EUR/USD Current price: 1.2360

View Live Chart for the EUR/USD

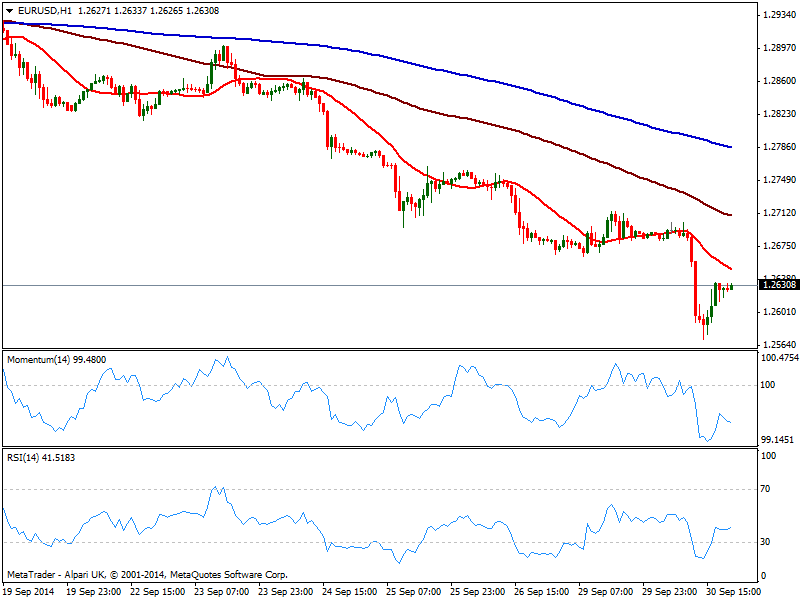

The Euro took another dip this Tuesday, with the EUR/USD down to 1.2570 fresh 2 year low, helped by local inflation readings, pointing out deflationary pressure are here to stay. EZ CPI fell to a 5 year lows in its core reading, albeit the selling in the pair began even before the release. Weaker than expected US data, with Chicago PMI below expected and Consumer confidence down to 86.0 against the 92.5 expected, helped the pair recover above the 1.2600 figure, yet stalled far from former year low of 1.2660, now immediate resistance.

With ECB meeting taking place next Thursday, trading may turn thin ahead of the event, despite Wednesday will bring local PMI readings. Anyway, the short term technical picture is still bearish, with price developing below its 20 SMA and indicators turning south in negative territory after correcting overbought readings. In the 4 hours chart 20 SMA extended its bearish slope, capping the upside now around 1.2880, while indicators barely corrected oversold readings, holding deep in red. Another downward acceleration below mentioned low should see the pair extending its decline towards 1.2510, with sellers now probably surging on approaches to the 1.2660 level.

