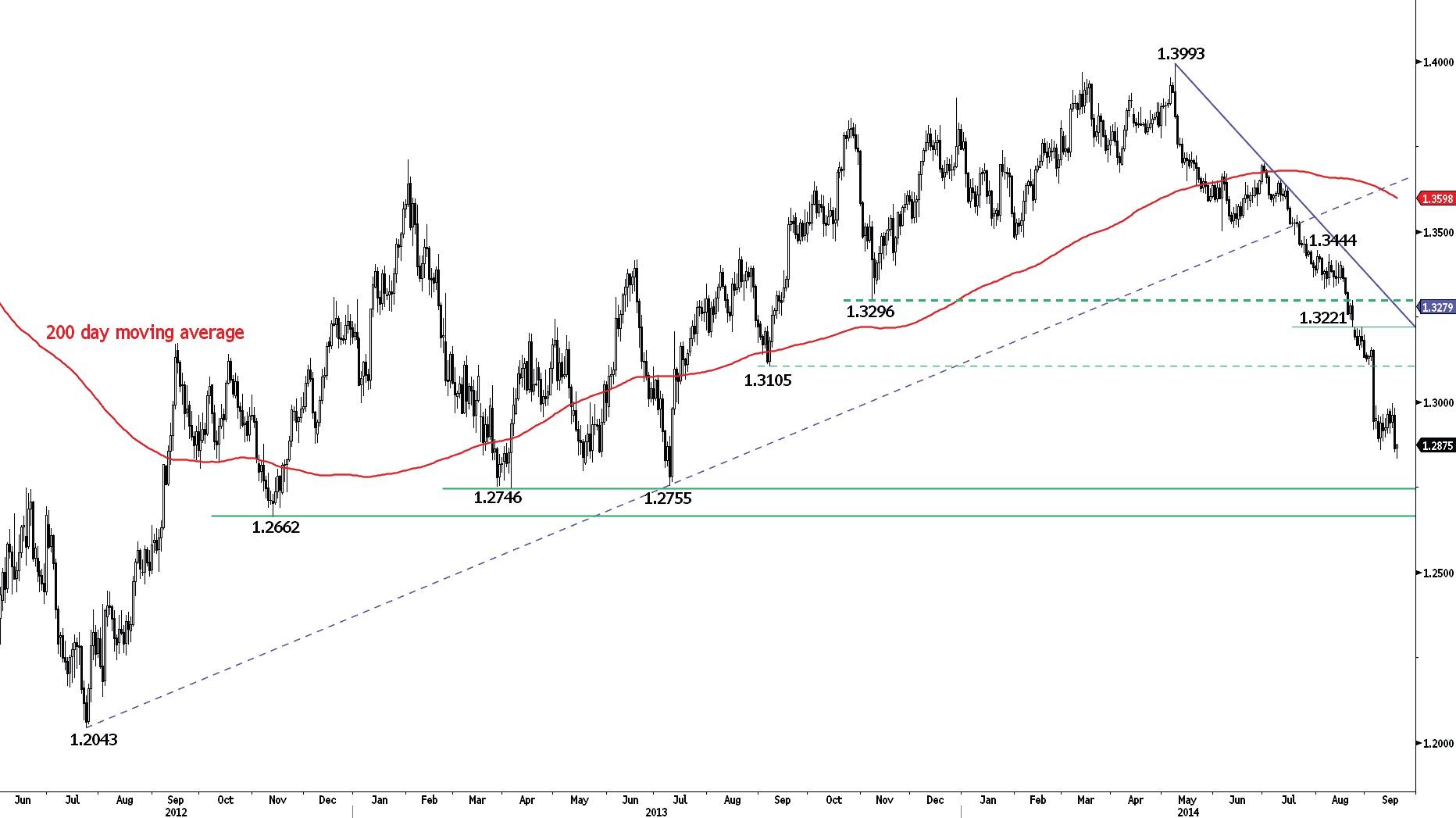

EUR/USD

Making (marginal) new lows.

EUR/USD has failed to break the hourly resistance at 1.2988 (05/09/2014 high). The subsequent marginal new lows confirm an underlying downtrend. A key support stands at 1.2755.

In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. The break of the key support at 1.3105 (06/09/2013 low) opens the way for a decline towards the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low). A key resistance lies at 1.3221 (28/08/2014 high).

