From a fundamental view, we know the US will close the QE chapter for good this October, trimming the last $15B of facilities. We also know the ECB is barely starting with facilities, so from that side, the downside continues to be favored on Central Banks imbalance.

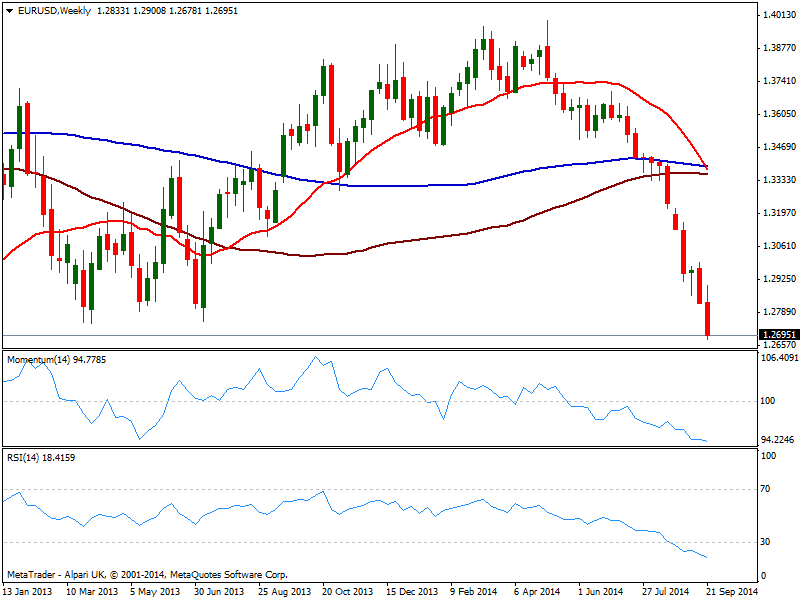

Technically, the weekly chart continues to show the pair extremely oversold, with RSI at 18.4 and an over 1000 pips almost straight decline. But at the same time indicators continue to head lower and show no aims to reverse bias. Furthermore, 20 SMA has turned strongly south and converges now with 100 and 200 ones, clearly reflecting latest dollar strength against its European rival.

In the daily chart, early momentum corrected partially higher but turned back south while RSI stands at 23 and 20 SMA capping the upside now in the 1.2920 price zone. Bottom line, bears still rule: some consolidation could be expected earlier next week, with recoveries up to mentioned 1.2920 not really affecting the dominant trend, but indeed mining sentiment among bears. Immediate support on the other hand, stands at 1.2660 and once below, the pair can quickly extend down to 1.2600 short term, thus once 1.2660 gives up, doors are open for a run towards the 1.2500 figure. If the decline continues steady with USD positive data sending price below this last by the end of the week, chances of an upward correction despite oversold readings will reduce even further, with 1.2740 then as a critical resistance for the rest of the month, and 1.2300 price zone becoming the next probable target.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

USD/JPY off lows, stays pressured near 142.50 ahead of BoJ policy decision

USD/JPY has bounced off lows but remains pressured near 142.50 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.