Breaking: Greek finance minister Varoufakis resigns

Yanis Varoufakis became one of the most influential European politicians overnight a few months ago. He raised an enormous interest when he became Greek Finance Minister because of his unusual style and his anti-austerity message.

Varoufakis is loved by some and hated by others. But do we know who he is? Where he comes from? Here you have some interesting facts about his life.

Who is Yanis Varoufakis?

Born: March 24, 1961 (age 54)Yanis Varoufakis is a Greek-Australian economist. He is the current Finance Minister of Greece. In the January 2015 general election, he was elected to the Greek parliament, representing SYRIZA.

Read more:

- Yanis Varoufakis: A Speech of Hope for Greece

- Varoufakis: We couldn't accept "seriously recessionary" proposal

1. What was his role in Valve corporation, a videogame company?

Valve is a company that developed well-known video games like Half Life or Counter-Strike. Varoufakis was hired in 2011 to create a virtual currency for Steam, an online video games distribution platform.Varoufakis says he was hired by Valve "to forge narratives and empirical knowledge that transcend the border separating the 'real' from the digital economies, and bring together lessons from the political economy of our gamers' economies and from studying Valve's very special (and fascinating) internal management structure."

This is the letter that Valve’s boss sent to Varoufakis when he offered him the job:

“I have been following your blog for a while… Here at my company we were discussing an issue of linking economies in two virtual environments (creating a shared currency), and wrestling with some of the thornier problems of balance of payments, when it occurred to me “this is Germany and Greeceâ€ÂÂÂÂ, a thought that wouldn’t have occurred to me without having followed your blog. Rather than continuing to run an emulator of you in my head, I thought I’d check to see if we couldn’t get the real you interested in what we are doing.â€ÂÂÂÂ

Read more:

- Varoufakis: A New Deal for Greece – a Project Syndicate Op-Ed

- Greek Crisis: A Greek Tragedy Hub

2. What was the relationship between Varoufakis and Papandreou?

From January 2004 to December 2006, Varoufakis served as economic adviser to George Papandreou, of whose government he was to become an ardent critic a few years later.Read more:

- Yanis Varoufakis at the Eurogroup: Greece's Proposals to End the Crisis

- Greek FinMin Varoufakis will ask Eurogroup for bailout extension of few weeks

3. Is Varoufakis still updating his own blog?

Varoufakis was a very active publisher on social media networks and on his own blog. When he became Finance Minister he was advised to close down his blog. Nevertheless he still publishes some of his opinions on his blog and that has been FXStreet republishing for many years now.Read more:

- Yanis Varoufakis Reports on FXStreet

- Varoufakis featured on FXStreet years before becoming Greek FinMin

4. What is Varoufakis’ salary?

Yanis Varoufakis earned $100.000 per year as a visitor professor at Lyndon B Johnson School of Public Affairs in 2014, according to data released by TexasTribute.org.Unfortunately, there’s no public information about his current salary as a Finance Minister of Greece.

Read more:

- Varoufakis: On the social conditions in Greece, now

- Varoufakis says there is no more room for further concessions

5. Is Varoufakis married?

Varoufakis is married to Danae StratouBelieve it or not, Google shows a special card with biographic information about his wife.

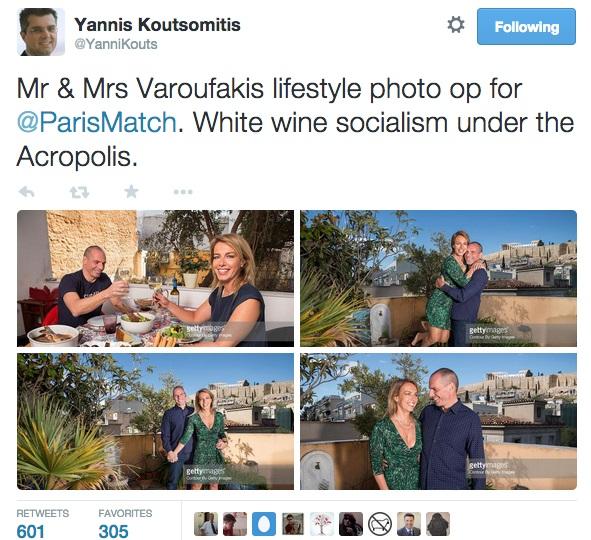

Paris Match published a controversial interview and photo-reportage about Varoufakis and his wife in March. Varoufakis regretted the aesthetics of the interview, while some of his colleagues criticized not only the aesthetics but the content and the luxury life they showed.

There has been speculations that Danae Stratou was the inspiration behind Pulp’s greatest hit “Common Peopleâ€ÂÂÂÂ.

Read more:

- What we’re reading: Bloomberg’s terminal dominance; Virtu’s HFT business; S&P CEO’s; Varoufakis and Pulp

- Yanis Varoufakis in conversation with John Nash Jnr on Ideal Money

- Greece Economic Indicators

6. What did Yanis Varoufakis look like when he was younger?

Varoufakis in October 1993 (aged 32) in Australian Television (ABC) about the Greek Elections.

7. Did Yanis Varoufakis write books?

Varoufakis is the author of several books on game theory, but not only:- Europe after the Minotaur: Greece and the Future of the Global Economy.

- Economic Indeterminacy: A personal encounter with the economists' most peculiar nemesis.

- The Global Minotaur: America, the True Origins of the Financial Crisis and the Future of the World Economy.

- Modern Political Economics: Making sense of the post-2008 world.

- Game Theory: A critical text.

- Foundations of Economics: A beginner's companion.

- Game Theory: A critical introduction.

- Rational Conflict.

- Conflict in Economics.

Editors’ Picks

AUD/USD defends gains below 0.7100 amid the Fed-RBA divergence

AUD/USD attracts some dip-buyers near mid-0.7000s during the Asian session on Monday, stalling last week's modest pullback from a three-year peak. The US Dollar continues with its struggle to attract any meaningful buyers amid bets for further rate cuts by the Fed, bolstered by the softer US CPI report on Friday. In contrast, the Australian Dollar retains a bullish bias on the back of the RBA's hawkish stance, which further acts as a tailwind for the currency pair.

USD/JPY stays firm around 153.00 after Japan's Q4 GDP miss

USD/JPY kicks off the new week on a positive note as Japan's weak Q4 GDP growth tempers bets for an immediate BoJ rate hike and undermines the Japanese Yen. Investors, however, seem convinced that the BoJ will stick to its policy normalization path amid hopes that PM Takaichi's policies will boost the Japanese economy. In contrast, cooling US consumer inflation reaffirmed bets for more Fed rate cuts in 2026, which acts as a headwind for the US Dollar and should cap the currency pair.

Gold buyers hesitate amid holiday-thinned trading

Gold trades volatile, but within range, as US, China holidays-led thin trading exaggerates moves. The US Dollar extends range play into the US GDP week, with markets pricing at least two Fed rate cuts this year. Technically, Gold tests key support at $5,000; daily RSI still remains bullish.

Top Crypto Losers: Dogecoin, Zcash, Bonk – Meme and Privacy coins under pressure

Meme coins such as Dogecoin and Bonk, alongside the privacy coin Zcash (ZEC), are leading the broader market losses over the last 24 hours. DOGE, ZEC, and BONK ended their three consecutive days of recovery with a sudden decline on Sunday, as crucial resistance levels capped the gains. Technically, the altcoins show downside risk, starting the week under pressure.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.