Await fresh signal.

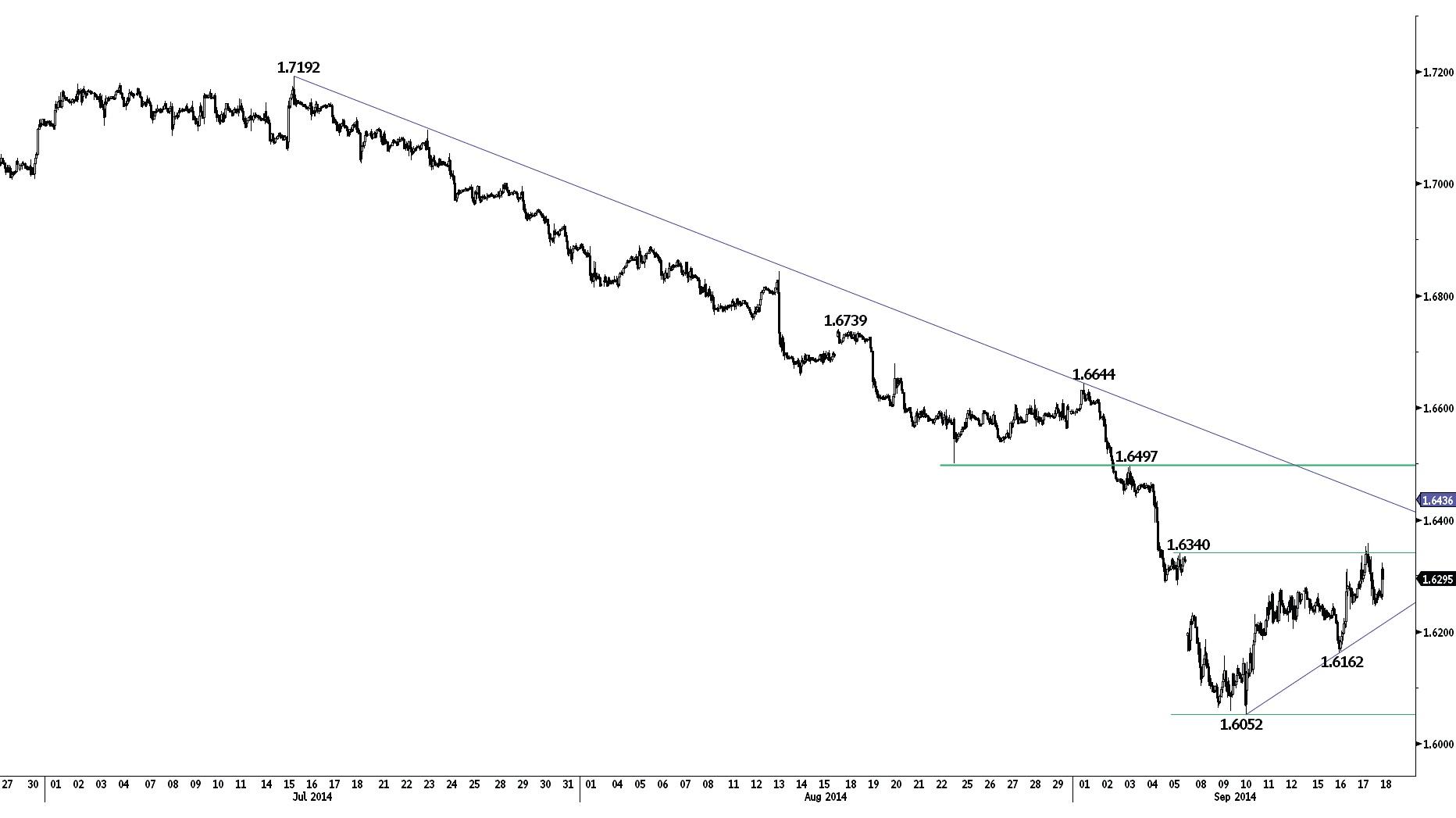

GBP/USD

Challenging its resistance at 1.6340.

GBP/USD has thus far failed to break the resistance at 1.6340 (05/09/2014 high). Hourly supports can be found at 1.6241 (intraday low) and 1.6162 (16/09/2014 low). Another resistance stands at 1.6497.

