Fundamental Forecast for Dollar: Bullish

The Fed rate decision is this week’s top event risk following a dovish shift recently for the ECB, BoE and BoC

Can the Fed maintain its drive towards its first rate hike in 2015 when the rest of the world is loosening the reins?

Want to develop a more in-depth knowledge on the market and strategies? Check out the DailyFX Trading Guides

In the past few weeks, we have seen a nearly universal dovish shift in global monetary policy. The ECB, BoE, BoJ, BoC and other central banks have offered up either actions or commentary that is tangiably more accommodative in its policy slant. This is reaction to cooler global growth winds, stagnant inflation pressures and perhaps even in response to an unofficial currency war. Yet, through this broad effort to head off economic trouble and financial crisis, there is one policy body standing firmly on the opposite end of the spectrum: the Fed. Can the US central bank continue to carve such a divergent path? And, what does this mean for the Dollar and capital markets?

When the scope of a market is international – as the FX market is – capital flows are driven by relative demand along national borders. The relative appeal of the US market and Dollar has grown exceptional over the past six months. Taking the temperature of the developed and emerging world’s health, we have seen economic forecasts – recently refreshed by the IMF’s WEO – downgraded. Meanwhile, the US was one of the few that continues to win upgrades. That bodes well for investor returns when market participants are still vying for higher yield even as confidence wavers.

A direct measure of returns itself, monetary policy is also leaning heavily in the Dollar’s favor. Working off the Fed’s remarks that a move towards normalization was justify as recently as the last FOMC minutes, there is a hawkish (if moderate) intention from the US authority. This represents a particularly dramatic contrast in the global scales following the introduction of a new, large-scale stimulus program from the ECB this past week. But it isn’t just the ECB that is on a sharply divergent path. The BoJ is maintining its own QQE program (recently upgraded in October), the BoE minutes showed hawks quieted their voice at the last meeting, the BoC surprised with a rate cut, the SNB failed to hold its EURCHF floor, and the RBA tipped back from neutral to dovish rhetoric.

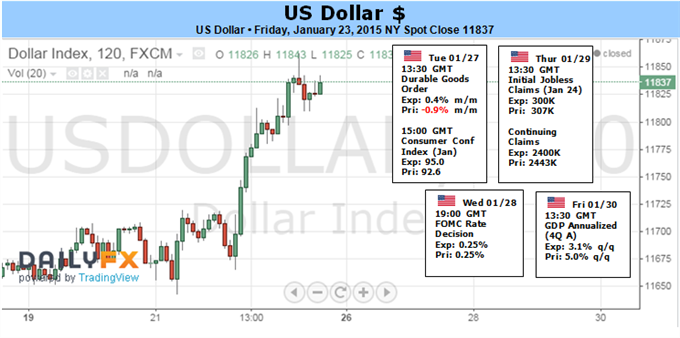

The question that should be on traders’ minds this week is whether or not the Fed can maintain its push towards the eventual rate hike when the rest of the world is reverting to accommodation. Given a rise swell of cross-asset volatility these past months, the ECB’s dramatic moves and semi-regular shocks in the headlines; it would seem that a softening of stance would be likely. However, many of these issues were already in play or expected during the last meeting when the Fed gave its optimistic remarks. In the US, conditions continue to show considerable improvement (even if it is slow) without financial shocks that instigated the unorthodox policy in the first place. What’s more, there is an opportunity one of the primary players in the global central bank community to make a move to normalize under relatively steady conditions with a backdrop where other major participants are readily offsetting the possible negative rammifications.

When the Fed meets on Wednesday, the primary question is whether the group maintains its tone to fuel speculation of a ‘mid-2015’ rate hike. That doesn’t require pre-commitment nor any rhetoric materially more hawkish than the last gathering. Rather, the market needs to simply see a lack of dovish cues in the monetary policy statement. If that is the case, the Dollar’s rate bearing will push it even farther off course of its counterparts.

Beyond, the forward rate advantage traders will be looking to glean from the event, the broader market will also measure the sentiment impact this event holds. If the Fed doesn’t push back a hike to 2016, it can upset a carefully crafted status quo and stimulus-smoothed investment environment. In other words, a ‘hawkish’ Fed generate risk aversion sentiment and perhaps finally turn holdout speculative benchmarks (like the S&P 500 and US equities) lower. If that is the case, the Dollar could also gain on a safe haven/liquidity bid.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.