Support levels: 1.2570 1.2540 1.2510

Resistance levels: 1.2620 1.2660 1.2700

EUR/JPY Current price: 138.52

View Live Chart for the EUR/JPY

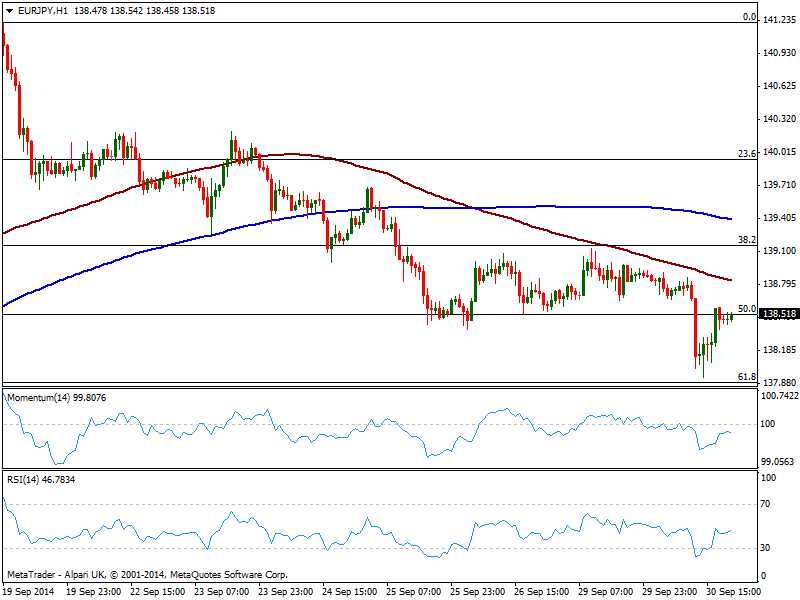

The EUR/JPY fall down to 137.94 on the back of EUR self weakness, managing however to regain most of the ground lost during the US afternoon. US Yields held pretty well despite local mild weak data, supporting yen negative tone. As for the technical picture, the EUR/JPY 1 hour chart shows price struggling around the 50% retracement of its latest daily bullish run, having stalled to the downside a couple pips above the 61.8% retracement of the same rally. The hourly chart shows 100 SMA well below 200 one, and with a strong bearish slope now offering intraday resistance of 138.80, while indicators turn south below their midlines after correcting oversold levels. In the 4 hours chart technical indicators stand directionless in negative territory, giving no much clues of what’s next for the pair. A break below 137.90, is now required to confirm a new run lower, meant to extend towards 135.80 over the upcoming days.

Support levels: 138.40 137.90 137.35

Resistance levels: 139.15 139.60 140.00

GBP/USD Current price: 1.6207

View Live Chart for the GBP/USD

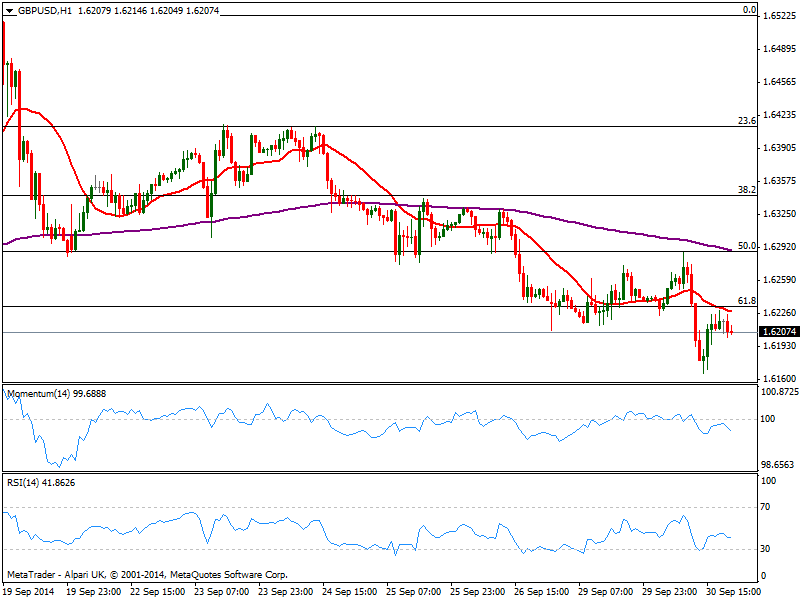

The GBP/USD trades around 1.6200, having ignored GDP positive readings already Europe, sliding along with its European counterpart and reaching 1.6166 from where it bounced. Nevertheless, the pair remained capped below the 61.8% of the latest daily bullish run from 1.6051 to 1.6523 at 1.6235 now immediate resistance. The 1 hour chart shows indicators turning south below their midlines and 20 SMA capping the upside a few pips below mentioned Fibonacci resistance, reinforcing its strength, while the 4 hours chart shows indicators biased lower, supporting the shorter term view. BOE won’t meet until next week, so there’s little to worry about that these days: dollar strength, if continues, may lead the moves with a break below mentioned 1.6160 pointing to a downward extension towards 1.6080/1.6100 price zone.

