EUR/USD Current price: 1.0610

View Live Chart for the EUR/USD

The dollar cached a bid and soared to a fresh 7-month high against the common currency in the American afternoon, posting 1.0550 before bouncing back. Ever since the day started, the macroeconomic picture kept the pair under pressure, as poor inflation results in the EU for November boosted the case for further ECB easing this Thursday. According to the official release, inflation in the region rose by 0.1% compared to the previous month, and 0.9% yearly basis, missing expectations and indicating deflationary pressures remain intact. In the US, the ADP survey showed that the private sector added 217K new jobs during November, anticipating a strong NFP report for the same month, whilst the unit labor cost surged to 1.8%. The start of the day was, however, the FED's chair, Janet Yellen, who spoke late in the US and affirmed that the economic and financial info has been consistent with their expectations of continued improvement, pretty much guaranteeing a rate hike this December. But at the same time she expressed concerns over long term inflation and added that "after the initial increase in the federal fund rate, monetary policy will remain accommodative."

The EUR/USD pair bounced from the mentioned low, and recovered up to the 1.0600 region, albeit its having a hard time to remain above it ahead of the US close. The pair has been trading in quite a limited range ever since the week started, ahead of the upcoming major events, and the technical picture is neutral-to-bearish, as the 4 hours chart shows that the price is struggling around a horizontal 20 SMA, while the technical indicators are seeking for direction around their mid-lines. A break below 1.0550, with additional easing coming from the ECB, can open doors for a retest of the year low at 1.0460 this Thursday, with chances of fresh lows afterwards, should US employment data beat expectations.

Support levels: 1.0550 1.0520 1.0490

Resistance levels: 1.0650 1.0690 1.0740

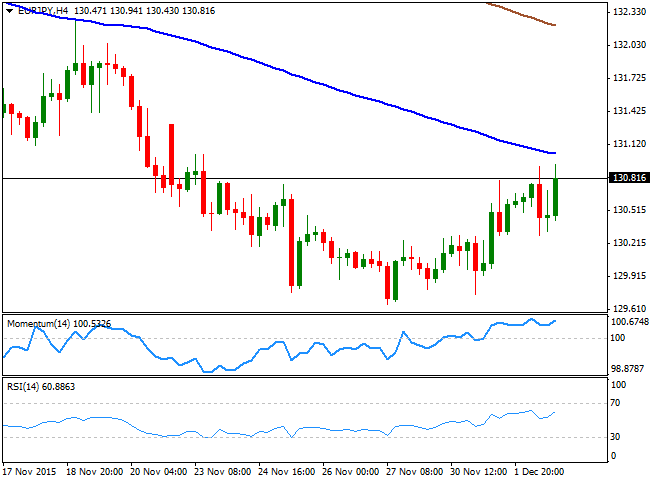

EUR/JPY Current price: 130.82

View Live Chart for the EUR/JPY

The EUR/JPY pair surged up to 130.94 as the Japanese yen weakened on renewed hopes that the US Federal Reserve will act in its upcoming December meeting. The short term picture for the pair suggests that further gains are likely given that the price has met buyers around the 200 SMA in the hourly chart, whilst in the same chart, the 100 SMA aims higher below the larger one, while the technical indicators aim strongly higher above their mid-lines. In the 4 hours chart, the technical indicators are also heading north above their mid-lines, but the pair continues trading below a bearish 100 SMA. Despite these last days' recovery, the longer term outlook is still bearish, with renewed selling interest below 130.00 is required to confirm a new leg south towards fresh lows.

Support levels: 130.40 130.00 129.65

Resistance levels: 130.90 131.30 131.80

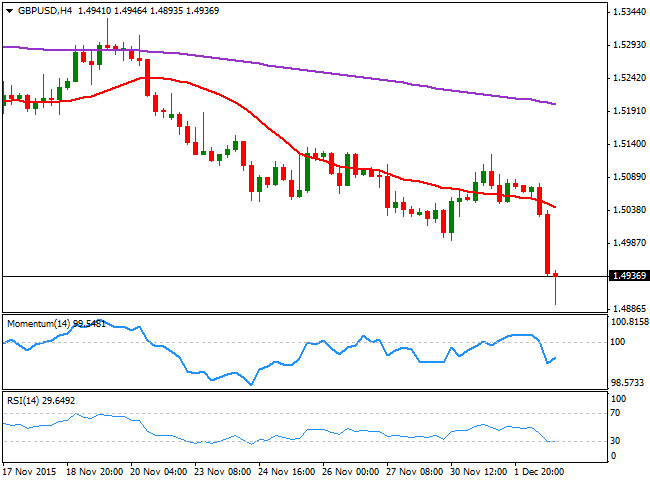

GBP/USD Current price: 1.4938

View Live Chart for the GPB/USD

The British Pound plunged to a fresh 8-month low against the greenback of 1.4893, initially affected by poor UK construction data, and later by stronger US one. Early Europe, the release of the November UK Construction PMI, showed that growth in the sector slowed, resulting at 55.3 against previous 58.8 and expectations of a 58.2 advance. The figures sent the pair towards the 1.5000 psychological figure, broken later on the day amid a strong US ADP survey. Currently trading back above the 1.4900 level, the pair seems poised to correct some, but maintains a bearish tone, as according to the 1 hour chart, the technical indicators have turned higher in extreme oversold territory whilst the 20 SMA heads lower far above the current level. In the 4 hours chart, the technical indicators are turning higher in negative territory, but the risk remains towards the downside, whilst the 20 SMA has extended its decline above the current level, in line with a continued decline for this Thursday.

