break above 104.50 required to confirm a stronger upward momentum.

Support levels: 103.55 103.20 102.85

Resistance levels: 104.20 104.50 104.80

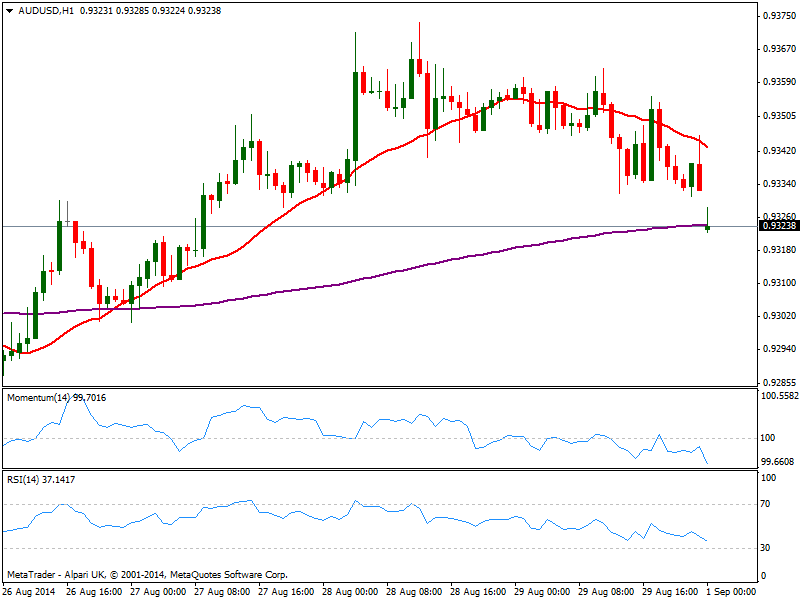

AUD/USD Current price: 0.9323

View Live Chart of the AUD/USD

It will be a busy week in Australia with loads of first line local data, including RBA meeting on Tuesday. For today, the calendar includes inflation and manufacturing indexes, not to mention Chinese manufacturing PMI also meant to weight on the Aussie. Gapping lower with the weekly opening, the hourly chart shows price below the 0.9330 mark, as 20 SMA gains bearish slope a few pips above it, and indicators gain bearish tone below their midlines. In the 4 hours chart the technical picture is also bearish, albeit a break below 0.9300 is required to confirm a continued decline for this Monday.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9370 0.9410 0.9450

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.