Technical Analysis

EUR/USD to approach weekly/monthly PPs

“The monetary policy divergence theme, although dying slowly, isn’t quite dead yet.”

- FXPRIMUS Europe (based on Bloomberg)

- Pair’s Outlook

EUR/USD posted a considerable 80-pip decrease in value on May 6, but no major technical levels were breached. This is because the closest demand is placed as low as 1.1376, namely the weekly/monthly pivot points and 20-day SMA. However, if bearish pressure persists throughout Friday, then the pair is likely to try and tackle this area. Success here would expose the second support for today, the weekly and monthly S1s at 1.1288. On the other hand, daily technical indicators are pointing to the upside, but we are not expecting a climb as high as the closest resistance at 1.1538 (weekly/monthly R1s).

- Traders’ Sentiment

At the moment 46% of SWFX market participants are expecting that the pair will rebound, up from only 41% yesterday. Alongside, pending orders remain little changed and mainly neutral.

GBP/USD risks stabilising under 1.45

“We tend to think that sterling looks too strong given the risks ahead of the Brexit referendum. Sterling/dollar should struggle to break $1.4570/80.”

- ING (based on Business Recorder)

- Pair’s Outlook

The Sterling weakened against the US Dollar for the third consecutive time yesterday, but with the pair losing only 13 pips. During the previous slumps the Cable was edging lower less and less, suggesting that a possible trend reversal is at hand. Technical indicators are now giving distinctly bullish signals in the short-term, bolstering the possibility of the positive outcome. Consequently, the Sterling could even climb over the immediate resistance, namely the weekly PP, which is located at 1.4563. Despite the bullish outlook, a positive surprise in the US NFP data today could also cause the pair to plunge under the 1.44 psychological level.

- Traders’ Sentiment

Bulls keep growing stronger, as 61% of traders are now long the Pound. At the same time, the share of purchase orders surged from 48 to 53%.

USD/JPY muted ahead of NFP figures

“Ever since the start of Abenomics, Japanese investors have accumulated a large position in foreign assets but in large part haven't been currency-hedged because Abenomics was expected to weaken the yen.”

- BNP Paribas (based on WBP Online)

- Pair’s Outlook

The USD/JPY currency pair not only remained relatively unchanged for the fourth day in a row yesterday, but also prolonged this week’s rally. The current bullish trend appears to be fading, largely depending on today’s NFP results. A positive reading is likely to cause the Greenback to put the immediate resistance, represented by the 20-day SMA, the weekly and the monthly PPs, to the test. On the other hand, disappointing data could trigger a sell-off, sufficient to reach the 20-month low at 105.20. According to technical indicators, the bearish scenario is to prevail, but the 106.00 mark should also be considered as a possible support area, as it kept the pair elevated this week.

- Traders’ Sentiment

Bullish market sentiment remains unchanged, taking up 71% of the market, while the number of buy orders slid from 58 to 49%.

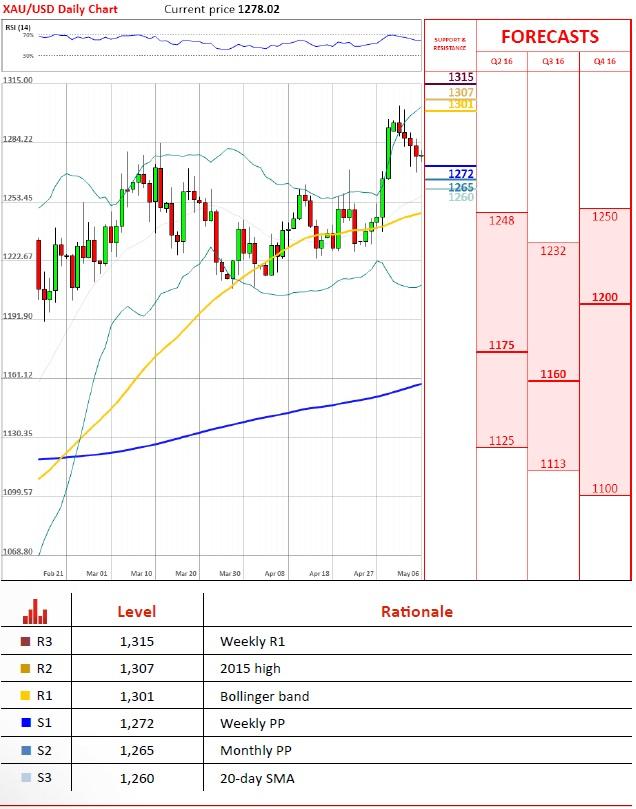

Gold: second attempt to cross weekly PP fails

“If the jobs data is bad, gold will go up... But there is one more set of jobs data before the next Fed meeting in June.”

- Argonaut Securities (based on CNBC)

- Pair’s Outlook

For a second day in a row on Thursday the yellow metal was unable to overcome the closest support line represented by the weekly pivot point at 1,272.92. This is going to raise doubts about the actual strength of the bearish camp. Along with positive daily and weekly technical signals, we are looking for a minor rebound on the last day of this working week, also because the weekly PP is immediately backed by the monthly pivot, which is unlikely to let the bears succeed. The 2015 high at 1,307.06 seems out of reach for the moment, and firstly gold should attack the yesterday’s peak at 1,286.42.

- Traders’ Sentiment

Only three percentage points were recovered by the bullish side yesterday, when they picked up from the lowest level in more than nine weeks to reach the 32% mark, a change from 29% about 24 hours ago.

Don't miss our new daily forecasts for EUR USD, GBP USD, USD CAD and USD JPY!

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.