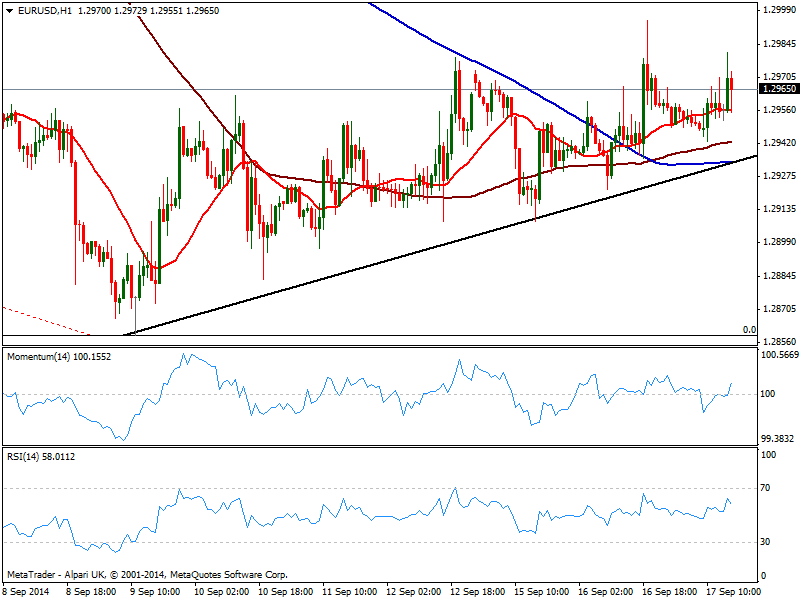

EUR/USD Current price: 1.2958

View Live Chart for the EUR/USD

Dollar lost ground across the board after inflation in the US resulted negative monthly basis down to -0.2% first time below 0.0% since October 2013, but market movements remain limited ahead of FED economic policy decision later on the day. The EUR/USD retraces from a high of 1.2980 finding short term sellers on approaches to the 1.3000 figure; the 1 hour chart shows no directional strength coming from technical readings as it has been over the past sessions, with all eyes now placed on the outcome of the FED meeting: levels to watch then will be 1.3000 figure to the upside, or 1.2880 to the downside as a break of either extreme will likely set the trend for the upcoming days.

Support levels: 1.2950 1.2910 1.2870

Resistance levels: 1.2990 1.3045 1.3080

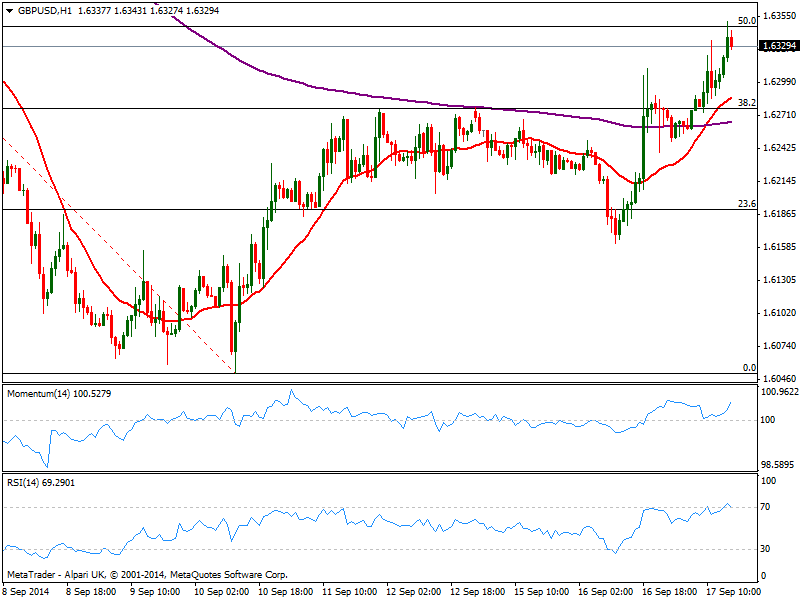

GBP/USD Current price: 1.6329

View Live Chart for the GBP/USD

The GBP/USD extends its early gains in the US session, advancing so far up to 1.6351, helped by improved employment figures in the UK. The pair has not only filled the gap left 2 weeks ago, but also extended up to the 50% retracement of this September slide, maintaining an overall positive tone in the short term: the hourly chart shows price well above its 20 SMA and indicators grinding higher in positive territory. In the 4 hours chart momentum heads north above 100 with chances of an extension up to 1.6420 if the FED disappoints market.

