EUR/USD Current price: 1.1118

View Live Chart for the EUR/USD

The US headline was a disappointment, with the economy creating just 173K new jobs in August, against expectations of 223K. Unemployment rate however, decreased to 5.1%, the lowest in 7 years, whilst wages rose beyond expected, up to 0.3%. July jobs creation was revised higher to 245K. Overall, the mixed result was not enough to confirm a rate hike in September, neither too bad to deny it, leaving uncertainty at high levels. The dollar however trades generally higher across the board, exception made by the Japanese yen that remains on demand.

The EUR/USD pair trades near its daily low, set at 1.1089, and maintains a short term negative tone, as the 1 hour chart shows that the price is unable to advance beyond its 20 SMA, whilst the technical indicators are turning lower around their mid-lines. In the 4 hours chart, the technical readings also support the downside, as the post report spike stalled below a bearish 20 SMA, whilst the technical indicators consolidate flat near oversold levels. Should the price break below 1.1080, the bearish momentum will accelerate, down to the 1.1010 region.

Support levels: 1.1080 1.1050 1.1010

Resistance levels: 1.1160 1.1200 1.1245

GBP/USD Current price: 1.5206

View Live Chart for the GPB/USD

The GBP/USD pair remains under pressure, consolidating in a tight range near a daily low set at 1.5189, and remains below the previous daily low of 1.5213. The 1 hour chart shows that the bearish trend remains firm in place, with the 20 SMA capping the upside, on intraday attempts of advancing, whilst the technical indicators hold in negative territory, lacking however, directional strength. In the 4 hours chart, the price retreated by the pip from a strongly bearish 20 SMA, whilst the technical indicators present a mild negative tone well below their mid-lines, maintaining the risk towards the downside.

Support levels: 1.5170 1.5135 1.5100

Resistance levels: 1.5220 1.5250 1.5290

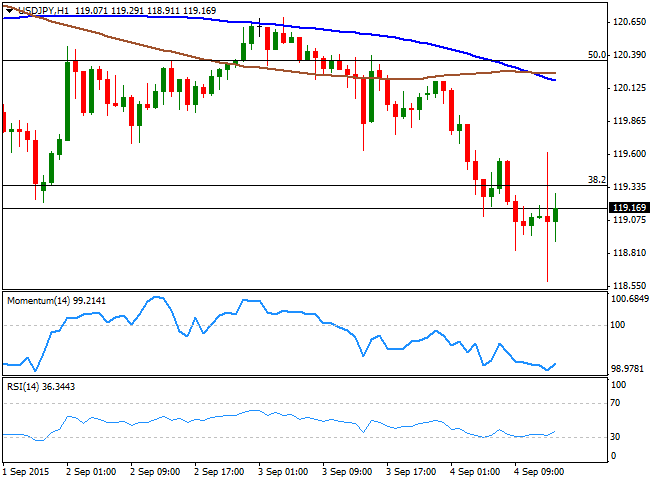

USD/JPY Current price: 119.17

View Live Chart for the USD/JPY

The USD/JPY pair sunk to 118.83, as risk aversion resumed in the Asian session, with the US Nonfarm Payroll report doing little to revert the dominant bearish trend. Following yen's strength post ECB, the Nikkei 225 fell sharply, spurring additional yen demand at the beginning of the day. The USD/JPY extended its daily low down to 118.58 on the NFP negative headline, but recovered back above the 119.00 level. Nevertheless, the bearish outlook is still strong, with the price far below its 100 and 200 SMAs, whilst the technical indicators are bouncing from oversold levels, but well into negative territory and far from suggesting further gains. In the 4 hours chart the technical indicators are flat below their mid-lines, maintaining the risk towards the downside. The price needs to establish above the 119.40 level, the 38.2% retracement of the last two weeks decline, to shrug off the negative tone, at least in the short term.

Support levels: 118.90 118.50 118.10

Resistance levels: 119.40 119.70 120.00

AUD/USD Current price: 0.6943

View Live Chart for the AUD/USD

The Aussie remains in a selling spiral, with the AUD/USD pair down to a fresh multi year low of 0.6927, and unable to bounce. The pair is oversold in the short term, as in the 1 hour chart, the technical indicators are losing their bearish potential near oversold levels, yet there's little hopes for an upward correction ahead. In the 4 hours chart, the price remains capped by a strongly bearish 20 SMA, currently at 0.7015, whilst the technical indicators head sharply lower, despite being near oversold levels, pointing for further declines below the 0.6900 level.

Support levels: 0.6930 0.6880 0.6845

Resistance levels: 0.6970 0.7015 0.7040

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.