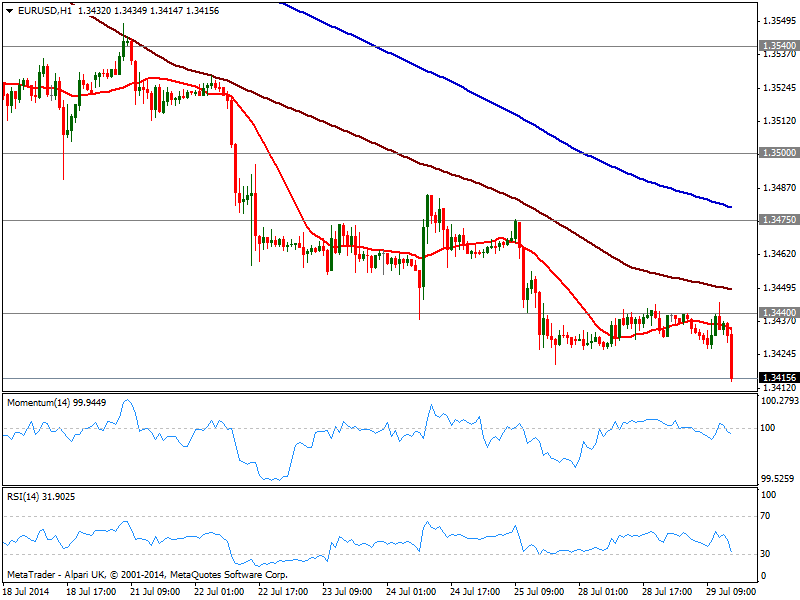

EUR/USD Current price: 1.3415

View Live Chart for the EUR/USD

The greenback keeps grinding higher against most rivals, broadly firmer across the board: the EUR/USD below the year low posted last week at 1.3420, accelerating south early US session, and with the hourly chart showing an increasing downward momentum, as price finally moves away from its 20 SMA while indicators head south in negative territory. In the 4 hours chart 20 SMA capped the upside earlier today, a few pips above 1.3440 and immediate resistance, while indicators hold directionless in negative territory. Further slides should be expected in case stops below 1.3410 get triggered, albeit movements will remain limited ahead of upcoming US data starting on Wednesday.

Support levels: 1.3410 1.3380 1.3335

Resistance levels: 1.3440 1.3475 1.3500

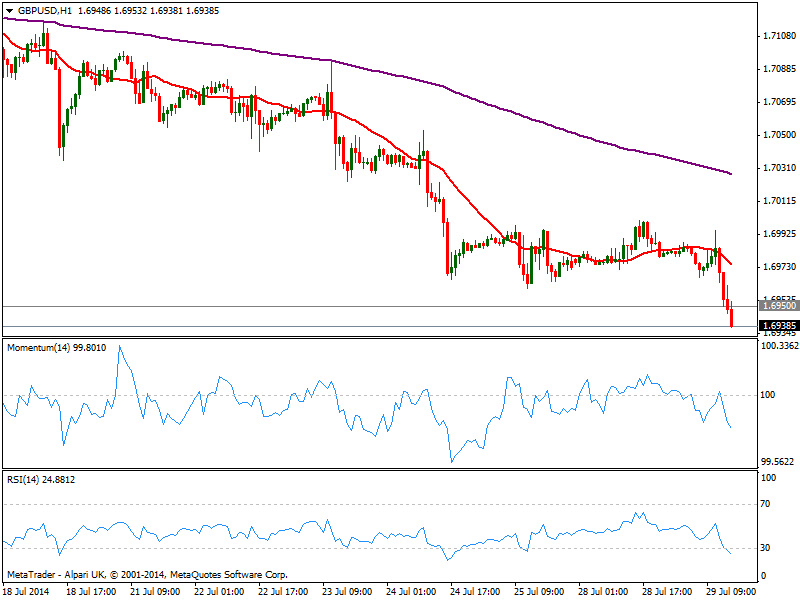

GBP/USD Current price: 1.6938

View Live Chart for the GBP/USD

The GBP/USD trades at a new month low having broken below 1.6950, June 26th daily low. The hourly chart shows a strong bearish momentum, with RSI entering negative territory and price well below moving averages, all of which supports a continued slide. In the 4 hours chart indicators stand below their midlines, but lack directional strength; nevertheless the downside is favored towards 1.6900/20 area, as long as mentioned level caps the upside.

