EUR/USD Current Price: 1.1352

View Live Chart for the EUR/USD

Improved markets' sentiment due to a continued recovery in oil prices continues to be the main market leader this Tuesday, keeping the dollar subdued all across the board. The common currency is a lager today, weighed by mixed local data, as the ZEW survey showed that assessment of the current situation decreased in April, but he economic sentiment improved for Germany and the EU, as latest positive data coming from China, eased concerns over a global economic slowdown. The EU current account released earlier today, recorded a surplus of €19 billion, while January readings were revised to €27.5B. Finally, Construction output in the region fell by 1.1% in the same month, well below the previous 3.6%. In the US, another batch of disappointing housing data sent the greenback further lower ahead of Wall Street opening, falling more than expected in March. Residential starts decreased 8.8% to a 1.09 million annualized rate that was the lowest since October, while Building Permits fell to 1.8 million.

The EUR/USD pair advances to fresh daily highs around the 1.1350 region, finally breaking above the 1.1330 price zone that contained advances ever since the week started. Technically, the 1 hour chart shows that the technical indicators have accelerated higher into overbought territory, whilst the price is currently above its moving averages, having broken beyond the 200 SMA in this last spike, all of which signals an upward continuation in the short term. In the 4 hours chart, the RSI indicator accelerated its advance and stands now around 61, although the price is still struggling to overcome its 100 SMA. Overall, the upside is now favored towards the 1.1400/20 region, ahead of the 1.1460 major resistance level.

Support levels: 1.1330 1.1280 1.1235

Resistance levels: 1.1380 1.1420 .1460

GBP/USD Current price: 1.4381

View Live Chart for the GBP/USD

The GBP/USD pair trades at fresh monthly highs, fueled by news showing that in the latest polls, those voting to remain within the EU have took the lead. The Pound is also being benefited by high-yielders demand, and the pair can continue advancing, particularly on a break above 1.4405, where the pair presents a daily descendant trend line coming from February high. Short term, the 1 hour chart shows that the technical indicators are partially losing upward strength within overbought territory, but are far from suggesting a reversal, as the price extends beyond its moving averages. In the 4 hours chart, the technical indicators are also losing upward momentum within overbought levels, but the price is also far above its moving averages, supporting at least a test of the mentioned trend line.

Support levels: 1.4350 1.4315 1.4260

Resistance levels: 1.4405 1.4440 1.4485

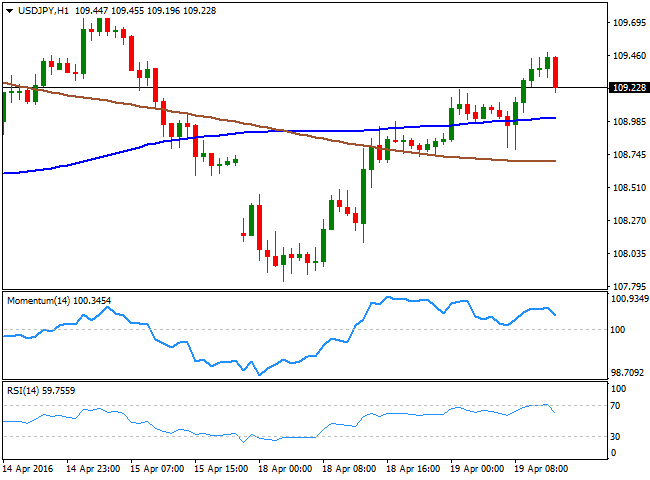

USD/JPY Current price: 109.23

View Live Chart for the USD/JPY

Short term bearish below 109.00.The USD/JPY pair retreats from a fresh weekly high set at 109.48, weighed by poor US housing data, as in March, housing starts and building permits fell beyond expected. Despite improved market's mood, the pair retains its long term bearish tone, although some consolidation could be expected, before the pair is able to break below 109.00. From a technical point of view, the 1 hour chart shows that the technical indicators have turned sharply lower from near overbought levels, but the price holds above the 100 SMA, which broke beyond the 200 SMA earlier this week. The shortest reinforces the immediate support, by standing around 109.00. In the 4 hours chart, the 100 SMA has accelerated its decline above the current level, whilst the technical indicators hover around their mid-lines, lacking clear directional strength, and therefore maintaining the risk towards the downside.

Support levels: 109.00 108.65 108.20

Resistance levels: 109.50 110.00 110.40

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.