EUR/USD Current Price: 1.0843

View Live Chart for the EUR/USD

Euro weakness has been the main theme over the European morning, although the currency remained within its recent range, showing no reaction, despite markets' mood improved, as oil remains stable while stocks traded higher in Asia. There were no relevant news coming from Europe this Wednesday, although local share markets are struggling around the opening. The just released US ADP survey, is doing little for the greenback in spite it resulted better-than-expected. According to the report, the private sector added 214K new jobs during February, above the 190K expected and the previous revised to 193K.

The EUR/USD pair was showing some short term choppy price action ahead of the news, but it retains its overall negative tone, as in the 1 hour chart, the pair is developing below its 20 SMA, while the technical indicators have turned south within bearish territory. In the 4 hours chart, the bearish potential is even stronger, although the pair needs to trigger stops below 1.0810 to be able to confirm further declines towards the 1.0730 region.

Support levels: 1.0810 1.0770 1.0730

Resistance levels: 1.0890 1.0925 1.0960

GBP/USD Current price: 1.4011

View Live Chart for the GBP/USD

The GBP/USD pair jumped above the 1.4000 level ahead of the US opening, helped by a sharp downward move in the EUR/GBP, as the common currency continues to be the weakest currency among majors. The Pound managed to advance, despite the UK Construction PMI fell in February to 54.2, its lowest in 10 months. Currently holding on to gains, the 1 hour chart shows that the pair has advanced above a mild bullish 20 SMA, albeit the technical indicators have lost upward strength, turning south from near overbought levels. In the 4 hours chart, the price has bounced once again from the 1.3900/10 region, where the 20 SMA holds flat, while the RSI indicator aims higher around 57 and the Momentum indicator turned lower within positive territory, indicating limited upward potential. Nevertheless, the pair needs to advance beyond 1.4040, the immediate resistance, to be able to extend its rally this Wednesday.

Support levels: 1.3960 1.3920 1.3875

Resistance levels: 1.4040 1.4090 1.4130

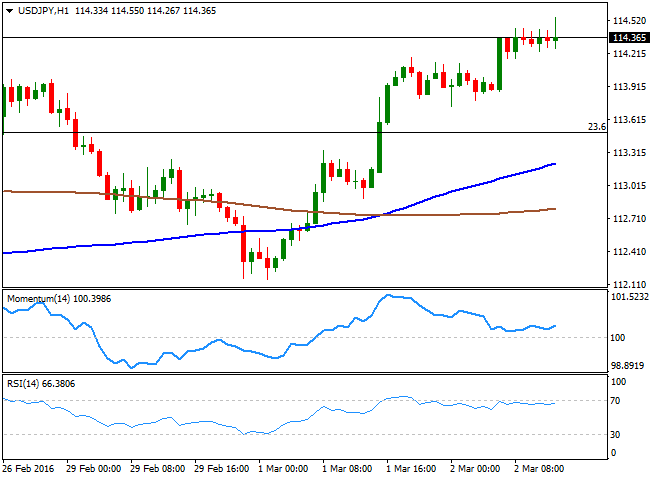

USD/JPY Current price: 114.36

View Live Chart for the USD/JPY

Losing upward potential. The USD/JPY pair advanced in the Asian session, extending its rally up to 114.55 following the release of an encouraging ADP survey, which showed the US private sector added 214K new jobs in February. Buying interest has anyway, diminished during the European session, as local stocks struggle to post gains. The 1 hour chart shows that the pair has been pretty much consolidating its latest gains, but the overall technical picture shows a strong lack of upward momentum, as the technical indicators are pretty much flat. In the same chart however, the 100 SMA heads higher above the 200 SMA, limiting chances of a stronger decline. In the 4 hours chart, the latest rally stalled well below the 38.2% retracement of its latest daily decline at 115.05, the level to beat to see a more constructive stance. In this last time frame, the Momentum indicator continues to head north within bullish territory, but the RSI is already turning lower from near overbought levels, in line with the shorter term tone.

Support levels: 114.10 113.65 113.30

Resistance levels: 114.60 115.05 115.50

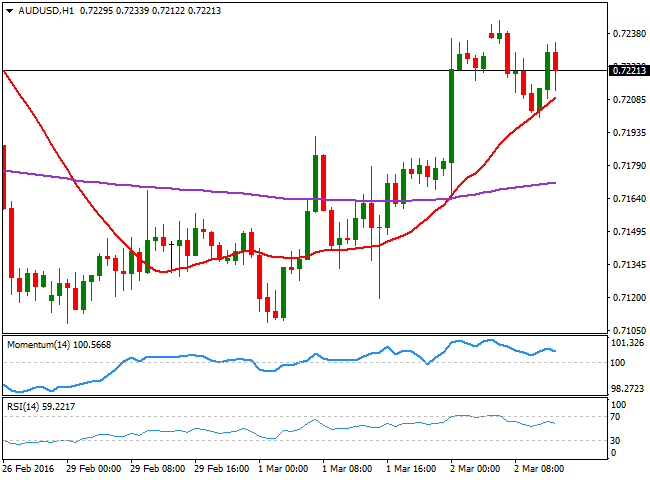

AUD/USD Current price: 0.7129

View Live Chart for the AUD/USD

The AUD/USD pair jumped higher at the beginning of the day, after the Australian real GDP expanded by a stronger than expected 0.6% Q/Q in Q4, resulting in a 3.0% annual gain, quite impressive figures given the commodity price crash and general global financial market conditions. But the rally stalled at 0.7243, where selling interest has been containing advances ever since the year started. The pair retreated down to 0.7200 from where it bounced back, although good US data has contained the advance. Technically, the 1 hour chart shows that the price has bounced from a sharply bullish 20 SMA, maintaining the risk towards the upside, albeit the technical indicators in the mentioned time frame are turning south ahead of the US opening. In the 4 hours chart, a positive outlook prevails as the price accelerated higher beyond its 20 SMA, while the technical indicators are turning back higher well above their mid-lines.

Support levels: 0.7200 0.7160 0.7115

Resistance levels: 0.7260 0.7300 0.7340

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.