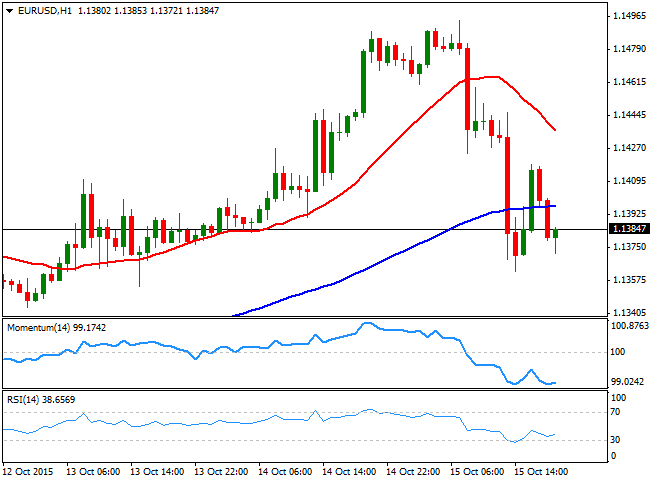

EUR/USD Current price: 1.1384

View Live Chart for the EUR/USD

An upward surprise in US inflation data for September, helped the American dollar to recover ground this Thursday, particularly against the EUR, which fell back below the 1.1400 level after trading as high as 1.1494. There were no relevant macroeconomic news in Europe, and the EUR/USD pair traded higher during the first half of the day, amid a sharp recovery in Asian and European equities. But the pair suffered a first hit from Nowotny, from the ECB, who pledged for the use of an additional set of measures in order to achieve the 2.0% inflation target. Then, the US released positive US data, referred to employment and inflation, reviving speculation the FED may raise rates before the year end. The consumer price index decreased by 0.2% as expected, remaining unchanged from a year before. The YoY ex food and energy reading however, resulted at 1.9%, above expectations of 1.8%, while the weekly unemployment claims decreased to 255K last week, against 270K expected.

The pair fell down to 1.1362 and has been unable to sustain gains beyond the 1.1400 level afterwards, ending the day around the 1.1380 level. Given that the ECB will have its monthly economic meeting next week, and there are some market talks on a possible QE extension, rallies may remain capped. Technically, the 1 hour chart shows that the price is now below the 20 and 100 SMAs, whilst the technical indicators are barely bouncing from oversold levels, maintaining the risk towards the downside. In the 4 hours chart, however, and despite the price is below its 20 SMA, the pair presents a limited downward potential, given that the technical indicators have turned flat around their mid-lines after correcting extreme overbought readings.

Support levels: 1.1350 1.1310 1.1280

Resistance levels: 1.1420 1.1460 1.1500

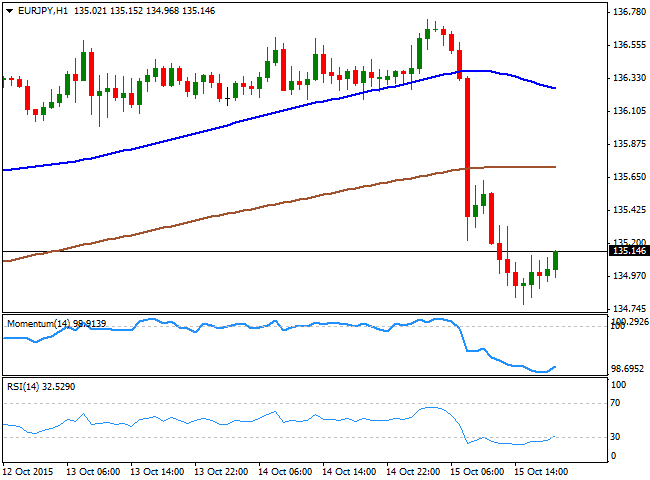

EUR/JPY Current price: 135.14

View Live Chart for the EUR/JPY

The Japanese yen soared during the past Asian session, leading to a sharp decline in the EUR/JPY pair that later accelerated amid EUR self weakness. The pair fell down to 134.78 intraday, recovering some ground during the American afternoon, as the Yen eased following better-than-expected US data. Nevertheless, the pair points to close the day well below its 100 SMA after holding above it for over a week, now around 136.00 and a key resistance for the upcoming hours. Short term, the 1 hour chart shows that the price is well below its 100 and 200 SMAs, with the shortest turning south far above the current price. In the same chart, the technical indicators are bouncing from extreme oversold levels, suggesting the pair may correct higher during the upcoming hours. In the 4 hours chart, the price is currently holding above its 100 and 200 SMAs, both in a 10 pips range and lacking directional strength, whilst the technical indicators are posting also some limited bounces well below their mid-lines. A break below the mentioned daily low however, should deny the possibility of an upward corrective move and favor a continued decline towards the 133.30 price zone.

