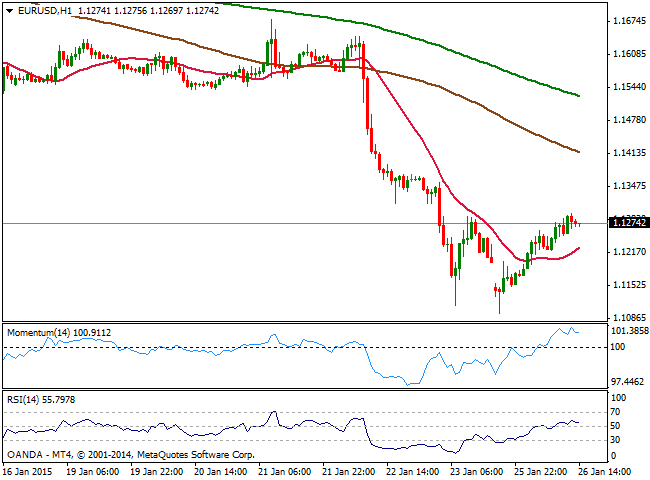

EUR/USD Current price: 1.1274

View Live Chart for the EUR/USD

The EUR/USD pair traded in upward corrective mode this Monday, stalling a couple of pips shy of the 1.1300 level, after trading as low as 1.1097 past Asian session. Despite Greek far-left Syriza took over government and new PM Alexis Tsipras pledged to end five years of austerity and renegotiate Greece's debt agreements, markets were optimistic, with stocks rising and safe havens under pressure for most of the day. The macroeconomic calendar was pretty empty, exception made by German IFO survey that showed an improvement in local business climate. Tuesday however will have a good number of fundamental readings particularly coming from the US, set to imprint more life to the US session.

Technically, the EUR/USD pair presents a mild positive tone in the short term, as the 1 hour chart shows price hovering near the highs and above a slightly bullish 20 SMA, whilst indicators lost upward strength but remain in positive territory. In the 4 hours chart indicators continue to advance from extreme oversold levels, but remain well below their midlines, with RSI at 41, while 20 SMA offers strong dynamic resistance in the 1.1350/60 price zone. If this last level is reached, chances are of a strong selling interest surging, limiting the upside, whilst a break below 1.1200 will probably put the pair back under selling pressure.

Support levels: 1.1245 1.1200 1.1150

Resistance levels: 1.1325 1.1360 1.1400

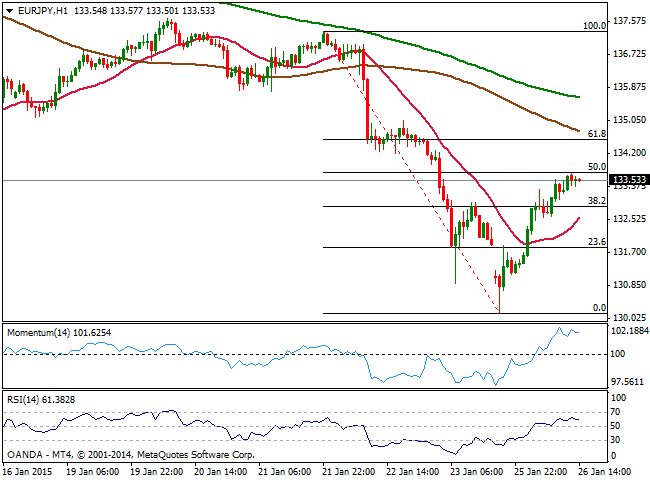

EUR/JPY Current price: 133.55

View Live Chart for the EUR/JPY

The Japanese yen was under pressure against all of its rivals in this first day of the week, with the EUR/JPY pair advancing almost 360 pips intraday after setting a fresh low of 130.14. The strong recovery in equities all over the world supported the rallies, with the EUR/JPY correcting by the pip 50% of its latest slide. The 1 hour chart shows indicators losing upward strength in positive territory, whilst 100 and 200 SMAs maintain strong bearish slopes well above current price. In the 4 hours chart indicators corrected oversold readings and continue to head north well below their midlines, suggesting further gains are likely if the pair breaks the immediate Fibonacci resistance at 133.70, aiming for a test of 134.55, 61.8% retracement of the same rally.

