In this edition of my industry insights article series for FXStreet, I would like to present and discuss a topic on which I receive many questions by traders when speaking at expos and conferences worldwide – the spreads’ role in margin trading. It seems to be one of the most important factors when selecting a broker, a pain point and a key indicator for evaluating account performance. And in order to further this topic, in my next industry insights article I will cover the various execution models that can be applied to your Live Trading Accounts, since you can have the best spreads to roll-out your strategy, if it does not execute... it will be pointless! As we are all here passionate about trading, always feel free to share with myself and the trading community your personal thoughts and experience on the topic in the comments box.

If you are among the community of well-versed and experienced FOREX and CFD traders, you clearly understand the importance of the spread as a critical factor in the success of any short- or long-term manual or automated strategy. Most likely, when looking for a new broker to open a live account with, you experience the following situation which may be quite difficult to deal with: numerous options of Live Trading Account types (mini, standard, premium, pro, ECN and so on) offering one of the following 2 different spread models:

- All-in spread (commission included to the spread as a mark-up, based on fixed or floating spreads)

- Core interbanking spread (commission charged separately, always offered alongside floating spreads)

In such a dilemma one question comes naturally: What is the best option for me? Although both of them sound equally reasonable when applied to specific trading conditions, there are certain differences that every serious investor should consider.

What is the spread impact on your overall performance?

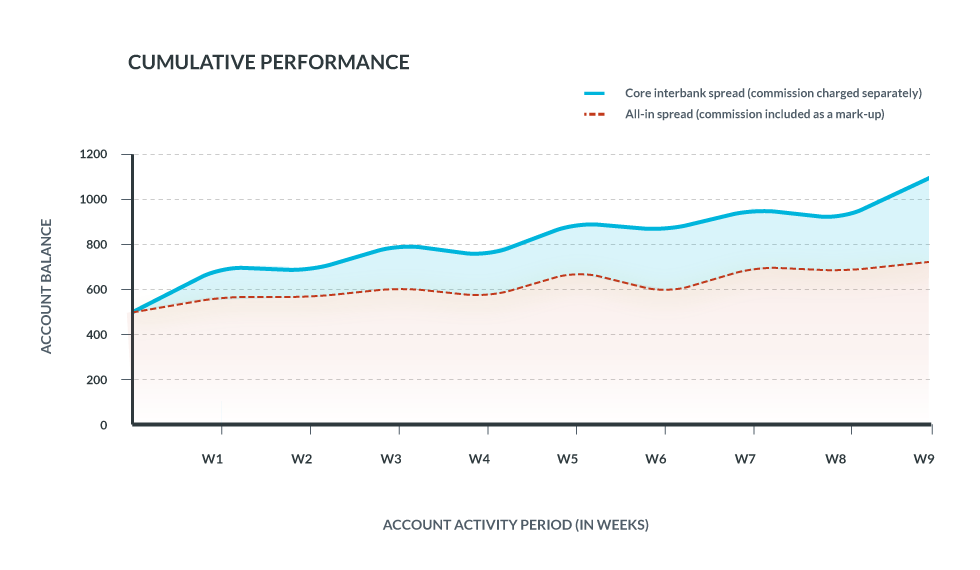

The core interbanking spread improves the trading efficiency while helping to mitigate the risks from unexpected adverse price movements. Moreover, if backed by a spread stability in either highly volatile or calm market conditions thanks to a deep liquidity pool, it leads to better predictability (ie stability) that has a very strong impact on EAs or any other automated trading algorithm. Therefore, deciding to trade on core spreads can possibly optimise your overall performance, measured by a long-term growth in your account’s balance (as illustrated on the chart), coupled with a higher ROI thanks to the better execution and the greater level of control over every open position.

Chart 1. Effects of the spread types on cumulative trading performance

In the example above, the cumulative effect of the 2 different spread models to the performance in an intra-day trading style is shown. Taking into consideration the execution quality and the possibilities for higher spread spikes during market news reaching Stop Loss and Take Profit levels, core interbanking spread lead to a higher yield from trading. Based on extensive research and analysis, such an example is statistically reliable.

Bottom line, if calculating the end cost of each trade is your main burden (because of an EA that takes this factor into account, for example), an all-in spread model may definitely make your life easier. However, as with any ‘packaged’ product, this option would give you less flexibility when fine-tuning your trades against close price movements as well as when setting conditions for entering or exiting the market.

As far as I am concerned, the core interbanking spread with commissions charged separately will always come out as the better alternative. Indeed, it provides you with cost transparency (displaying how much the broker earns upon your trades) and higher levels of control when setting up T/P and S/L levels as well as opening pending orders. If these are key ingredients of your trading style and strategy, the core interbanking spreads will most probably be a better fit to facilitate your efficiency.