Support levels: 1.6315 1.6250 1.6220

Resistance levels: 1.6350 1.6385 1.6420

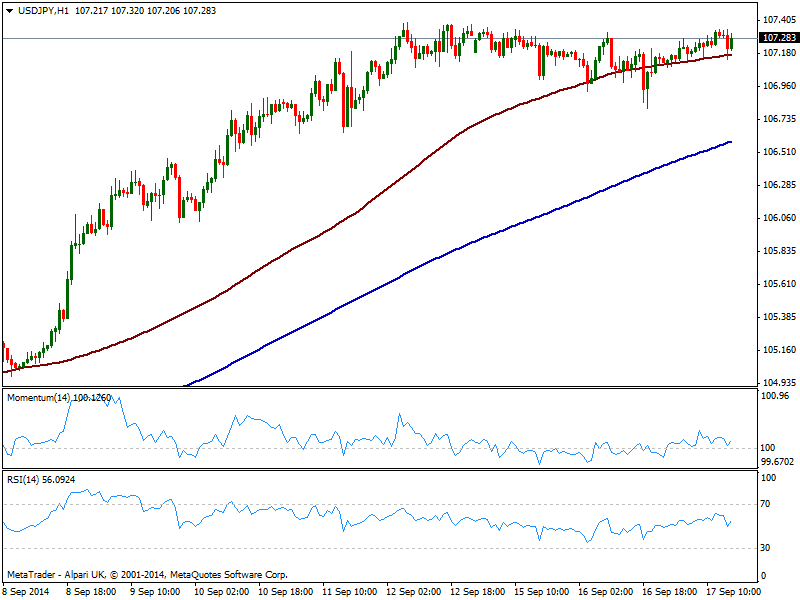

USD/JPY Current price: 107.28

View Live Chart for the USD/JPY

The USD/JPY short term downward move after worse than expected US data, was not enough to approach to 107.00, with the pair barely 10 pips away from its recent highs. The 1 hour chart however, maintains a quite neutral stance as per recent tight 40 pips range, with price holding above its 100 SMA. In the 4 hours chart indicators also turned flat with momentum around 100, with investors now in wait and see mode.

Support levels: 106.80 106.50 106.10

Resistance levels: 107.40 107.90 108.20

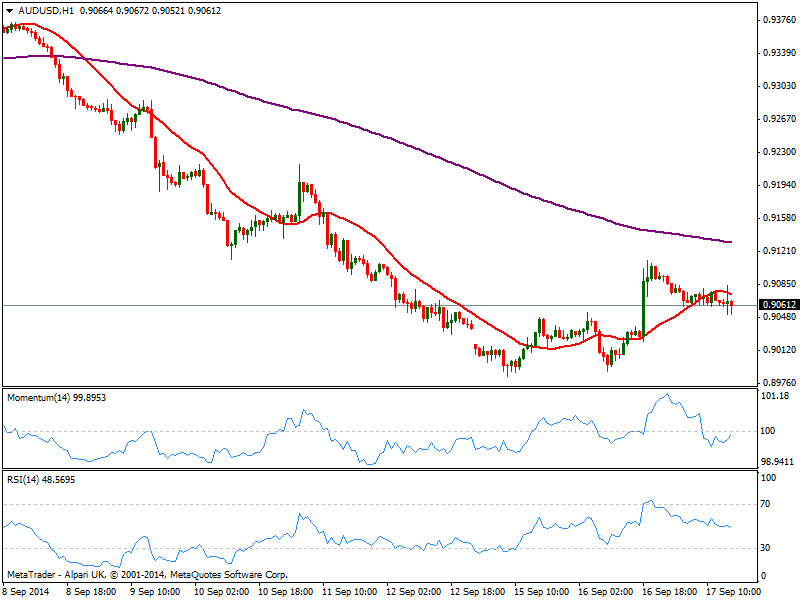

AUD/USD Current price: 0.9060

View Live Chart of the AUD/USD

The AUD/USD retraces from its highs around 0.9110 posted yesterday, with the pair pressuring now former resistance area now immediate support of 0.9050. The 1 hour chart shows price below 20 SMA and indicators below their midlines, albeit showing no downward strength at the time being. In the 4 hours chart indicators maintain a positive tone, with momentum heading higher above 100 and 20 SMA offering support around 0.9040.

Support levels: 0.9040 0.8990 0.8955

Resistance levels: 0.9110 0.9150 0.9190

Recommended Content

Editors’ Picks

AUD/USD: A tough barrier remains around 0.6800

AUD/USD failed to maintain the earlier surpass of the 0.6800 barrier, eventually succumbing to the late rebound in the Greenback following the Fed’s decision to lower its interest rates by50 bps.

EUR/USD still targets the 2024 peaks around 1.1200

EUR/USD added to Tuesday’s losses after the post-FOMC rebound in the US Dollar prompted the pair to give away earlier gains to three-week highs in the 1.1185-1.1190 band.

Gold surrenders gains and drops to weekly lows near $2,550

Gold prices reverses the initial uptick to record highs around the $$2,600 per ounce troy, coming under renewed downside pressure and revisiting the $2,550 zone amidst the late recovery in the US Dollar.

Australian Unemployment Rate expected to hold steady at 4.2% in August

The Australian Bureau of Statistics will release the monthly employment report at 1:30 GMT on Thursday. The country is expected to have added 25K new positions in August, while the Unemployment Rate is foreseen to remain steady at 4.2%.

Ethereum could rally to $2,817 following Fed's 50 bps rate cut

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.