Majors have shown little developments during the Asian session, waiting in cautious mode for the upcoming FOMC decision later on this afternoon. The US Central Bank is expected to maintain its rates on hold this month, and no press conference is scheduled for after the decision. But the market is expecting a generally hawkish tone in where to find clues on the upcoming rate hike anticipated early this year.

September seems to be the date and a change in the wording, welcoming the latest economic progress, will be a way to convince the markets the FED will move in its next meeting. A dovish tone, and no change in the wording, will signal the FED may want to wait further, stretching the date of the lift-off towards December and therefore weigh on the greenback

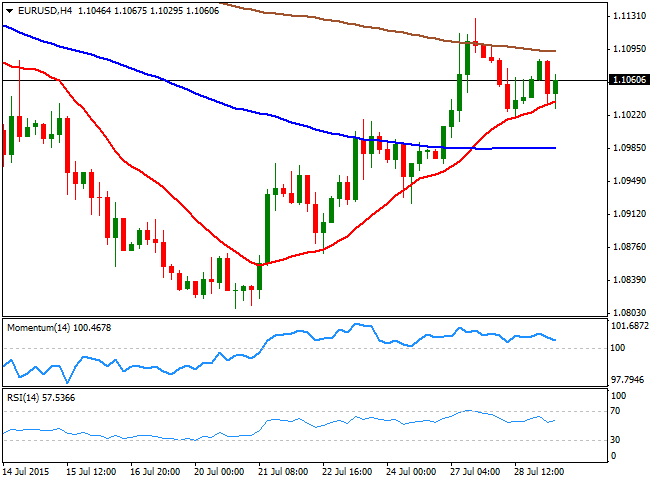

View live chart of the EUR/USD

The EUR/USD pair has been trading in a limited range around the 1.1050 level, now bouncing from a daily low set at 1.1029. The 4 hours chart shows that the price is holding above a bullish 20 SMA, whilst the RSI indicator has resumed its advance above the 50 level, albeit the Momentum indicator has lost its upward strength and turned lower above 100. The critical resistance level for the upcoming hours will be the 1.1120 price zone, this week high and a strong static resistance level, as it will take a break above to confirm additional advances towards 1.1160 and 1.1200.

Below 1.1020 on a strong dollar on the other hand, should see the pair accelerating south, eyeing the 1.0950 region as the probable bearish target.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.