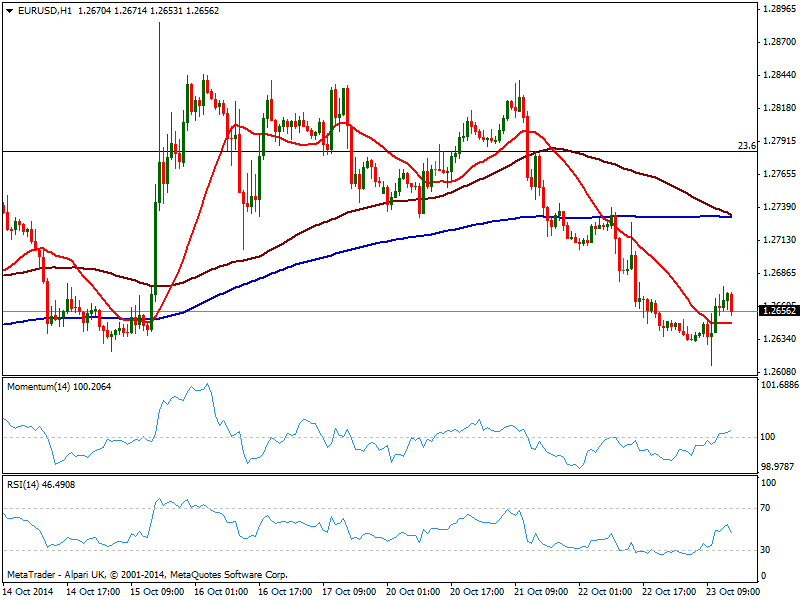

EUR/USD Current price: 1.2656

View Live Chart for the EUR/USD

The EUR/USD retraces from a daily high of 1.2676, reached after mild positives Manufacturing and Services PMIs coming from Europe. But the greenback sees some demand after the release of weekly unemployment data in the US, with Initial claims above expected, but Continuing claims posted their best number since the ends of 2000, pointing to a steady recovery in the employment sector. As for the EUR/USD, the technical picture shows the pair remains unable to firm up above the 1.2660 static resistance level, but price stands above a flat 20 SMA and indicators in positive territory, so far limiting slides. In the 4 hours chart however, price develops well below a bearish 20 SMA, while indicators barely advance from oversold levels, still deep in red. The pair still looks heavy after setting a daily low of 1.2614, with renewed selling pressure below 1.2620 exposing the pair to a new leg south.

Support levels: 1.2620 1.2580 1.2550

Resistance levels: 1.2660 1.2700 1.2740

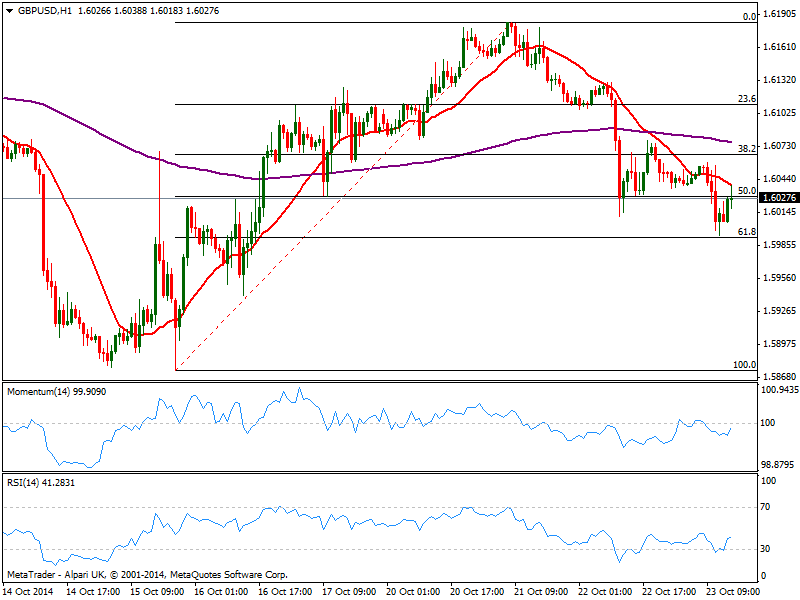

GBP/USD Current price: 1.6027

View Live Chart for the GBP/USD

The GBP/USD bounces some after falling to 1.5998 on the back of weak UK Retail sales figures, maintaining a pretty negative short term tone according to the 1 hour chart: indicators aim slightly higher below their midlines, but 20 SMA caps the upside with it strong bearish slope. In the 4 hours chart, technical readings present a strong bearish bias, with the pair quoting around the 50% retracement of its latest bullish run. The 61.8% retracement of the same rally stands at 1.5995, meaning a break below it should lead to further falls with an initial target at 1.5940/50.

