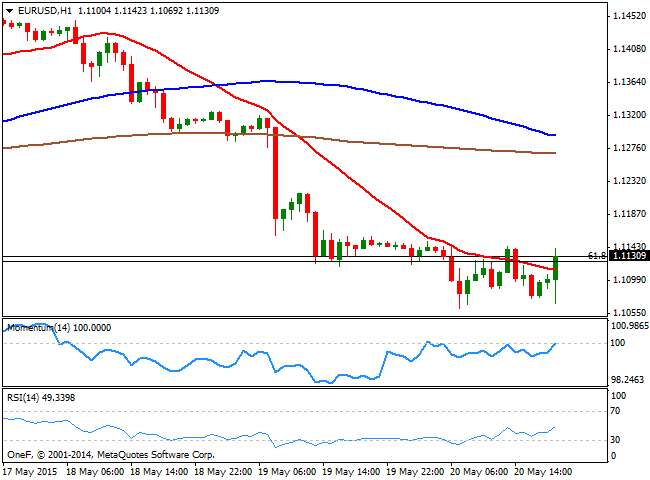

EUR/USD Current price: 1.1126

View Live Chart for the EUR/USD

The dollar discretely extended its Tuesday's advance at the beginning of the day, but traded for the most range bound against most of its major rivals until the release of US FOMC Minutes during the American afternoon. The Minutes showed officials seen a rate hike in June as "unlikely," despite believing that the Q1 slowdown was unlikely to persists. FED's members were generally optimistic about the economic outlook, but reaffirmed that the timing for a rate hike will "be determined on a meeting-by-meeting basis and would depend on the evolution of economic conditions and the outlook." Market was actually not expecting a rate hike by June, but the Minutes were seen as dovish, as a weaker USD seems to be supportive of economic growth, which means rates will remain low for longer. At the time of the release, news hit the wires saying that the ECB rose Greek Bank Emergency Cash by €200 million, approving a new limit of €80.2 billion, bringing some relief to EUR buyers.

The EUR/USD pair initially fell towards its daily low established at 1.1061 with the release, but bounced from it and hovers around the 1.1120 level, unable to break above the critical Fibonacci resistance. The short term technical picture shows that the price is barely above a mild bullish 20 SMA whilst the technical indicators head higher below their mid-lines, suggesting the pair may extend its upward correction. In the 4 hours chart however, the 20 SMA maintains a strong bearish slope well above the current level, whilst the technical indicators have barely bounced from extreme oversold levels, keeping the risk towards the downside albeit the limited buying interest around the pair. Nevertheless, a break below former highs in the 1.1050 region is required to confirm a bearish continuation towards the 1.1000 figure.

Support levels: 1.1050 1.1000 1.0960

Resistance levels: 1.1140 1.1170 1.1220

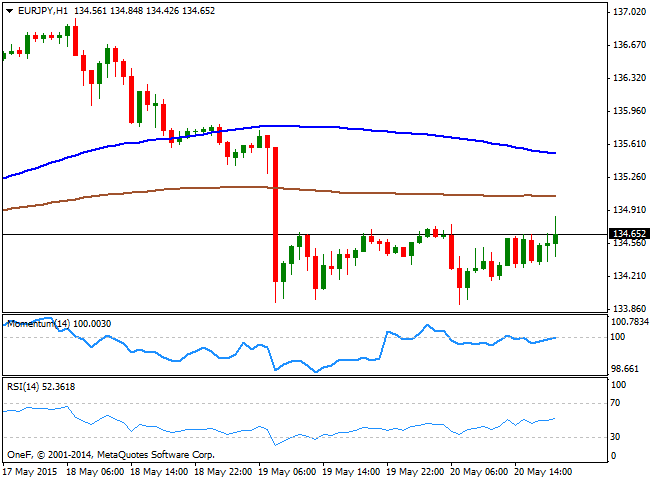

EUR/JPY Current price: 134.63

View Live Chart for the EUR/JPY

The EUR/JPY is ending the day practically unchanged in the 134.60 region, albeit the cross managed to post a lower low daily basis, at 133.90. The Japanese yen saw a limited advance as Japanese GDP in the Q1 grew above expected, reaching 2.4%, but the yen failed to sustain gains, and EUR weakness kept the pair subdued. Technically, the 1 hour chart shows that the price remains below its 100 and 200 SMAs, with the largest offering an immediate intraday resistance around 135.00. The technical indicators in the same time frame recovered up to their mid-lines where they stand now flat, reflecting little buying interest around the pair. In the 4 hours chart the price moves back and forth around a still bullish 100 SMA, whilst the technical indicators recovered from oversold territory, but lost upward strength well into negative territory, supporting additional declines on renewed slides below the 134.00 level.

