EUR/USD Current price: 1.0705

View Live Chart for the EUR/USD

The EUR/USD pair recovered from a daily low set at 1.0659 in the European morning, following market comments about the ECB studying a way to limit financial aid to Greece. In Germany, the ZEW survey for April showed that the local Economic Sentiment fell for the first time since October 2014, down to 53.3 from previous 54.8. In the EZ however, Economic Sentiment improved above expected in the same month. There are no relevant fundamental readings scheduled for the US, with the market then probably continue trading on sentiment. Short term, the 1 hour chart shows that the price stands below the 38.2% retracement of its latest bearish run at 1.0715, the immediate resistance, whilst the 20 SMA heads lower around it. In the same chart, the technical indicators are bouncing from their oversold levels but remain below their mid-lines, which suggest some follow through above the mentioned level is required to confirm additional advances. In the 4 hours chart the Momentum indicator heads lower below 100 whilst RSI indicator stands flat around 48.

Support levels: 1.0680 1.0640 1.0590

Resistance levels: 1.0715 1.0745 1.0775

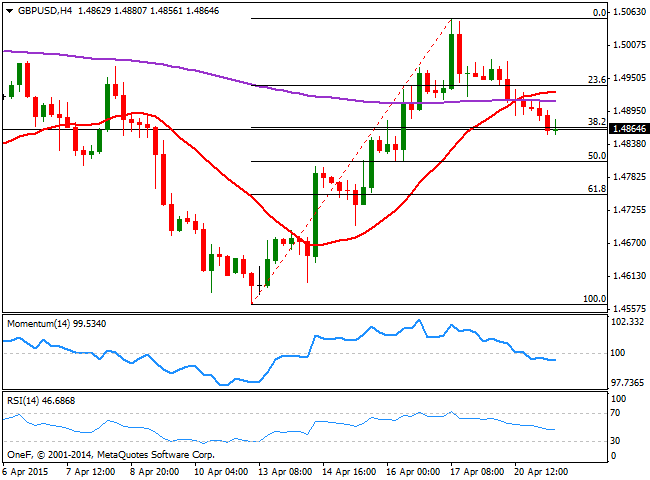

GBP/USD Current price: 1.4900

View Live Chart for the GBP/USD

The GBP/USD pair aims to recover the 1.4900 figure, with the 1 hour chart showing the price extending above a flat 20 SMA, whilst the technical indicators aim higher above their mid-lines, anticipating additional advances towards the 1.4940 area, the immediate Fibonacci resistance. In the 4 hours chart however, the Momentum indicator heads lower below the 100 level, whilst the 20 SMA stands flat around the mentioned 1.4940 level, reinforcing the resistance level. In this last chart, the RSI advances above 50, all of which supports limited intraday advances.

Support levels: 1.4870 1.4830 1.4790

Resistance levels: 1.4940 1.4985 1.5040

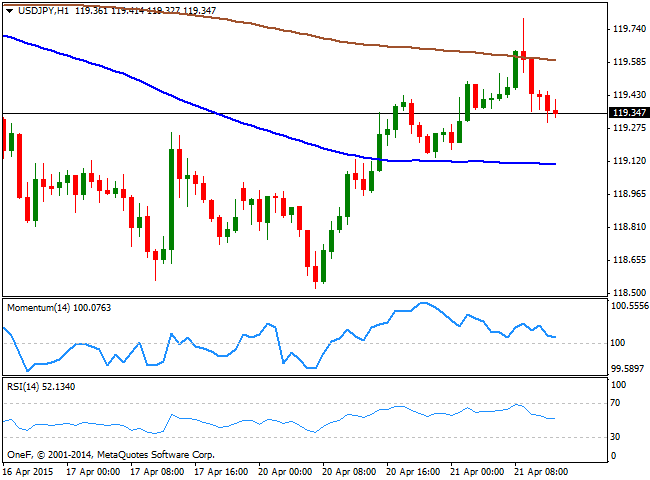

USD/JPY Current price: 119.35

View Live Chart for the USD/JPY

The USD/JPY advanced up to 119.79 earlier this Tuesday on broad dollar strength, albeit the pair eases ahead of the US opening. The 1 hour chart shows that the price failed to sustain gains beyond its 200 SMA, and now trades below it, but above the 100 SMA around the 119.00, providing an immediate short term support. In the same chart, the technical indicators are turning flat above their mid-lines after correcting overbought readings. In the 4 hours chart the price faltered around its 100 SMA, albeit the technical indicators remain above their mid-lines, with the Momentum indicator heading higher and the RSI lower around 52.

Support levels: 118.90 118.50 118.15

Resistance levels: 119.40 119.80 120.10

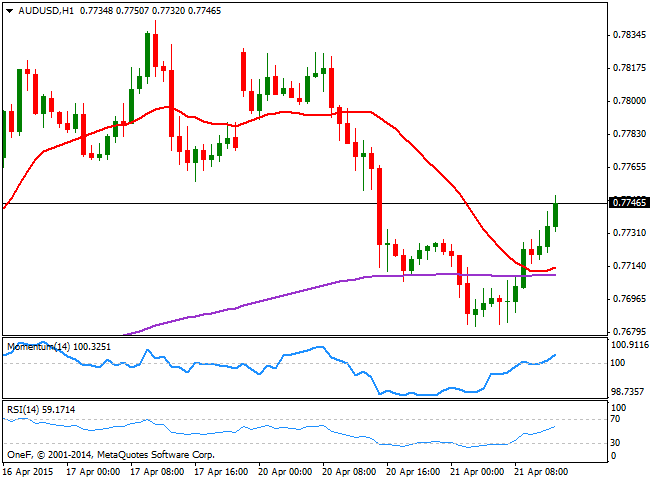

AUD/USD Current price: 0.7745

View Live Chart for the AUD/USD

The Australian dollar is recovering from a daily low set at 0.7682 against the greenback, and presents a mild bullish tone in the short term, as the 1 hour chart shows that the price extends above its 20 SMA, whilst the technical indicators aim higher above their mid-lines. In the 4 hours chart however, the 20 SMA presents a bearish slope in the 0.7775 region, whilst the technical indicators remain below their mid-lines, suggesting advances may be temporal and that selling interest can reappear at higher levels.

Support levels: 0.7720 0.7685 0.7640

Resistance levels: 0.7775 0.7810 0.7845

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.