Support levels: 1.5995 1.5950 1.5910

Resistance levels: 1.6065 1.6090 1.6125

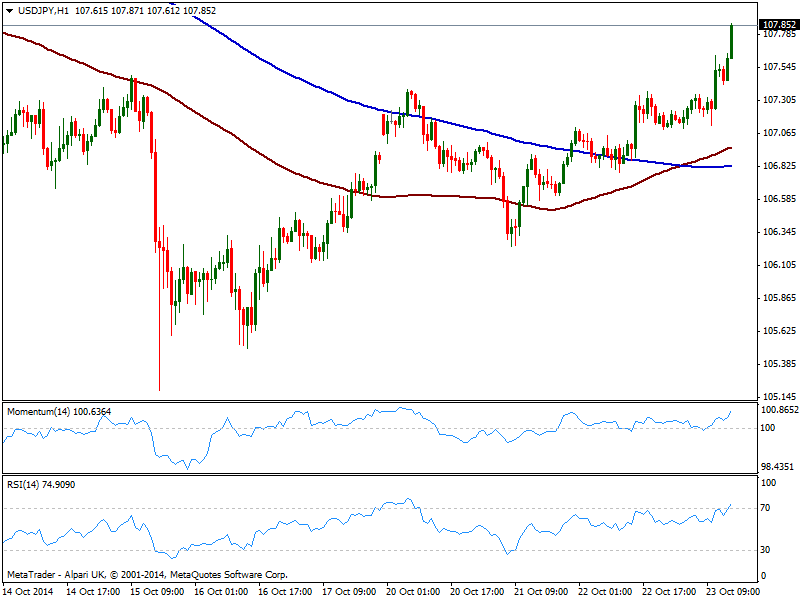

USD/JPY Current price: 107.86

View Live Chart for the USD/JPY

The USD/JYP has been triggering short term stops to the upside ever since early Europe, accelerating through 107.35 first on good European news supporting stocks advances, and once more above 107.60 after positive US data. The pair has therefore set a short term intraday trend, with the 1 hour chart showing 100 SMA crossing above 200 one and indicators heading higher in positive territory. In the 4 hours chart technical readings also present a positive tone, with next resistance now at the 108.00 figure: a break above won’t see much resistance until the 108.50 price zone.

Support levels: 107.60 107.35 106.95

Resistance levels: 108.00 108.50 108.90

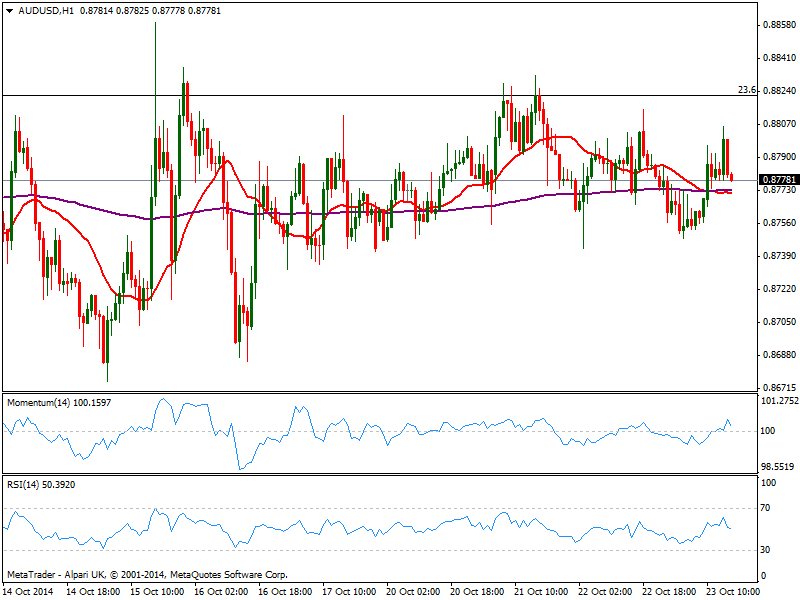

AUD/USD Current price: 0.8778

View Live Chart of the AUD/USD

The range continues to shrink in the AUD/USD, with the pair showing no progress this Thursday: still trades in the upper half of its wider range, hovering around the magnet area around 0.8770. Technically, both 1 and 4 hours charts present a neutral stance, with a very limited bearish bias. Nevertheless, only a price acceleration below 0.8730 should signal some downward potential in the pair, while the upside remains limited as long as 0.8820 holds.

Support levels: 0.8770 0.8730 0.8690

Resistance levels: 0.8820 0.8860 0.8900

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.