The Scottish referendum is likely to significantly impact the medium-term trend.

In the longer term, prices have collapsed after having reached 4-year highs. The break of the key support at 1.6220 confirms persistent selling pressures and opens the way for further decline towards the strong support at 1.5855 (12/11/2013 low). A key resistance now stands at 1.6644.

Buy stop 2 units at 1.6368, Obj: Close 1 unit at 1.6495, the remaining at 1.6640, Stop: 1.6290.

USD/JPY

Pushing higher.

USD/JPY has confirmed its underlying uptrend by making new highs. The short-term technical structure is positive as long as the support at 107.39 (12/09/2014 high) holds. Another hourly support can be found at 106.81 (16/09/2014 low).

A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. The break to the upside out of the consolidation phase between 100.76 (04/02/2014 low) and 103.02 has resumed the underlying bullish trend. A test of the major resistance at 110.66 (15/08/2008 high) is expected. Another resistance can be found at 114.66 (27/12/2007 high).

Await fresh signal.

USD/CHF

Approaching the strong resistance at 0.9456.

USD/CHF has broken the resistance at 0.9404 (61.8% retracement of 2013 decline), confirming persistent buying interest. However, monitor the test of the strong resistance at 0.9456. Hourly supports can be found at 0.9361 (intraday high) and 0.9301 (16/09/2014 low).

From a longer term perspective, the technical structure calls for the end of the large corrective phase that started in July 2012. The break of the strong resistance at 0.9250 (07/11/2013 high) opens the way for a move towards the next strong resistance at 0.9456 (06/09/2013 high). Supports can be found at 0.9176 (03/09/2014 low) and 0.9104 (22/08/2014 low). A psychological resistance lies at 0.9500.

Await fresh signal.

USD/CAD

Monitor the support at 1.0934.

USD/CAD has thus far successfully tested its support at 1.0934. However, monitor this level as a break would validate a bearish head and shoulders formation. Hourly resistances can be found at 1.1033 (intraday high) and 1.1099.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Resuming its declining trend.

AUD/USD has made new lows, confirming its underlying downtrend. Monitor the support at 0.8891. Resistances stand at 0.9112 (16/09/2014 high) and 0.9218 (10/09/2014 high).

In the medium-term, the break to the downside out of the 5 month horizontal range between 0.9206 and 0.9505 (bearish head and shoulders formation) calls for a further decline towards the support at 0.8891 (03/03/2014 low). A strong support stands at 0.8660 (24/01/2014 low).

Await fresh signal.

GBP/JPY

Making new multi-year highs.

GBP/JPY has broken the key resistance at 175.37 (03/07/2014 low), confirming the underlying bullish trend. Hourly supports now lie at 175.31 (intraday low) and 174.67 (12/09/2014 high).

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). Another resistance stands at 183.98 (50% retracement of the 2007-2009 decline). A decisive break of the strong support at 169.51 (11/04/2014 low) is needed to invalidate this scenario.

Await fresh signal.

EUR/JPY

Challenging a key resistance area.

EUR/JPY continues to improve after its recent bullish base formation. The key resistance area defined by the declining trendline (around 139.56) and 140.09 (see also the 200 day moving average) is challenged. Hourly supports can be found at 139.15 (intraday low) and 138.47 (15/09/2014 low).

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. The strong resistance at 140.09 (09/06/2014 high) is challenged. Another resistance can be found at 142.47 (29/04/2014 high).

Await fresh signal.

EUR/GBP

Challenging the low of its range.

EUR/GBP is approaching the low of the horizontal range defined by the support at 0.7874 and the key resistance at 0.8034. An hourly resistance can now be found at 0.7952 (intraday high). The long-term declining channel continues to favour a bearish bias.

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

The resistance at 1.2121 continues to cap prices.

EUR/CHF remains unable to break the resistance at 1.2121 (15/08/2014 high). An hourly support area can be found between 1.2081 (16/09/2014 high) and the rising trendline (around 1.2082). Another support lies at 1.2045.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future. As a result, further sideways moves are expected in the mediumterm.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Drifting lower.

Gold has broken the support at 1240, confirming an underlying bearish momentum. The support at 1219 (08/01/2014 low) is challenged. Hourly resistances can be found at 1243 (16/09/2014 high) and 1258 (09/09/2014 high).