Support levels: 1.6160 1.6120 1.6085

Resistance levels: 1.6235 1.6260 1.6290

USD/JPY Current price: 109.65

View Live Chart for the USD/JPY

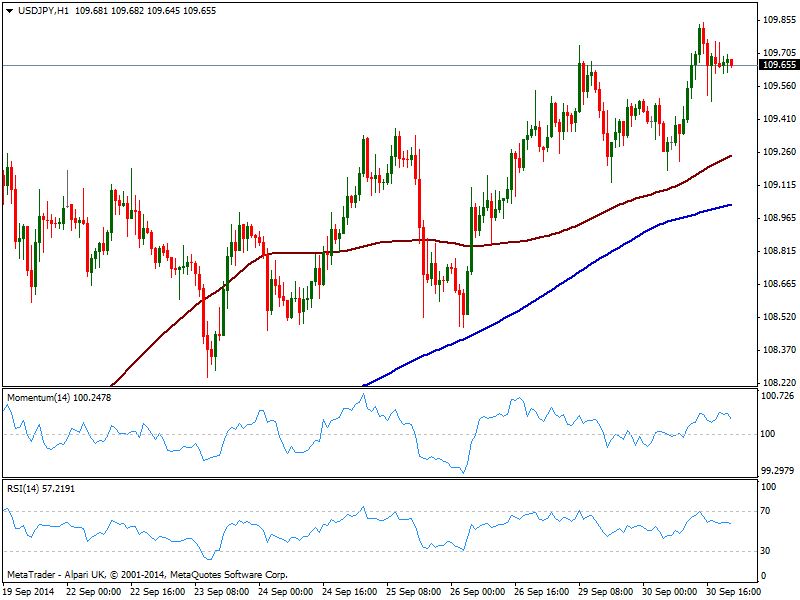

Dollar advanced again against its Japanese rival, with the pair reaching 109.84 before retracing some. Buyers however, surged on small intraday dips towards former high of 109.45, with the pair ending the day near mentioned high. The 1 hour chart shows indicators losing upward potential above their midlines, with moving averages heading higher below current price. As commented on previous updates, the moves can be slowmo, but the direction is up. In the 4 hours chart higher highs support the ongoing bias, despite indicators also turned lower in positive territory: dips down to 108.90 will remain as buying opportunities, at least until Friday’s US NFP readings.

Support levels: 109.45 109.15 108.90

Resistance levels: 109.80 110.20 110.50

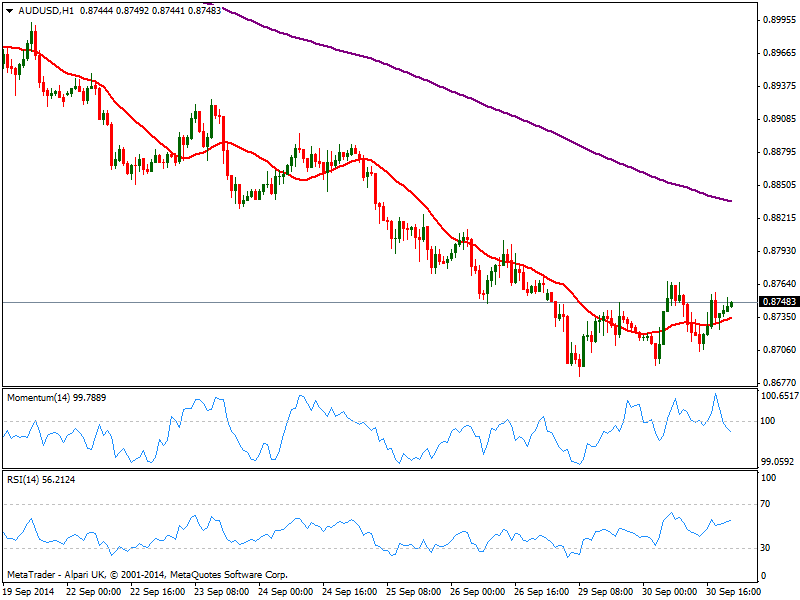

AUD/USD Current price: 0.8748

View Live Chart of the AUD/USD

The AUD/USD show little change over US hours, holding within range yet closing the day to the upside, and with a higher high and a higher low, suggesting the pair may be developing a base. Far from confirmed however, there’s a long way up before calling for a bottom, at least a recovery above 0.8920. Short term, the hourly chart shows price above a flat 20 SMA and indicators diverging with each other in neutral territory; the 4 hours chart shows price struggling with a bearish 20 SMA at current levels and momentum turning south below 100, with the daily high of 0.8766 as immediate resistance to overcome to see the pair extending its recovery, at least intraday.

Support levels: 0.8710 0.8680 0.8635

Resistance levels: 0.8765 0.8800 0.8840

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.