Support levels: 134.70 134.30 133.85

Resistance levels: 135.40 136.00 136.50

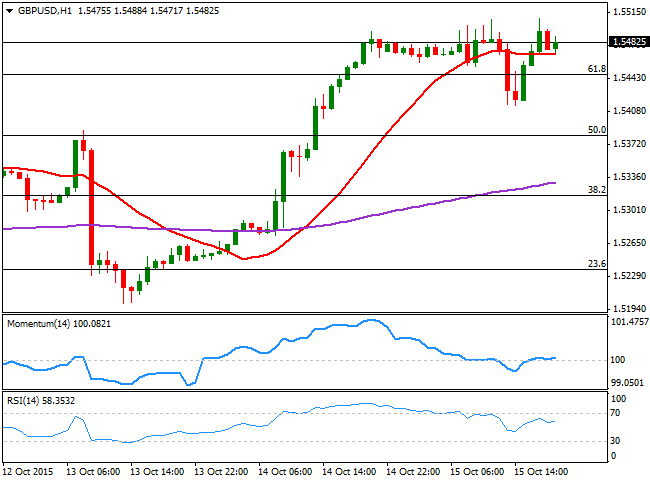

GBP/USD Current price: 1.5482

View Live Chart for the GPB/USD

The British Pound extended further its advance against its American rival, reaching a daily high of 1.5508, and holding a few pips below it by the end of the day. . With no macroeconomic events scheduled in the UK, the pair has been showing little directional strength until the release of US data, which sent the pair down to 1.5414, from where the pair quickly recovered back towards its daily highs. The overall bullish tone in the pair remains in place as the pair is also back above the 61.8% retracement of the latest daily decline at 1.5445, the immediate support for the upcoming hours. Technically, the 1 hour chart shows that the price is now above a flat 20 SMA, whilst the technical indicators are posting some limited advances above their mid-lines. In the 4 hours chart, the technical picture is more constructive, given that the Momentum indicator heads sharply higher well above its mid-line, whilst the RSI is regaining its upward tone near overbought levels, in line with a continued advance, particularly on a price acceleration above the mentioned daily high.

Support levels: 1.5445 1.5410 1.5375

Resistance levels: 1.5515 1.5560 1.5600

USD/JPY Current price: 118.74

View Live Chart for the USD/JPY

The USD/JPY pair fell down to 118.05, extending its decline for a third day in a row, on technical selling and despite the strong upward momentum in Asian and European stocks. The pair has been trading in quite a limited range since late August, with buying interest surging on dips towards the 119.00 level. But the pair broke below this last late Thursday on risk aversion, spooking buyers and leading to a continued decline. Better-than-expected US data however, interrupted the bearish rally of the pair, leading to an intraday recovery up to the current 118.70 price zone. Short term, the 1 hour chart suggest the ongoing recovery may extend, given that the technical indicators continue heading higher from oversold levels, but the upside seems limited, as the mentioned indicators remain well below their mid-lines, whilst the moving averages have turned lower well above the current level. In the 4 hours chart, the technical indicators are also aiming higher from extreme oversold levels, but remain well below their mid-lines. Above 119.00, the pair can extend up to 119.35, but if selling interest surges around this last, the risk will turn back lower, looking then for a retest of the 118.00/10 price zone.

Support levels: 118.55 118.10 117.70

Resistance levels: 119.00 119.35 119.70

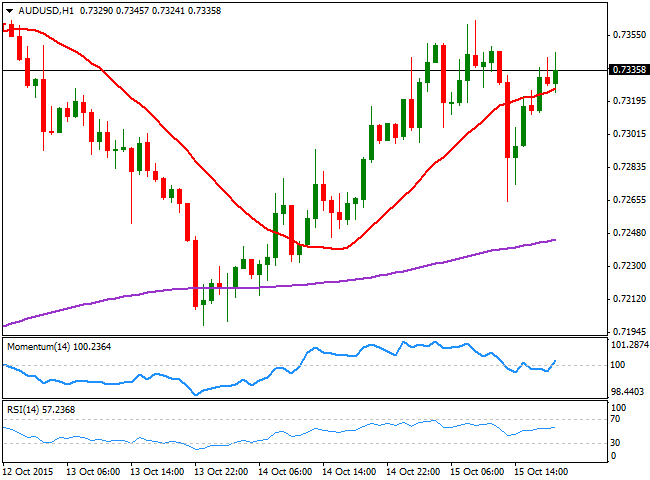

AUD/USD Current price: 0.7336

View Live Chart for the AUD/USD

The AUD/USD pair sunk down to a daily low of 0.7265 following the release of US data, already under pressure after tepid Australian employment data for September, showing that employment fell by 5,100 from August, compared with a median forecast of a 9,600 new jobs increase. The unemployment rate dropped to 6.2%, but as a consequence of a decrease in the participation rate that fell to 64.9%. The pair however, managed to bounce from the mentioned low and recover well above the 0.7300 level, reflecting strong buying interest waiting for dips. Technically, the 1 hour chart shows that the price is now a few pips above a mild bullish 20 SMA, whilst the technical indicators lack directional strength above their mid-lines, all of which limits the downside, but suggest no upward momentum at the time being. In the 4 hours chart, the 20 SMA offers an immediate support around 0.7290, whilst the technical indicators stand above their mid-lines, but also unable to suggest a clear upcoming direction.

Support levels: 0.7290 0.7250 0.7220

Resistance levels: 0.7300 0.7350 0.7390

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.