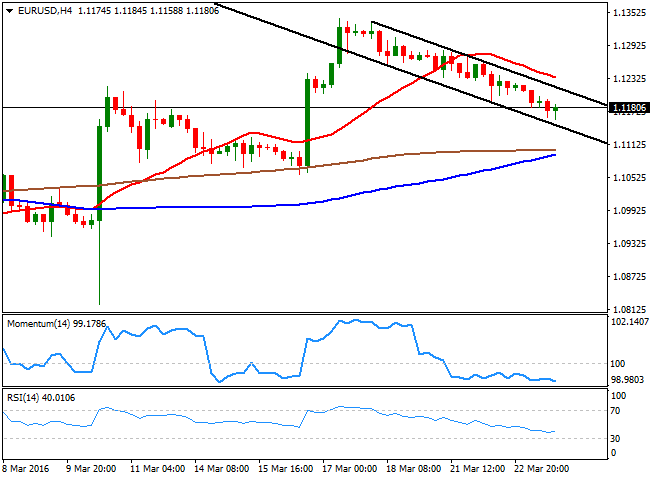

EUR/USD Current Price: 1.1183

View Live Chart for the EUR/USD

The EURUSD pair extended its weekly decline down to 1.1158, and trades roughly 20 pips away from the level by the end of the US session, with the greenback higher against all of its major counterparts. A strong slide in commodities, alongside with more FED's officers pledging for a soon to come rate hike, were behind dollar's strength. Federal Reserve Bank of St. Louis President James Bullard and Chicago FED President Charles Evans, said policy makers should consider raising interest rates at least a couple of times this year, inspiring confidence in the US economic situation.

In the US, New Home sales rose 2.0% in February to a 512,000 annual pace, while January figures were also revised higher, to 502,000 from previous 494,000. The figures indicate some continued growth in the sector, although sales levels are still 6.1% below a year ago. Crude oil inventories jumped higher, with the EIA report showing a build of 9.37M against the 3.09M expected, pushing crude back towards the $ 40.00 a barrel region.

The pair has now declined for a fourth consecutive day, having trimmed half its FED's inspired gains, and seems poised to extend its decline, given that short term selling interest is now surging on approaches to the 1.1200 level. Technically, the 4 hours chart shows that the price remains midway inside a daily descendant channel, while the technical indicators present strong bearish slopes within bearish territory, supporting some additional declines for this Thursday, down to the 1.1085 level.

Support levels: 1.1160 1.1120 1.1085

Resistance levels: 1.1210 1.1245 1.1290

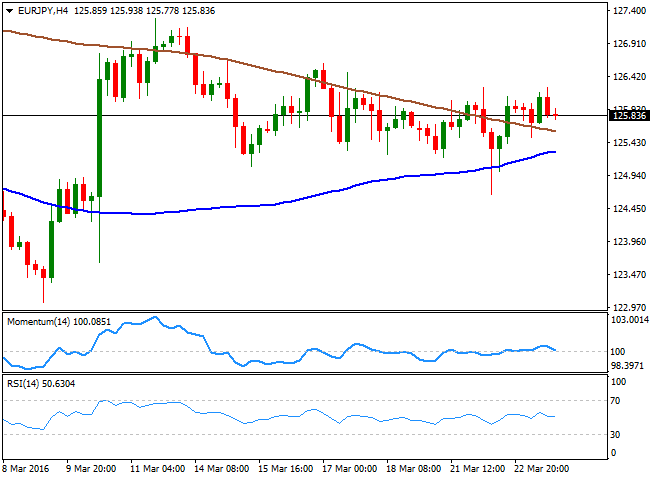

EUR/JPY Current price: 125.83

View Live Chart for the EUR/JPY

The EUR/JPY pair was unable to find direction this Wednesday, closing the day flat a few pips below the 126.00 level. Both, the Japanese Yen and the Euro were generally weaker against the greenback, with the first affected by a downward assessment of Japanese situation by BOJ's members, and the second pressured by an early rebound in European equities that kept it subdued. The short term technical picture has turned neutral, as in the 1 hour chart, the price is currently trading between its 100 and 200 SMAs, with the shortest offering an immediate support at 125.70. In the same chart, the technical indicators have turned horizontal around their mid-lines, indicating no clear upcoming direction. In the 4 hours chart, the price is still holding above a bearish 20 SMA, while the technical indicators lack directional strength within neutral territory, in line with the shorter term outlook.