Now, being aware of the differences between the spread types and the impact each of them may have on your overall performance, it’s time to dig a little deeper.

How do the various spread models work in reality when applied to your trading strategy?

Comparing the total costs of trading at core interbanking spreads (commission charged separately) or at spreads with a mark-up (commission included) is important, yet you may ask yourself a question: ‘Is this the whole story?’

When the market conditions change rapidly or unexpectedly, using pending orders is definitely a highly recommended tactic to mitigate the risk, prevent dramatic losses or secure reasonable profits. But is it only the trader’s intention and skills that matter?

Unfortunately, not! It’s true that calculating the total cost of a trade is important but what is critical and can truly make or break your strategy is the spread type that your broker is offering. Let’s explore the following 3 scenarios and see the different outcomes from trading at core interbanking spreads or spreads with a mark-up.

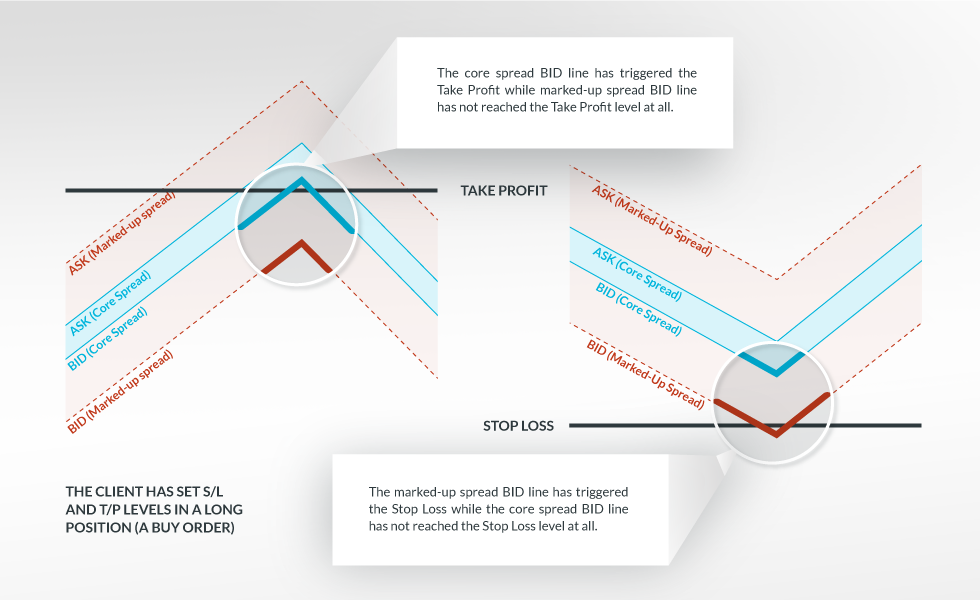

Scenario 1. The client has set S/L and T/P levels in a long position (a buy order)

When the price moves in a favorable direction, in many cases what matters the most is whether the Take Profit level could be reached or the opportunity to cash in would be missed. When trading at core interbanking spreads, your BID price will reach the Take Profit level faster and more often being closer to it.

In the opposite situation (unexpected adverse price movement), it will take longer for the BID price of the core interbanking spreads to reach the Stop Loss level. As a result, you will have more chances to benefit from potential positive shifts in the price direction, unlike trading at all-in (marked-up) spreads - when the BID price could have reached the Stop Loss level faster.

