EUR/USD Daily

Settling back from the 1.0917 high but the upside stays in focus following recovery from the 1.0778 low of last week. Resistance is at 1.0921 and break here and 1.0940 will clear the way for retest of the Jan range high at 1.0970/85. Support now at 1.0819 and below this needed to expose 1.0778 low to retest. [PL]

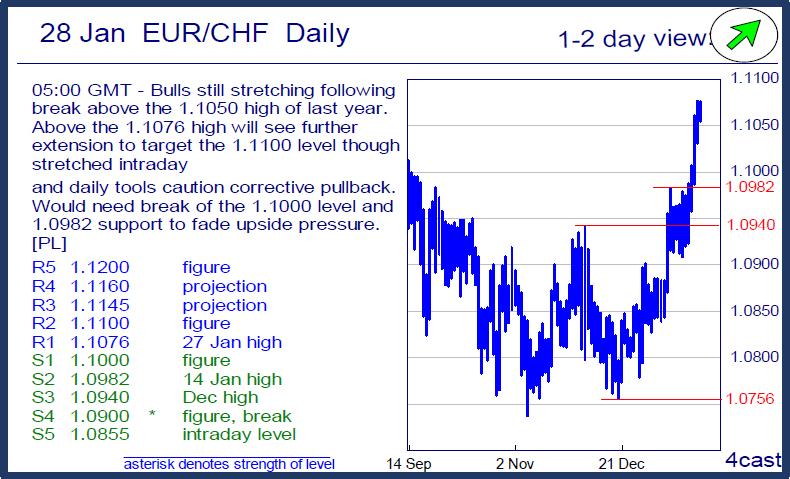

EUR/CHF Daily

Bulls still stretching following break above the 1.1050 high of last year. Above the 1.1076 high will see further extension to target the 1.1100 level though stretched intraday and daily tools caution corrective pullback. Would need break of the 1.1000 level and 1.0982 support to fade upside pressure. [PL]

USD/CHF Daily

Settled back in consolidation from the 1.0200 level though the downside still limited and see support at the 1.0125/107, prev highs. Would take break to swing focus lower within the 6-1/2 wk up channel from the .9786, Dec low. Clearing the 1.0200 level will see extension to 1.0240 then 1.0328, 2015 high. [PL]

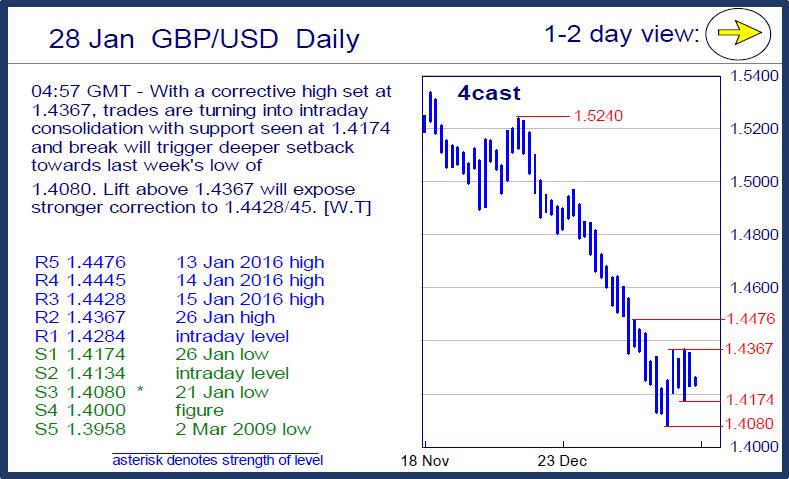

GBP/USD Daily

With a corrective high set at 1.4367, trades are turning into intraday consolidation with support seen at 1.4174 and break will trigger deeper setback towards last week's low of 1.4080. Lift above 1.4367 will expose stronger correction to 1.4428/45. [W.T]

USD/JPY Daily

Keeping below the 119.00 level though upside stays in focus while above the 118.00 level. Higher will see further extension of the up-leg from the 115.98 low of last week to target 119.70 then strong resistance at the 120.00/35 area. Would take break of the 117.66/48 support to return focus to the downside. [PL]

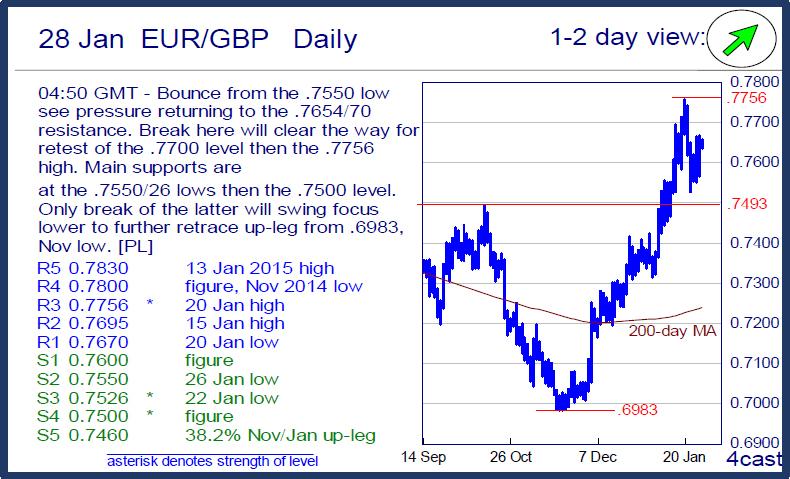

EUR/GBP Daily

Bounce from the .7550 low see pressure returning to the .7654/70 resistance. Break here will clear the way for retest of the .7700 level then the .7756 high. Main supports are at the .7550/26 lows then the .7500 level. Only break of the latter will swing focus lower to further retrace up-leg from .6983, Nov low. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.