Support levels: 125.70 125.40 125.00

Resistance levels: 126.50 126.90

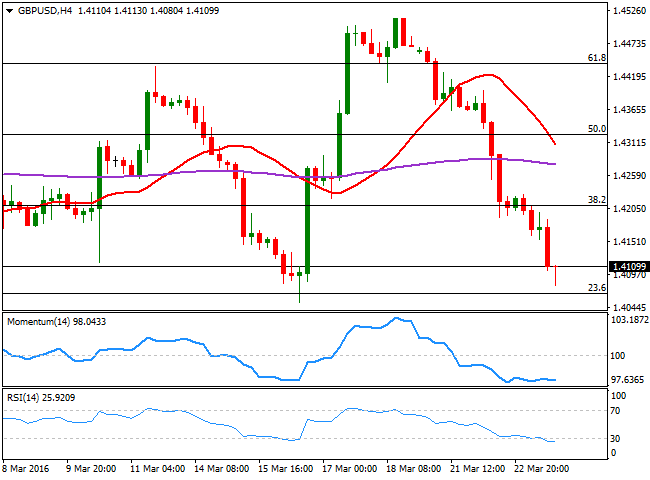

GBP/USD Current price: 1.4110

View Live Chart for the GBP/USD

The GBP/USD pair remained under strong selling pressure, hitting a fresh 4-day low of 1.4080 during US trading hours. There was no catalyst behind this Wednesday's decline, as the UK did not publish any kind of macroeconomic data. But fears of a Brexit have been lately exacerbated, after a new poll showed the lead of the Remain campaign is slipping. The UK is expected to release its February Retail Sales figures for February during the upcoming session, expected to have fall into negative territory, something that will fuel concerns over the economic future of the kingdom, and further weigh on the Sterling. In the meantime, the short term technical picture shows that the risk remains towards the downside, as in the 1 hour chart, the price develops well below a bearish 20 SMA, while the technical indicators are hovering within oversold levels. In the 4 hours chart, technical readings are getting overstretched, as both the Momentum and the RSI are in extreme oversold territory. The pair has a strong support at 1.4052, March 16th low, and a break below it will likely send the pair below the 1.4000 critical psychological support.

Support levels: 1.4100 1.4050 1.4010

Resistance levels: 1.4160 1.4190 14225

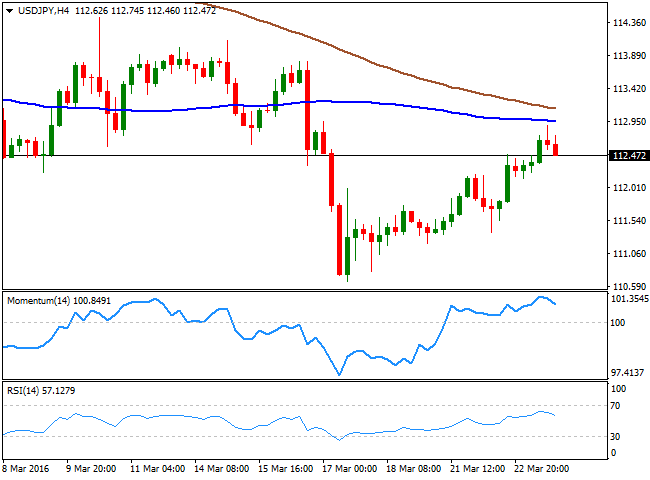

USD/JPY Current price: 112.47

View Live Chart for the USD/JPY

The USD/JPY pair continued rallying over the last session, with the dollar expending its gains up to 112.89, before retreating down to the current 112.47 level. The Japanese currency came under selling pressure during the past Asian session, as the government downgraded the economic assessment, expressing concerns on how the sluggish emerging market demand and volatile financial markets may hurt exports and capital expenditure. Also, the Abe administration has decided to cancel its plan to increase the sales tax from 8% to 10%, scheduled to be implemented in April 2017. The short term technical picture is showing that the early upward strength has lost steam, given that the price is now a few pips below its 200 SMA, whilst the technical indicators have turned south, and are about to cross their mid-lines towards the downside. In the 4 hours chart, the pair stalled its rally a handful of pips below its 100 SMA, while the technical indicators have also turned lower, but remain well above their mid-lines, limiting chances of a sharper decline, as long as buyers surge on approaches to the 112.00/10 region.

Support levels: 112.10 111.70 111.30

Resistance levels: 112.95 113.30 113.75

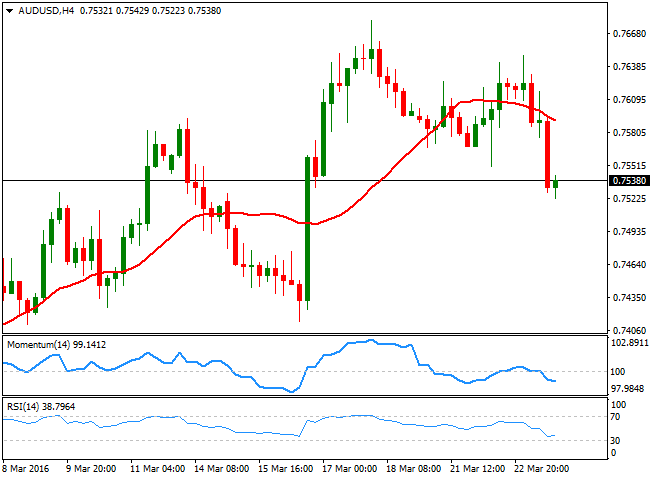

AUD/USD Current price: 0.7538

View Live Chart for the AUD/USD

The Aussie was hit hard this Wednesday, falling down to 0.7522 against the greenback on the back of commodities' sharp decline. Precious metals plummeted, with spot gold reaching a daily low of $1,215 a troy ounce and silver closing the day near its daily lows. Additionally, and as more US policy makers have heightened the possibility of a rate hike as soon as next April, the dollar was broadly higher on improved market's sentiment. Except for the New Zealand trade balance, the macroeconomic calendar will remain empty during the upcoming Asian session, which means that currencies will likely continue trading on sentient. This latest slide in the AUD/USD has harmed partially the dominant bullish trend, with further declines below 0.7500 opening doors for a steeper decline. Short term, the 1 hour chart points for some additional slides, given that the technical indicators are heading lower, despite being in oversold territory, while the 20 SMA turned sharply lower, almost 100 pips above the current level. In the 4 hours chart, the price has finally extended well below its 20 SMA, while the technical indicators maintain bearish slopes within oversold territory, in line with the shorter term view.

Support levels: 0.7510 0.7470 0.7440

Resistance levels: .7550 0.7605 0.7640

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.