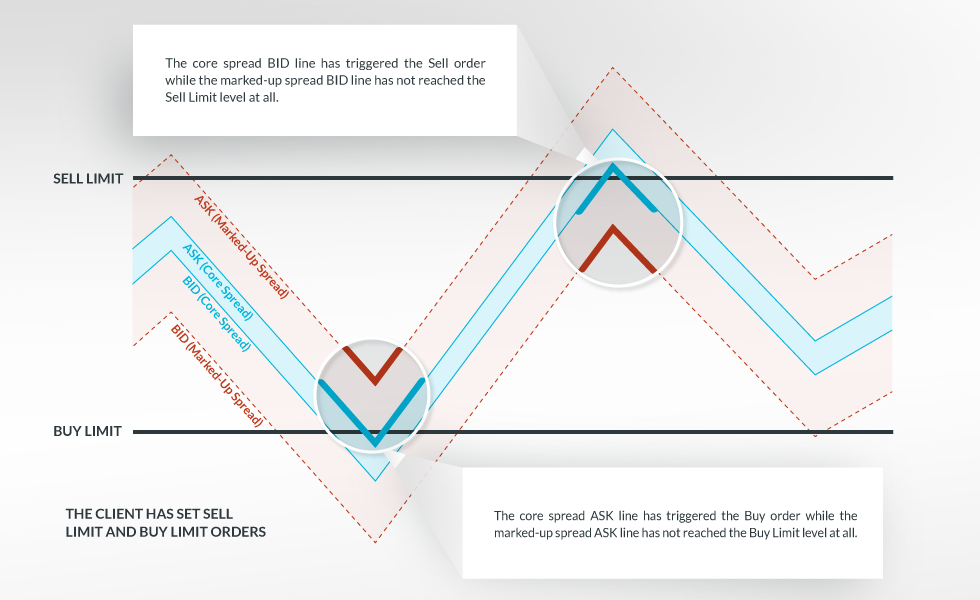

Scenario 2. The client has set sell limit and buy limit orders

Related to the BID/ASK line, Sell/Buy Limit orders are triggered faster when trading at core interbanking spreads. Therefore, you are able to benefit from well-predicted price movements. In the opposite case, when you trade at all-in (marked-up) spreads, the BID/ASK line may not trigger the limit order at all preventing you from realizing your planned strategy, hence, there will be a negative impact on your overall performance due to several missed opportunities.

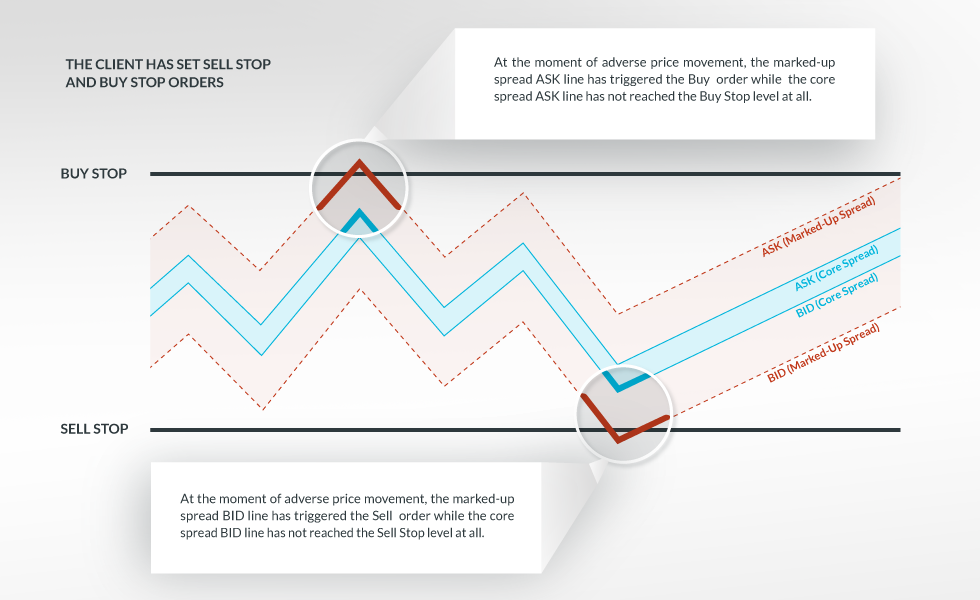

Scenario 3. The client has set sell stop and buy stop orders

The core interbanking spread’s BID/ASK price triggers the Stop order later than the respective all-in (marked-up) spread BID/ASK price does. Thus, you are less exposed to the risk of unexpected negative market movements. As a result, here again, when you trade at core interbanking spreads, your overall performance is positively influenced.

These situations happen quite often in real-time trading conditions and one shall not underestimate the influence that the spread type has on efficiency and profitability. It all relates to the broader topic of trading costs and how much you can save/earn when trading either in core or marked-up spread conditions. In fact, when I discuss such details in front of large audiences, we systematically reach the conclusion that trading costs are the one and only name of the game.

To illustrate what I mean, I would like to do a simple yet important calculation comparing the 2 types of spreads on EUR/USD (world’s most traded FX pair of all times) applied by 6 sample brokers. One is having a 0.1 pip average core interbank spread with a transparent commission of 40 USD/million per side (equivalent to approx. 1 pip total spread) and the other 5 - a fixed 2 pips spread (commission included). To see the impact of this 1 pip difference, let’s assume that the total monthly trading volume generated by the clients of the above mentioned 5 brokers is 1 thrillion USD. The savings that would have been generated for 1 year by these traders if their broker had used the core spread model equal 1.2 billion USD! Combined with the improved efficiency and profitability (having more money available to invest and diversify the portfolio, thus, mitigating all risks), this I believe is worth much more than the total effect of all types of credit bonuses and promotions offered out there in the market.

The core interbank spread is the only model that aligns any broker’s offering to the institutional-grade conditions applied by the Top Private Banks to their HNW individual or corporate clients. Nowadays, the retail traders also have real-time access to such conditions and people share stories with me on how much their cost efficiency has improved when trading at core interbank spreads. To facilitate your research, there are plenty of websites comparing brokers in this regard. You may consider it when selecting with whom to trade with. After all, it is up to you to decide what will work best for your particular trading style.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.