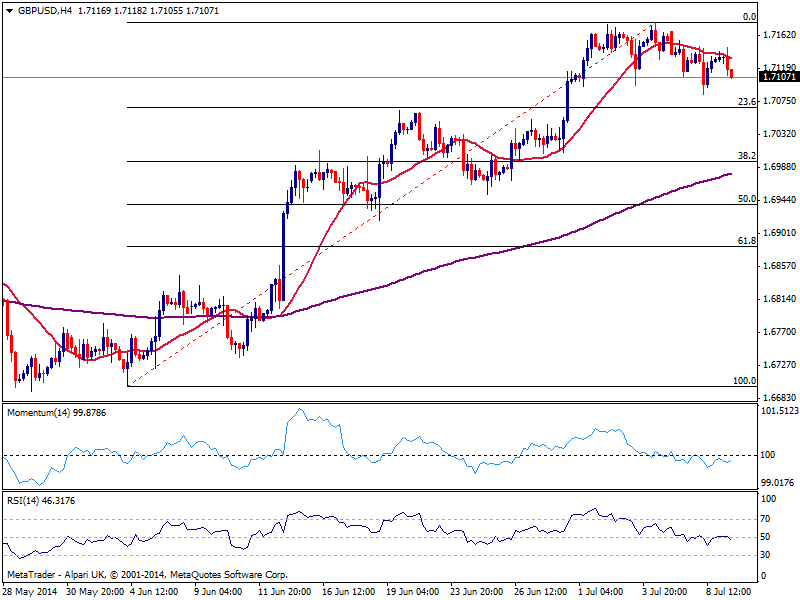

The long term outlook for GBP/USD is still bullish, and downward movements are understood mostly as corrective, giving buying opportunities rather than suggesting a top is in place: there’s a long way down before the pair can confirm a trend reversal, most likely a break below 1.6880, 61.8% retracement of the latest bullish run.

But in the short term, a mild bearish tone prevails according to the 4 hours chart that shows indicators turning south below their midlines, and price capped below its 20 SMA. 1.7060 is the immediate support as if below, the downward potential may extend down to 1.7000 price zone. On the other hand, a recovery above 1.7150 is needed to revert the short term negative tone, and see a quick recovery towards 1.7180, in route to 1.7220 price zone.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.