Support levels: 132.85 132.30 131.90

Resistance levels: 133.70 134.10 134.55

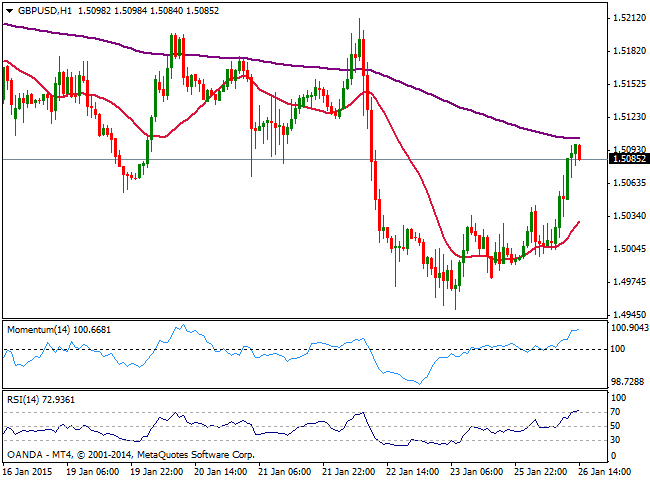

GBP/USD Current price: 1.5085

View Live Chart for the GBP/USD

The GBP/USD pair surged up to 1.5099 fresh 3-days high before retracing some, closing the day however fairly higher. There was no fundamental data to drive the Pound higher, although early day weakness in EUR, pushing EUR/GBP to new multi-years lows, helped to support the pair above the 1.5000 figure. Up roaring stocks alongside with comments of Bank of England Kristen Forbes saying that she is optimistic on global growth and that falling oil prices may boost consumption worldwide, leading to an early rate hike in the UK, also supported the British currency. Technically, the 1 hour chart shows indicators getting exhausted to the upside in overbought territory, as 20 SMA turns higher well below current price, offering intraday support in the 1.5120 price zone. In the 4 hours chart price advanced and holds above its 20 SMA, whilst momentum aims higher below 100 and RSI crosses the 50 level to the upside, all of which favors further advances if the pair manages to pick up momentum above the 1.5120 price zone.

Support levels: 1.5055 1.5010 1.4950

Resistance levels: 1.5125 1.5160 1.5200

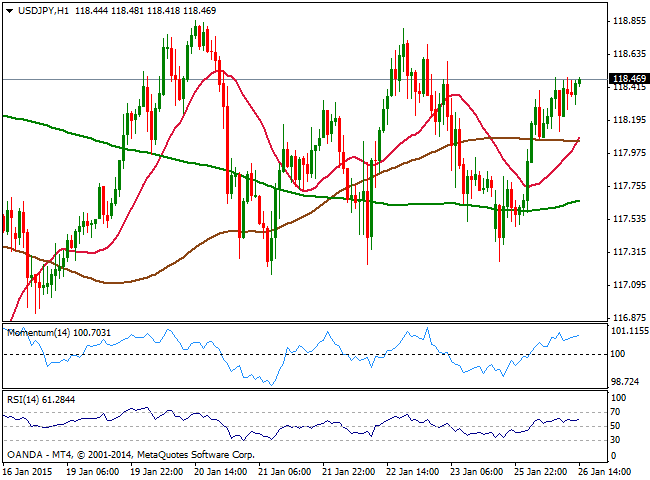

USD/JPY Current price: 118.47

View Live Chart for the USD/JPY

The USD/JPY recovered from an intraday low of 117.36, pressuring its daily highs near 118.50 by US close. During the past Asian session, BOJ’s Policy Board has published its latest minutes, in which by an 8-1 majority vote, voting members maintained the decision to conduct money market operations so that the monetary base will increase at an annual pace of about 80 trillion yen. Trade balance deficit shrunk as exports were stronger than expected, rising 12.9%y/y and imports slightly softer at 1.9%y/y. There will be no relevant data in Japan this Tuesday, and yen crosses’ direction will likely depend on stocks and risk sentiment. Short term, the pair remains trading within a quite clear 117.00/118.80 range, which means a certain directional strength will depend on the break of any of both extremes. In the meantime, the 1 hour chart shows that indicators head higher above their midlines, whilst 100 SMA offers dynamic support around 118.05. In the 4 hours chart technical readings present a mild positive tone, albeit indicators shown no actual strength at the time being, supporting the need of a break higher to confirm more intraday gains.

Support levels: 118.00 117.60 117.30

Resistance levels: 118.80 119.20 119.55

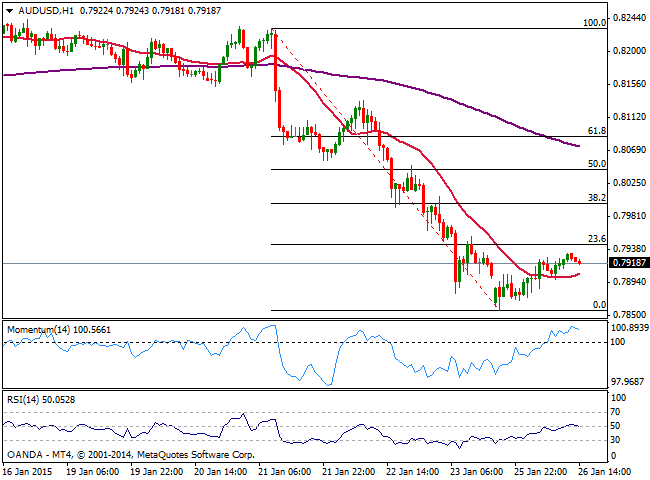

AUD/USD Current price: 0.7919

View Live Chart of the AUD/USD

The AUD/USD pair saw a limited intraday demand, as the antipodean currency recovery against the greenback stalled at 0.7933. Gold decline weighted on Aussie, as the metal lost around $ 15 this Monday. From a technical point of view, the dominant bearish trend remains firm in place, as the latest recovery stalled short of the 23.6% retracement of the latest decline. In the 1 hour chart, price stands above a flat 20 SMA whilst indicators are also directionless above their midlines. In the 4 hours chart momentum turns back lower after a limited upward correction, while RSI also losses upward strength around 38, all of which supports upcoming declines particularly if 0.7900 gives up.

Support levels: 0.7900 0.7860 0.7830

Resistance levels: 0.7930 0.7965 0.8000

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.