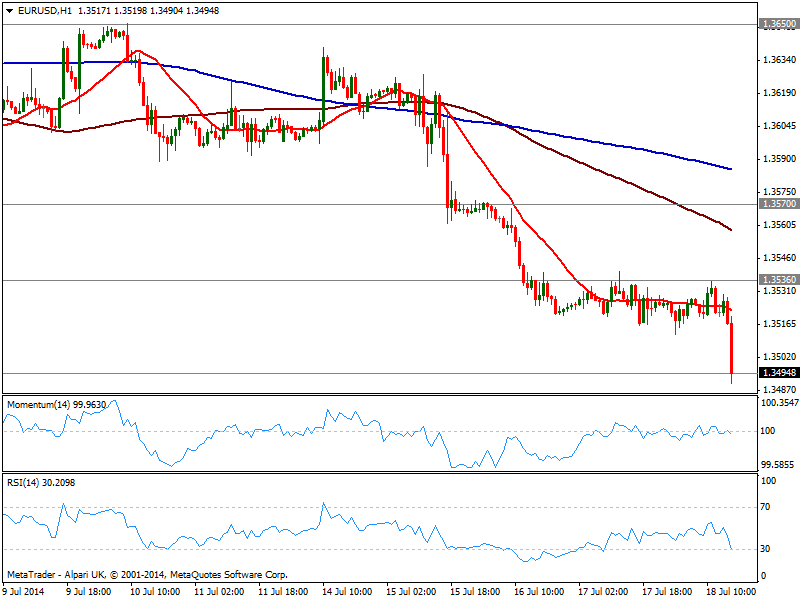

EUR/USD Current price: 1.3491

View Live Chart for the EUR/USD

Starting with GBP/USD accelerating to fresh weekly lows out of the bloom, dollar gathered momentum across the board, with USD/CHF above 0.9000 and the EUR/USD at levels not seen since last February, a handful of pips away from critical 1.3476 year low. The EUR/USD finally moved away from the 30 pips range that contained price for most of the week, with the hourly chart showing an increased bearish potential as per price accelerating below its 20 SMA and the 4 hours chart showing indicators resuming the downside after repeated failure around 1.3535 static resistance. Immediate support comes at 1.3476, this year low, and a large amount of stops should stand below so if trigger, the slide may quickly extend.

Support levels: 1.3476 1.3440 1.3410

Resistance levels: 1.3535 1.3570 1.3620

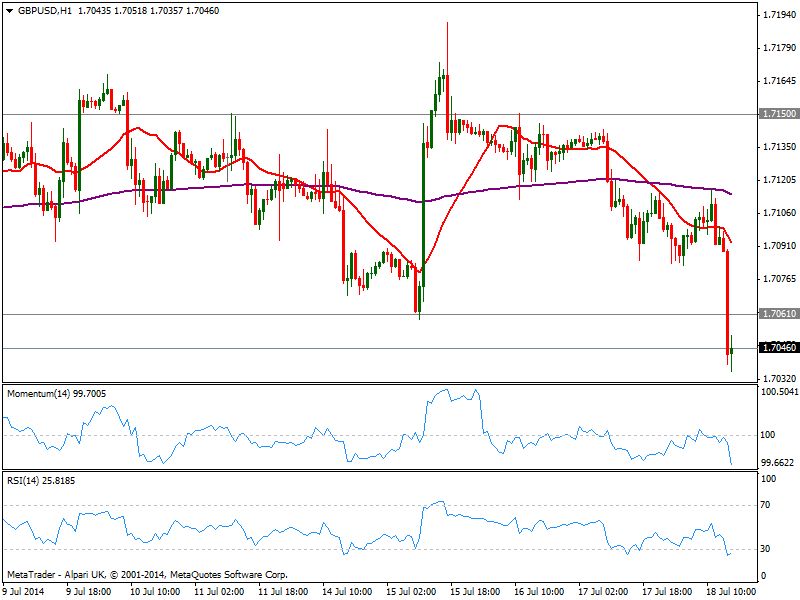

GBP/USD Current price: 1.7045

View Live Chart for the GBP/USD

Pound being Pound lost nearly 60 pips against the greenback with no trigger behind the move, advancing dollar momentum across the board. The pair sunk to 1.7035 so far, fresh weekly low, and maintains a strong bearish tone according to the hourly chart that shows indicators almost vertical getting into oversold territory, as 20 SMA gains bearish slope. In the 4 hours chart the technical picture is also quite bearish, with 200 EMA standing in the 1.7020 price zone now immediate support: a break below it should lead to a continued slide albeit some buyers are expected to surge in the area.

