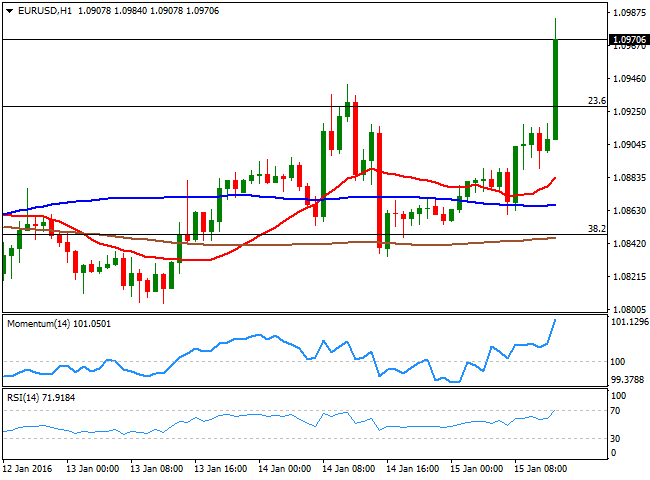

EUR/USD Current Price: 1.0971

View Live Chart for the EUR/USD

Market is all about risk sentiment this Friday, with currencies being lead by the sharp decline in oil prices. US WTI crude futures broke below the $30.00 level in the European morning and accelerated its decline to fresh 12-year lows around 29.30, while Brent also plummeted below the 30.00 level. Stocks were under pressure worldwide, whilst gold prices recovery amid increasing risk aversion. The EUR/USD pair advanced up to 1.0925 and held around the highs ahead of the release of US data, with investors holding their breath ahead of the releases. Finally out, US figures disappointed big, as Retail sales in December, fell 0.1% monthly basis, while the core reading, ex-autos, also came out negative at 0.1%. The PPI readings matched expectations, whilst the New York Empire State Manufacturing Index for January plummeted to -19.37, sending the dollar broadly lower across the board.

The technical picture for the 1 hour chart has become firmly bullish, with the EUR/USD pair up to fresh highs in t the 1.0970 region, above its moving averages and with the technical indicators heading sharply higher above their mid-lines. In the 4 hours chart, the technical indicators are also heading north above their mid-lines, while the price extends above their mid-lines, but remains within the selling zone that has contained rallies ever since the year started. Some consolidation should be expected, with a break above 1.0950 favoring a run towards 1.1000 before the daily close, should upcoming US data continue to disappoint.

Support levels: 1.0920 1.0880 1.0845

Resistance levels: 1.1000 1.1045 1.1090

GBP/USD Current price: 1.4335

View Live Chart for the GBP/USD

The GBP/USD pair trades near its daily low, with the bearish trend prevailing, despite worse-than-expected US data released ahead of the US opening. The pair has stalled its decline, but the short term picture is strongly bearish, as in the 1 hour chart, the price is below a bearish 20 SMA, while the technical indicators maintain their sharp bearish slopes below their mid-lines. In the 4 hours chart, the technical picture is also bearish with the price extending below its 20 SMA and the technical indicators heading south below their mid-lines, with a limited bearish momentum at the time being.

Support levels: 1.4310 1.4260 1.4220

Resistance levels: 1.4350 1.4410 1.4460

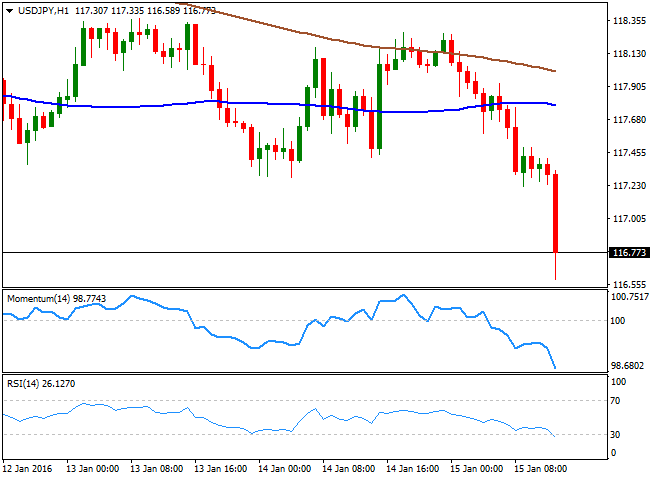

USD/JPY Current price: 116.74

View Live Chart for the USD/JPY

Fresh lows, eyeing 116.10. The USD/JPY pair is trading at levels not seen since August, when China's Black Monday resulted in an almost 600 pips decline in the pair down to 116.13. The yen advanced earlier in the day as oil prices broke below $30.00 a barrel, triggering some risk aversion all across the financial world. The decline was later fueled by poor US manufacturing and retail sales data, which sent stocks to fresh daily lows ahead of the close. Technically, the 1 hour chart shows that the price has accelerated below its moving averages, whilst the technical indicators present sharp bearish slopes, entering oversold territory, but maintaining their negative slopes and supporting a test of the mentioned 116.10 region. In the 4 hours chart, the strong bearish momentum is also presents supporting the shorter term view as the pair already stands below its previous weekly low.

Support levels: 116.50 116.10 115.80

Resistance levels: 117.10 117.40 117.75

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.