The EUR/USD pair lost some ground during the first hours of this Wednesday, down to 1.1241 early Europe as stocks opened with a soft positive tone.

In Europe, the only macroeconomic release was the Producer Price Index for July that matched expectations of -0.1%, whilst year-to-year resulted at -2.1%. Later on in the day, the US will release the private ADP survey, probably the most relevant figure of the day.

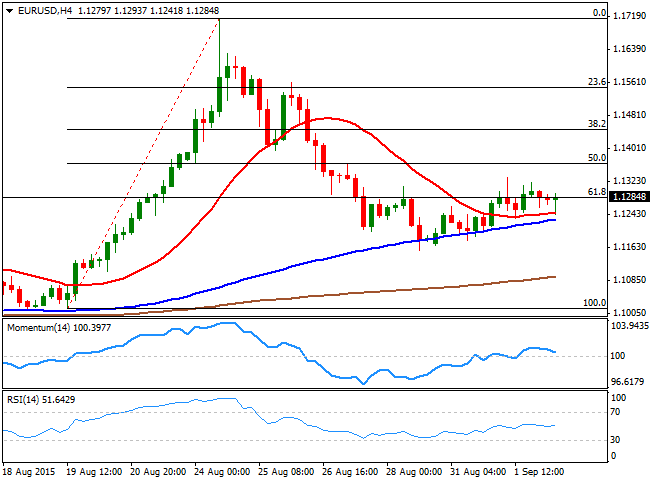

View live chart of the EUR/USD

In the meantime, the technical picture is neutral, with the pair hovering around the 61.8% retracement of its latest rally, around 1.1280, having found some intraday selling interest on spikes beyond 1.1300. The 4 hours chart shows that the 20 SMA stands flat around the mentioned daily low, whilst the technical indicators lack directional strength around their mid-lines.

Should the price recover above 1.1300, the pair may advance up to the 1.1340/60 price zone, although stronger gains seem unlikely for today. Below the daily low on the other hand, the decline can extend down to 1.1180 a strong static support level.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.