Read: Central banks to continue trying to achieve 2% inflation in 2016

Anyway, and despite the pair maintains a long term bullish tone, some bearish divergences that are surging in the monthly chart suggest that fresh highs are not yet to be taken for granted. Indeed, with the FED triggering a lift off in December, and if the pair holds near the current 123.50 region, the pair can run up to the mentioned yearly high around 125.80, while if somehow the rally extends beyond this last, the next probable bullish target comes at 127.60, April 2002 monthly low. Seems unlikely the JPY will continue weakening into March next year, when some yen strength could be expected by the end of the fiscal year. Nevertheless and after that, the next logical target on dollar strength comes at the 130.00 psychological figure.

_20151119152802.png)

The mounting bearish divergences are far from being confirmed, but if the pair breaks below 119.30, the main support for the upcoming months, it can retest the low posted last August at 116.60. Further falls however are unlikely, and in fact, given that the dollar should lead the way during 2016, any decline towards the level should be consider a long term buying opportunity.

USDJPY Point & Figure Charts Forecast by Gonçalo Moreira, CMT

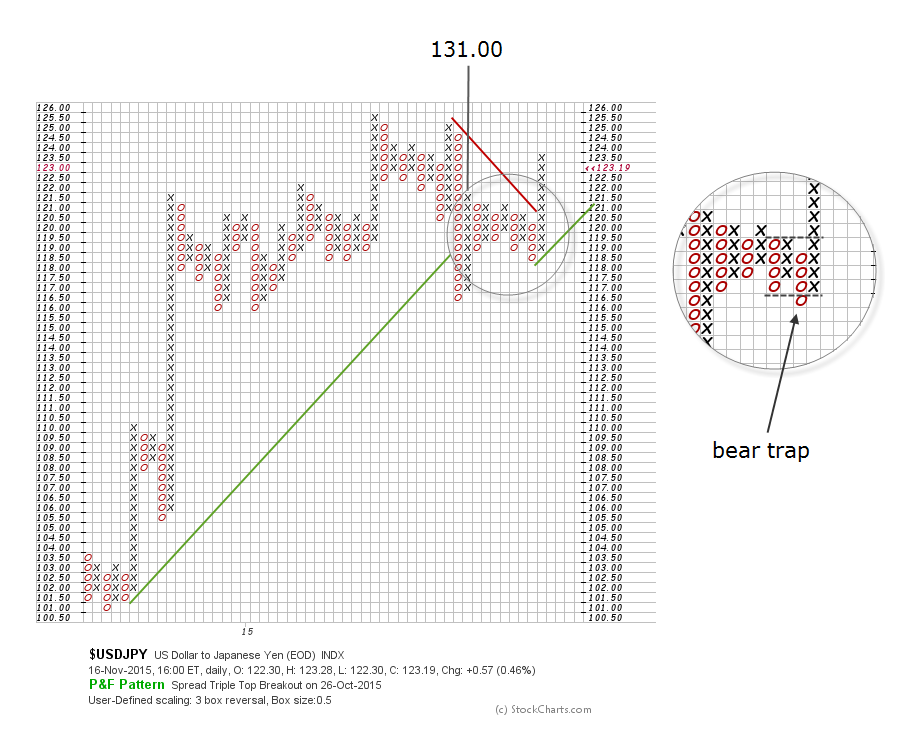

The bearish 45º line was broken by a bear trap pattern, in this case a bottom double sell signal, which has been reversed into a double-top and then triple-top buy signal. The whole affair let the new bullish objective line dictate the trend which is now bullish, valid until broken by a double or triple bottom.

The 3-box reversal chart enable for a vertical count which has been plotted on the chart. 131.00 is the next target for this currency pair, short of the 2002 highs.

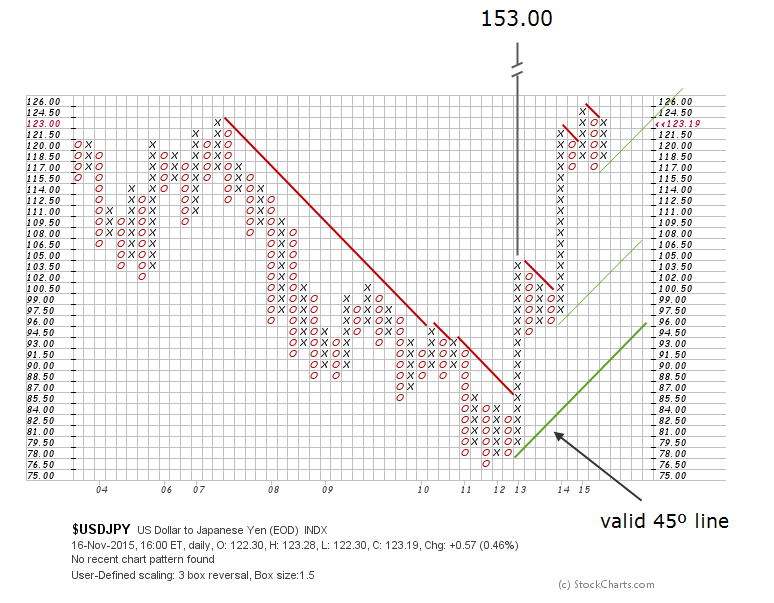

Thereafter, trying to find scope for the legacy 1998 spike highs maintaining a 3-box granulation, I come up repeatedly with an 150.00+ count. The below chart depicts just one of these vertical calculations using a 150 pip box size. 153.00 Japanese yen per US dollar is the long-term target to have in mind for next year.

Note the successive internal lines (in thin green) defending the bullish stance of this market. The eventual break of the first of these lines would not change the trend direction, but rather alert of a correction towards the next one.

Read also other related articles about what 2016 could bring for the markets:

Currencies

EUR USD Forecast 2016

GBP USD Forecast 2016

Central Banks

ECB Forecast 2016

RBA Forecast 2016

PBoC Forecast 2016

FED Forecast 2016

BoE Forecast 2016

BoJ Forecast 2016

SNB Forecast 2016

Commodities

Gold Forecast 2016

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.