Support levels: 1.6920 1.6870 1.6825

Resistance levels: 1.6950 1.7010 1.7055

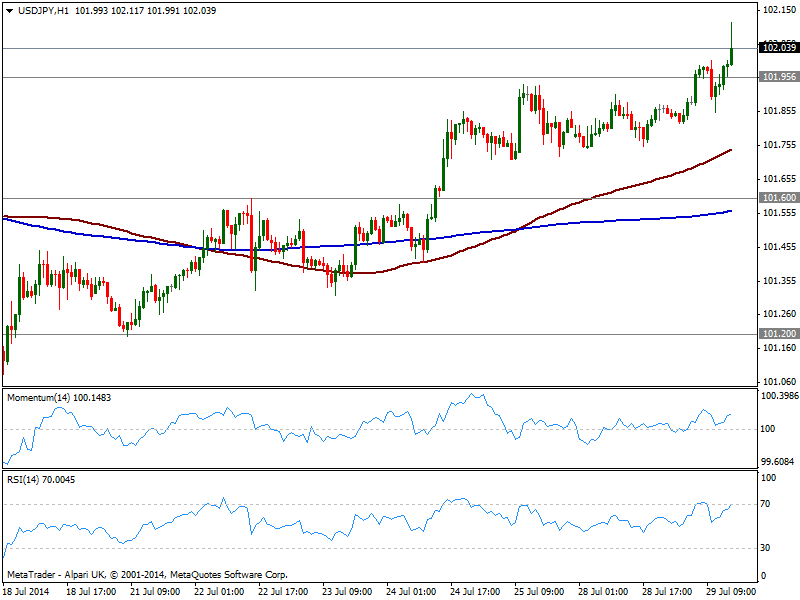

USD/JPY Current price: 102.03

View Live Chart for the USD/JPY

The USD/JPY extended its advance up to 102.11, trading steady above the 102.00 to level but not too far away from it. The hourly chart shows price well above moving averages, with indicators in positive territory, supporting some upward continuation. In the 4 hours chart technical readings also present a mild positive tone, with the upside favored as long as buyers surge on approaches to 101.90/5 support area.

Support levels: 101.95 101.60 101.20

Resistance levels: 102.35 102.80 103.10

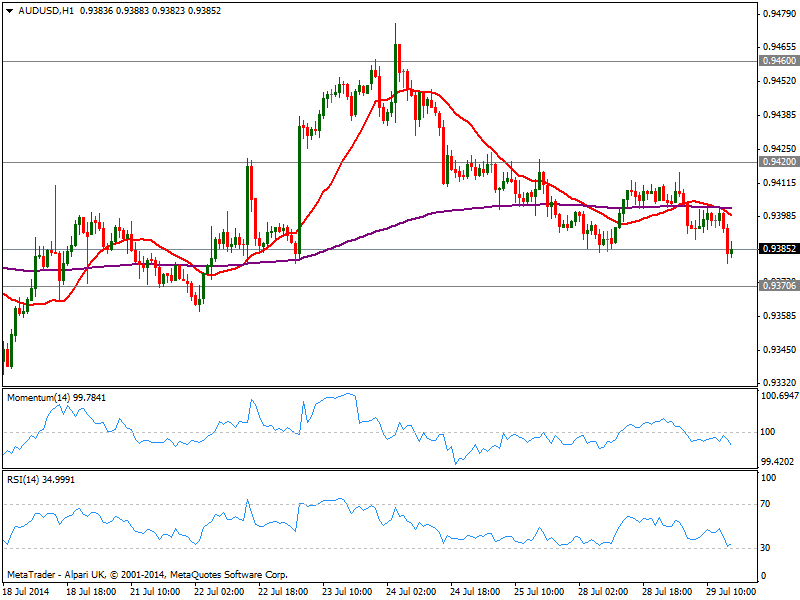

AUD/USD Current price: 0.9385

View Live Chart for the AUD/USD

Slightly lower, the AUD/USD approaches 0.9370 support but trades within range. The hourly chart shows indicators heading south below their midlines and price steady below its moving averages, while the 4 hours chart shows also an increasing bearish potential, all of which keeps the pressure to the downside. A break below mentioned support exposes 0.9330 strong static support, probable daily bottom in case of a stronger slide.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

AUD/USD approaches 0.6900 ahead of Australian inflation

The Aussie is among the best performers against the Greenback this week, trading at fresh 2024 highs, not far from the 0.6900 mark. Australian inflation data taking centre stage in the Asian session.

EUR/USD extend recovery amid persistent USD weakness

The Euro benefited from the broad US Dollar’s weakness on Tuesday, trimming weekly losses and looking to retest the 1.1200 level. Additional gains out of the table amid discouraging European data.

Gold's unstoppable run extends beyond $2,650

Gold price keeps posting record highs on a daily basis, now comfortable above $2,650. Poor United States data fueled speculation the Federal Reserve will trim rates by another 50 bps when it meets in November.

Crypto Today: Bitcoin, Ethereum and XRP consolidate as SUI continues impressive run

Bitcoin traded around $63,600 on Tuesday, as prices appear to be consolidating within the $62,000 and $64,700 key levels. On-chain data shows that the consolidation may be due to profit-taking by holders and mild Bitcoin ETF net inflows of $4.5 million, per Farside Investors data.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.