![]()

The end of April Fool’s Day in North America was rather tepid even though both US equity markets as well as the USD tried to battle back from early declines. Stocks ended up down on the day despite that puncher’s mentality, but were well off the lows established in early trade. The USD as well shook off early weakness and found support in currencies like the USD/JPY around previous established price levels, but an overwhelming rally was lacking. As we careen in to the back half of this short week, liquidity is likely to get lighter as investors have spring break and Easter holiday on their minds more than price breaks and Greek loan payment holidays.

Despite the thin trading conditions likely to manifest over the next couple days, there are some intriguing possible moves beginning to set up; and one such move could be in the GBP/CHF. The GBP has been eviscerated over the last month against many other currencies mainly, it seems, on the fact that so much has been expected of it. Granted, inflation hasn’t been stellar and the unemployment rate ticked up from 5.6% to 5.7%, but other than that, economic figures haven’t been particularly dour. Most of the PMI figures are strong, borrowing is up, sales on the retail side are increasing with conviction, and even the final GDP release was revised higher for Q4. Perhaps some of this GBP bashing will come to an end and reverse some of the negative trends we’ve seen for the currency.

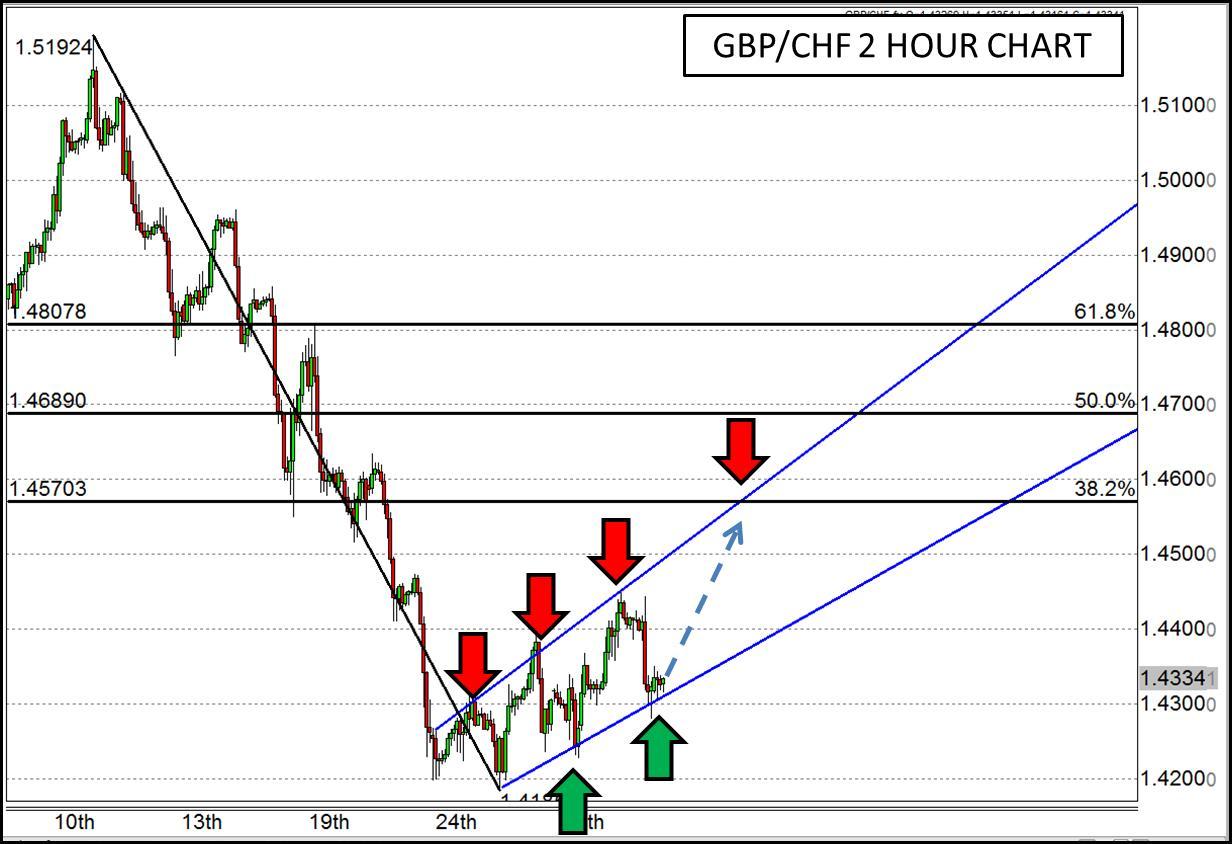

The GBP/CHF is an intriguing pair due to a potential changing of that downward trend. In the month of March, when this pair fell from nearly 1.52 down to 1.42, it followed a relatively tight channel on the way, but the end of the month and the beginning of the new month has revealed that a new channel could be developing in the opposite direction. Extrapolating Fibonacci retracements from the March high to low shows that there may be room for a run up to 1.46, 1.47, or even 1.48 if it were to rise at the pace of the currently developing channel. Being that prices are near the bottom of the new channel currently, the time is nigh to test this theory and see if the GBP can get some spring in its step and blaze a new trail higher.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.