Fundamental Forecast for Pound:Neutral

Daily OBV Divergence in GBP/USD a Concern

Video: GBPUSD Dives After UK CPI, EURUSD Awaits Clear Risk

For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

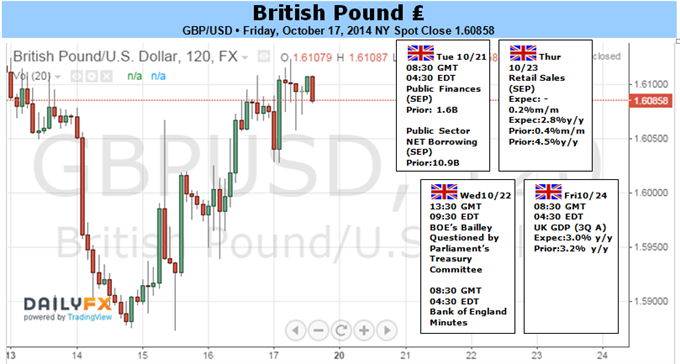

The British Pound may face additional headwinds in the week ahead should the fundamental developments coming out of the U.K. drag on interest rate expectations.

Indeed, Bank of England (BoE) Chief Economist Andrew Haldane warned ‘interest rates could remain lower for longer’ amid the uncertainly surrounding the economic outlook, and the central bank may look to preserve the highly accommodative policy stance for an extended period of time especially as the Euro-Zone, the U.K.’s largest trading partner, faces a growing risk of slipping back into recession.

As a result, the BoE Minutes are widely expected to show another 7-2 split, with Martin Weale and Ian McCafferty still voting against the majority, but the policy statement may highlight a more dovish tone for monetary policy as the headline reading for U.K. inflation slows to an annualized 1.2% in September to mark the lowest reading since 2009. At the same time, the 3Q Gross Domestic Product (GDP) report may undermine the BoE’s expectations for a faster recovery as the growth rate is projected to expand 0.7% after rising 0.9% during the three-months through June, and a marked slowdown in the real economy may generate fresh monthly lows in GBP/USD as market participants scale back bets of seeing higher borrowing costs in the U.K.

Nevertheless, the technical outlook highlights a more meaningful recovery for GBP/USD as the Relative Strength Index (RSI) breaks out of the bearish momentum carried over from the end of June, and we will continue to keep a close eye on the ongoing divergence in the oscillator amid the string of lower highs in price. - DS

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.