Volatility is how much an asset, such as a currency pair,fluctuates with no regard to direction. It's an important aspect of trading since it provides investors with an idea of potential profit or risk. Through analyzing option prices it's possible to see how much volatility the market are expecting. This is because an option price is not only driven by market direction, it is also driven by volatility.

Whilst EUR/USD trading remains flat, from 1.1150 to 1.12, its weekly implied volatility has increased,suggesting that the market are factoring more volatility in the run-up and after June 30th, the day Greece is due to payback €1.6Bn to the IMF. Real-time option volatility data tells us that markets are expecting an average daily EUR/USD move of 0.9% (approximately 100 pips) over the next week.

With only four days left, investors have no way of knowing the outcome of the Greek saga. Will the Greek parliament accept EU leaders proposal to receive a $17.3Bn bailout package or will they reject to leave only a day or two to reach a new deal? If your outlook is for EUR/USD to become more volatile over the next week, yet you have no view on direction,it's possible to trade this using a long straddle strategy on MT4.

A long straddle involves buying a Call option and a Put option at the same time. A Call will return a profit as EUR/USD moves UP and a Put will return a profit as the pair moves DOWN. To understand simple buy Call or buy Put positions on MT4 click here. The benefit of buying a straddle is the exposure to a limited risk yet your profit may be unlimited.

The below image shows the EUR/USD underlying rate, a weekly Call option and a weekly Put option. Both the Call and the Put have as trike rate of 1.1174 and expire on Friday 3rd July at 14:00 GMT (you can view these details by hovering your mouse over the symbol or from the Order ticket).

To set-up a EUR/USD long straddle position, you buy a Call and subsequently buy a Put. In this example, the Call costs 0.01002 to buy and the Put costs 0.00829 (Ask price), this can also be described as a cost of 100.2 pips and 82.9 pips respectively. Hence, the total cost is 183.1 pips. We have chosen a deal size of 0.1 lots (€10,000) for each trade, therefore the total cost in monetary terms is 10,000 x 0.0183 = $183.

Over the next week, if EUR/USD moves UP the Call option's value will rise and the Put option's value will fall and, as long as EUR/USD moves UP far enough, the Call's profit will cover the Put's loss. The vice-versa is also true, if EUR/USD moves DOWN the Put option's value will rise and the Call option's value will fall. Hence, this strategy is used by traders when they are expecting a large move in the market, i.e. an increase in volatility.

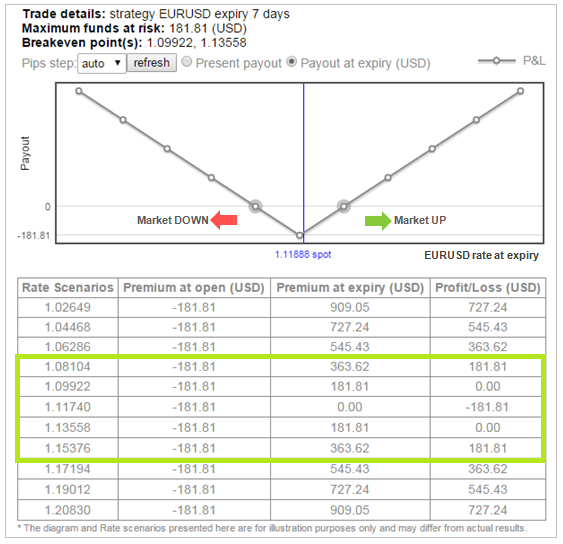

The below Scenario chart and table shows the profit or loss of the strategy over a range of EUR/USD rates at expiry (at 14:00 GMT on Friday July 3rd). If EUR/USD trades above 1.1355 or below 1.0992, the strategy will return a profit. These break-even points are around 180 pips (0.0180) away from the option's strike of 1.1174, this is because the price paid for the options is equivalent to how far the market needs to move for the strategy to make a profit by expiry. On the other-hand, if EUR/USD does not trade out of this range the strategy will make a loss, the maximum loss is around $180.

When to trade a long straddle?

When you expect the underlying market, such as EUR/USD,to move further than the cost of the options in the time frame you are trading.In this case, the total cost to buy the options was 183 pips, hence we have a week for EUR/USD to move either 183 pips UP or DOWN.

What if you expect volatility to decrease?

Using a short straddle strategy, it is possible to trade the expectation that volatility will decrease. This involves selling a Call and selling a Put at the same time (the opposite to a long straddle). In this case,if EUR/USD trades sideways and stays within the range 1.0992 to 1.1355, unable to moves more than 180 pips higher or lower, the strategy will return a profit.However, it is important to note that profit is limited and maximum profit achieved if EUR/USD expires at strike rate 1.1174. On the other-hand, if EUR/USD breaks-out of the range, potential loss is unlimited. On MT4 loss can be limited using stop-loss orders or by 'covering' using buy option positions. Click here to read more about covering sold options.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.