EUR/USD Current price: 1.0580

View Live Chart for the EUR/USD

The EUR/USD pair trades near a fresh low set at 1.0562, having however bounced from the level ahead of the US opening. Germany release its Retail Sales figures for October, which grew by 2.1% from a year before, but fell by 0.4% monthly basis, and also published the preliminary readings of November inflation, which met expectations, rising 0.4% yearly basis. The data has done little for the EUR, which continues trading below the 1.0600 level against the greenback, and maintains a bearish short term tone. The fact is that investors are waiting for some major events, including the ECB during the upcoming days, and some further range trading should be expected, with the downside still favored and mostly on a break below 1.0550.

In the 1 hour chart, the price is being limited by a bearish 20 SMA, while the technical indicators have recovered within negative territory, but remain below their mid-lines. In the 4 hours chart, a mild negative tone prevails, as the price is also below a bearish 20 SMA, while the technical indicators remain horizontal below their mid-lines, showing no actual directional strength, but maintaining the risk towards the downside.

Support levels: 1.0550 1.0520 1.9485

Resistance levels: 1.0620 1.0660 1.0695

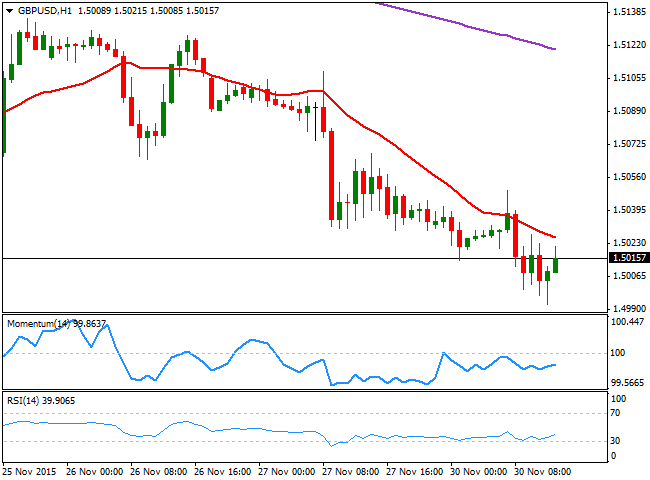

GBP/USD Current price: 1.5015

View Live Chart for the GPB/USD

The GBP/USD pair flirted with the 1.5000 figure early Europe, following the release of the UK Money figures for October. Despite the figures are not big market movers, they weighed on an already weakened Pound. consumer credit in October decreased to £1.178B against previous £1.261B, while less mortgages than-expected were approved in the same month, 69.63K against 68.87K previous. The pair however bounced from a low set at 1.4992, and the 1 hour chart shows that the technical indicators are heading higher from near oversold levels, but are still below their mid-lines, whilst the price stands a few pips below a bearish 20 SMA. In the 4 hours chart, the technical indicators have turned higher in negative territory, whilst the 20 SMA heads lower around 1.5070, providing a strong intraday resistance in the case of a recovery.

Support levels: 1.5050 1.5010 1.4980

Resistance levels: 1.5135 1.5170 1.5200

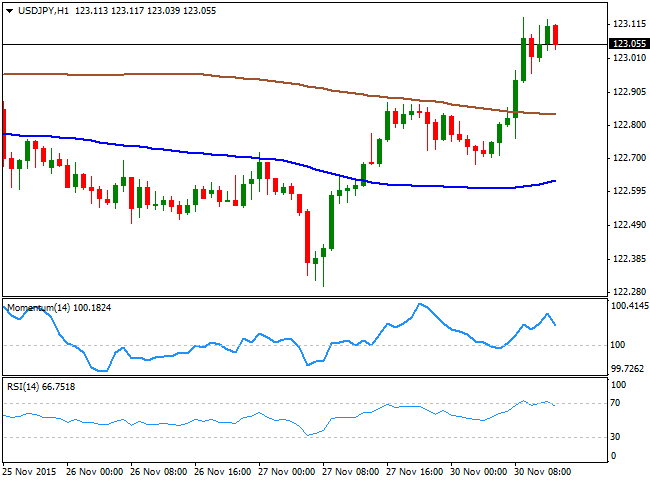

USD/JPY Current price: 123.05

View Live Chart for the USD/JPY

Above 123.00, but still bearish. The USD/JPY pair recovered above the 123.00 figure by the end of the Asian session, but bulls began to desist on a test of the 123.10 region. The pair has advanced some 40 pips ever since the day started, quite an irrelevant move, considering its now trading some pips above the 122.80, its comfort zone for most of the past week. Given the large number of fundamental events that will be released during this week, there are little hopes of an USD/JPY relevant move in the short term. Technically, the 1 hour chart shows that the price has recovered above its 100 and 200 SMAs, although the shorter stands below the largest, limiting chances of a more sustainable rally. In the same chart, the technical indicators are turning lower near overbought readings, also limiting advances. In the 4 hours chart, the technical indicators turned higher above their mid-lines, with the RSI indicator now turning flat above its mid-line, suggesting some range for the upcoming hours.

Support levels: 122.60 122.20 121.70

Resistance levels: 123.10 123.40 123.75

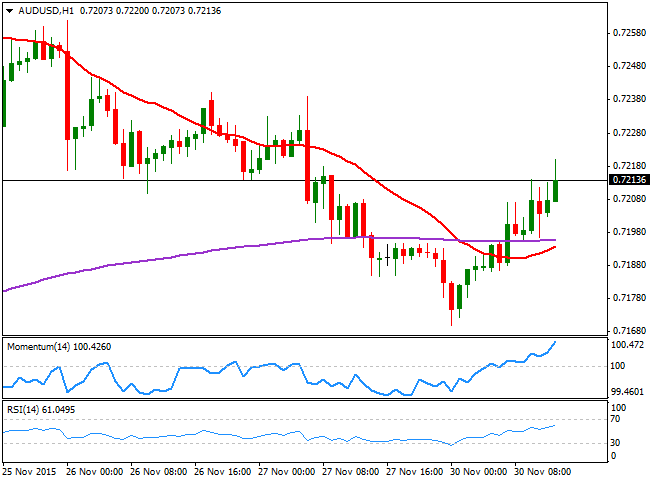

AUD/USD Current price: 0.7214

View Live Chart for the AUD/USD

The AUD/USD pair traded as low as 0.7174 during the Asian session, recovering later above the 0.7200 on a tepid up-tick in the monthly RD securities inflation preview for November. The pair presents a limited upward toe in the short term, as the price is above a bullish 20 SMA in the 1 hour chart, where the technical indicators also head higher above their mid-lines. In the 4 hours chart, however, the price is struggling around a bearish 20 SMA, whilst the technical indicators have lost their upward strength below their mid-lines, suggesting some further advances are required to confirm a steadier recovery during the upcoming sessions.

Support levels: 0.7200 0.7150 0.7110

Resistance levels: 0.7240 0.7285 0.7330

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.