EUR/USD Daily

Tight intraday trading but the sharp sell-off last session below 1.0904 support and negative crossing seen on daily Stochastic are turning pressure towards downside and should keep this currency pair on a subdued tone. Below 1.0899 low set last session to expose move to 1.0870/48. [W.T]

USD/CHF Daily

Strong rally last session with a higher closing triggered a positive cross-over on daily Stochastic and seen boosting this currency pair with immediate threat to 0.9946 hurdle and break will see stronger level at 0.9990 targeted. [W.T]

USD/JPY Daily

With the year 2015 coming to an end , trades are getting thinner with prices stuck in tight consolidation and with the preceding down move from 123.56 high still dominating, selling into upticks still favoured. Below 120.14/07 supports will signal bears back in control. [W.T]

EUR/CHF Daily

Upmove stretching and currently stalled by the 1.0859 congestion high and the appearance of a High-wave candle last session is slowly taking pressure off the upside and downside break of 1.0827 support will help tilt pressure lower to 1.0800 then 1.0773. [W.T]

GBP/USD Daily

Intraday trade remains consolidative but the strong decline seen last two sessions with break of 1.4806 strong support is helping bears regain control and eyes lower support at 1.4740 ahead of 1.4700. Strong resistance is now seen at 1.4970 and lift above latter will shift focus towards upside. [W.T]

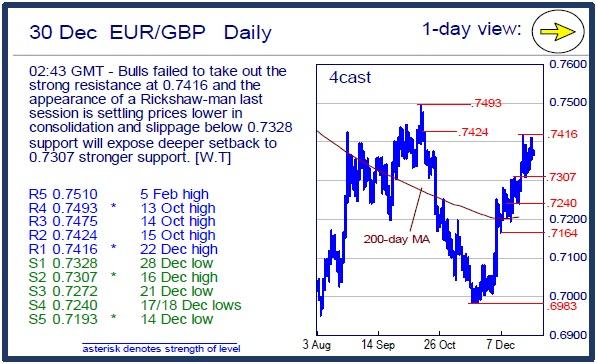

EUR/GBP Daily

Bulls failed to take out the strong resistance at 0.7416 and the appearance of a Rickshaw-man last session is settling prices lower in consolidation and slippage below 0.7328 support will expose deeper setback to 0.7307 stronger support. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.