Support levels: 1.7020 1.6985 1.6950

Resistance levels: 1.7060 1.7095 1.7120

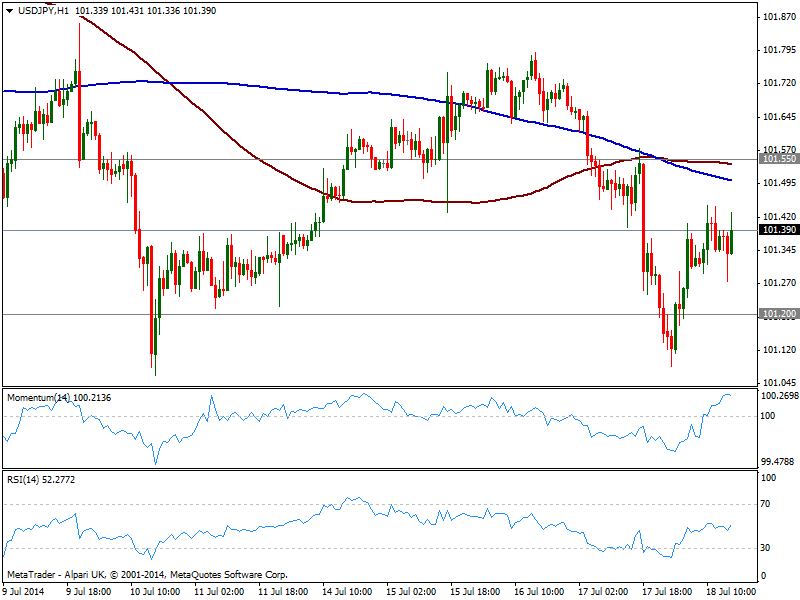

USD/JPY Current price: 101.39

View Live Chart for the USD/JPY

The USD/JPY posts some shy advance amid dollar strength, coming back from a daily low of 101.16 achieved over Asian hours. The hourly chart shows a mild positive tone with indicators aiming higher above their midlines, but moving averages offering strong dynamic resistance in the 101.50/60 price zone. In the 4 hours chart however, the bearish tone prevails with price well below moving averages and indicators heading south in negative territory. The upside remains limited as long as mentioned resistance area caps the upside, with scope for a recovery up to 101.80/95 if taken.

Support levels: 101.20 100.70 100.35

Resistance levels: 101.55 101.95 102.35

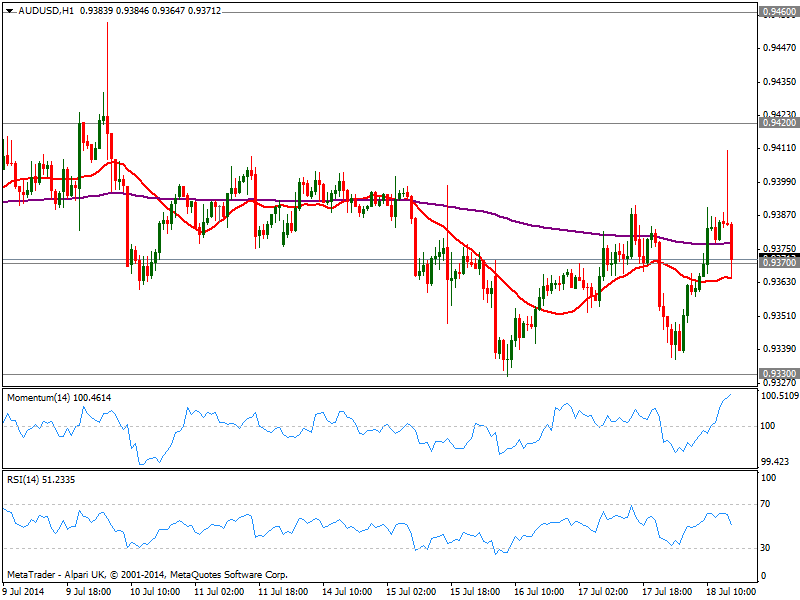

AUD/USD Current price: 0.9371

View Live Chart for the AUD/USD

The AUD/USD advanced up to 0.9410 late European session, only to quickly pull back down to current 0.9370 area. The 1 hour chart shows a strong selling interest aligned around mentioned top, as the reversal was quite impressive in the short term. Nevertheless, the movement is yet to break below current level to be able to extend down towards 0.9330 critical support. Only below this last the bearish momentum will be more sustainable in time eyeing then a probable test of 0.9260 price zone.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.