Support levels: 1.4920 1.4885 1.4850

Resistance levels: 1.4960 1.5000 1.5030

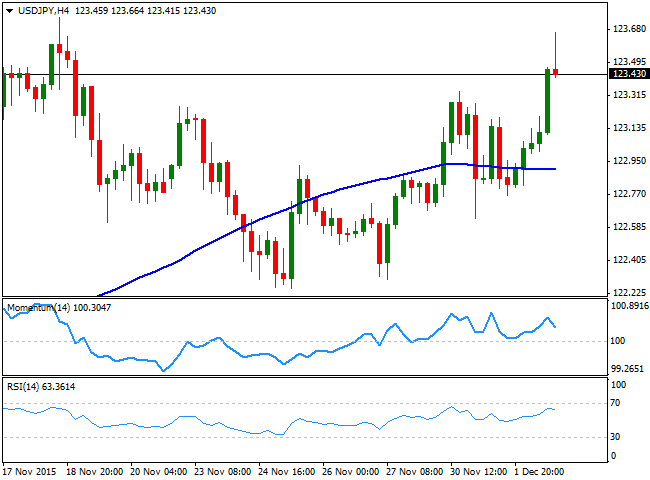

USD/JPY Current price: 123.43

View Live Chart for the USD/JPY

The dollar rallied up to 123.66 against the Japanese yen, retreating, however, from the fresh 2-week high before Wall Street's close. Dollar's rally after Yellen's comments was interrupted by news that the ECB may present its economic outlook with no major revisions this Thursday, although further stimulus is out of the question for now. The USD/JPY pair has been developing a more constructive outlook ever since the week started, although investors will likely wait until Friday's US employment figures to determinate where to go with the pair. Short term, the pair is set to correct lower as in the 1 hour chart, the technical indicators are heading south from extreme overbought levels, but the price is well above the 100 and 200 SMAs. In the 4 hours chart, the technical indicators turned lower, but remain in positive territory, whilst the price stands well above a flat 100 SMA, presenting a limited upward potential at the time being.

Support levels: 122.60 122.20 121.70

Resistance levels: 123.40 123.75 124.40

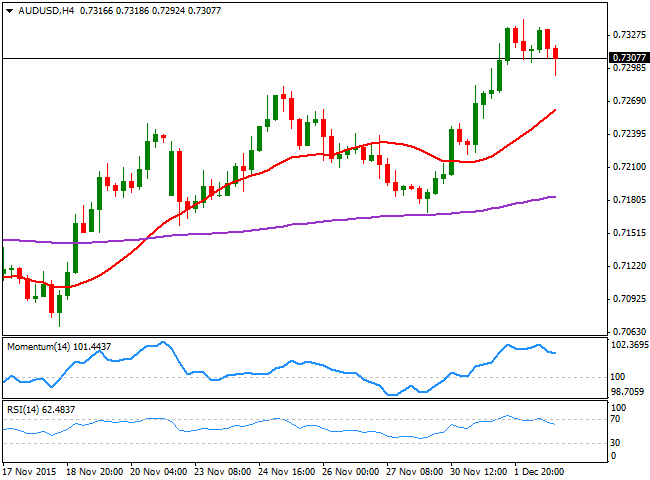

AUD/USD Current price: 0.7307

View Live Chart for the AUD/USD

The Australian dollar holds to its recent strength, despite having eased some against the greenback this Wednesday, as the AUD/USD pair holds above the 0.7300 figure by the end of the day. During the previous Asian session, Australia released its GDP data for the third quarter, which resulted in a 0.9% growth compared to a previously revised 0.3% and expectations of 0.8%. The short term picture is mild bearish, suggesting that the pair may correct lower before resuming its advance, as the price is holding below its 20 SMA while the technical indicators are heading lower around their mid-lines. In the 4 hours chart, the technical indicators are heading slightly lower from overbought territory, but the 20 SMA maintains a strong upward slope well below the current level. The pair can decline down to 0.7200 in a corrective movement and recover afterwards, as only an extension below 0.7150 will confirm a bearish continuation during the upcoming sessions, quite unlikely at the time being.

Support levels: 0.7280 0.7240 0.7200

Resistance levels: 0.7335 0.7380 0.7410

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.