Support levels: 134.00 133.60 133.20

Resistance levels: 135.00 135.55 136.10

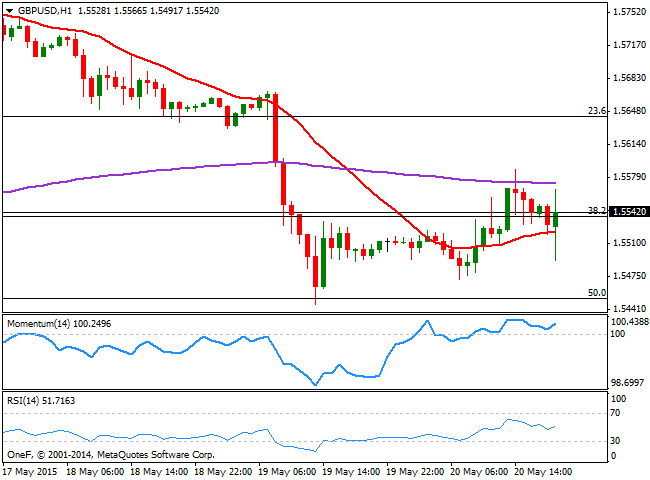

GBP/USD Current price: 1.5541

View Live Chart for the GBP/USD

The GBP/USD pair traded as low as 1.5471 in the European session, before the release of BOE's Minutes showing MPC members voted unanimously to keep the current economic policy unchanged, whilst they believe the economic slowdown will probably be over within a year. The only negative tone of this mostly hawkish statement was related to the housing sector, as officers suggested rising prices will be closely watched by the Central Bank. The pair managed to post a daily high of 1.5587, but retreated, trading now around the 1.5540 Fibonacci level, the 38.2% retracement of the bullish rally between 1.5088 and 1.5814. The short term picture is mild bullish, as the price holds above its 20 SMA whilst the technical indicators aim higher above their mid-lines. In the 4 hours chart, however, the technical indicators are losing their upward strength well below their mid-lines whilst the 20 SMA maintains a strong bearish slope in the 1.5600 price zone, whilst the 23.6% retracement of the mentioned rally stands around 1.5620, all of which suggests only a recovery above this last will signal a recovery of the British Pound.

Support levels: 1.5500 1.5450 1.5410

Resistance levels: 1.5585 1.5620 1.5660

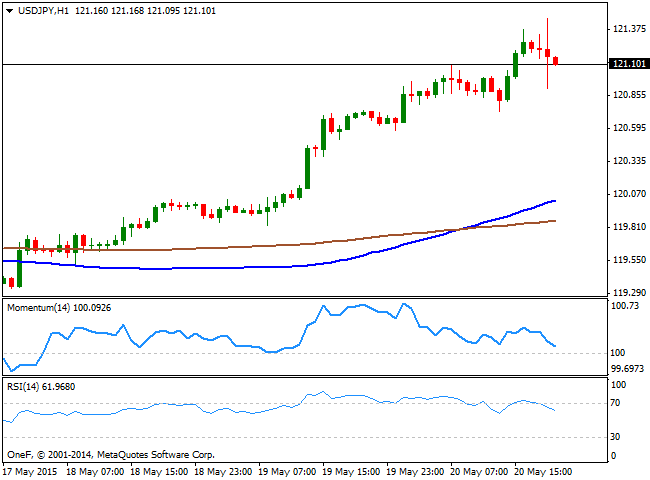

USD/JPY Current price: 121.11

View Live Chart for the USD/JPY

The release of the FOMC Minutes helped the USD/JPY pair reached a fresh 2-month high of 121.46, although the pair retraced some afterwards, consolidating, however above the 121.00 level. The strong advance of these last few days was supported by fresh all-time highs in stocks, and extended despite Wednesday's limited volume in equity trading. Technically, the 1 hour chart shows that the price continues to develop well above its moving averages, whilst the technical indicators head lower towards their mid-lines, and a clear bearish divergence in the Momentum indicator, yet to be confirmed. In the 4 hours chart, the technical indicators are losing their upward strength in extreme overbought levels, supporting a bearish corrective movement towards the 120.45 level. Nevertheless, as long as the price holds above this last level, the upside will remain favored, with scope to retest the year high around 122.00 on a break above the mentioned daily low.

Support levels: 120.85 120.45 120.10

Resistance levels: 121.45 121.70 122.10

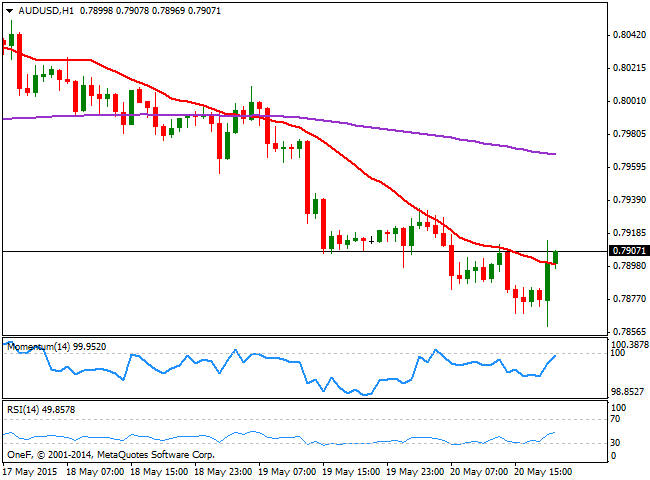

AUD/USD Current price: 0.7905

View Live Chart for the AUD/USD

The Australian dollar fell down to 0.7860 against the greenback, before bouncing back now struggling to regain the 0.7900 level. The pair is however positioned to close its fifth day in a row in the red, on the back of the open possibility of further rate cuts coming from the RBA, fueled by the latest Central Bank statement. Technically, the 1 hour chart shows that the price is trying to advance above a bearish 20 SMA, while the technical indicators remain below their mid-lines. In the 4 hours chart, the 20 SMA presents a bearish slope, offering dynamic resistance around 0.7950 while the technical indicators lack directional strength deep into negative territory. The price has tried to break below 0.7880, its 200 EMA in this last time frame, but so far the dynamic support has held. Nevertheless, renewed selling interest below this level should lead to a stronger bearish continuation towards the 0.7810 price zone.

Support levels: 0.7880 0.7845 0.7810

Resistance levels: 0.7940 0.7990 0.8030

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.