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured. The recent break to the downside out of the symmetrical triangle confirms this scenario.

Await fresh signal.

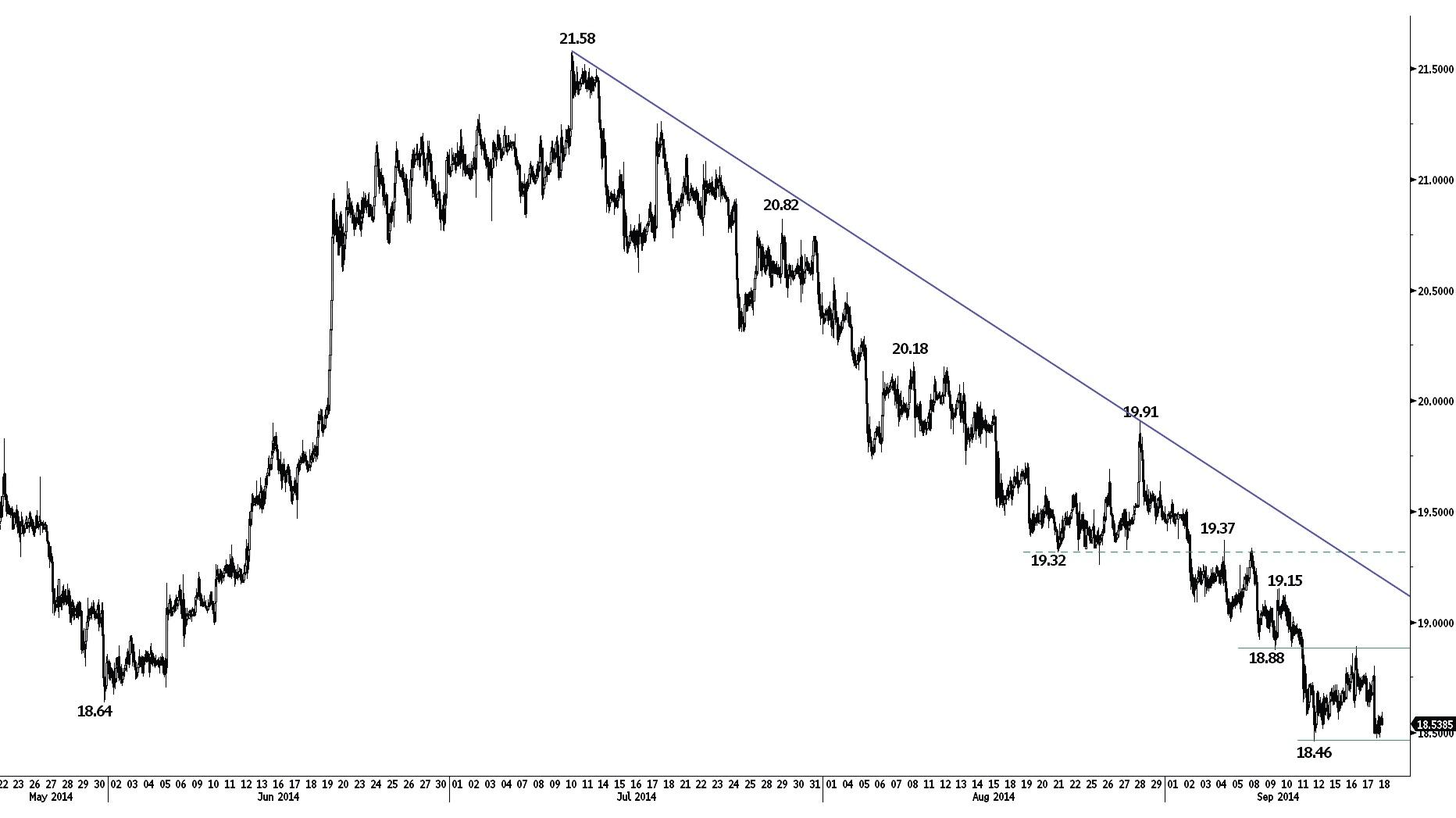

SILVER (in USD)

Remains weak.

Silver is challenging its major support area defined by 18.64 and 18.23. A break of the hourly resistance at 18.88 is needed to suggest exhaustion in short-term selling pressures. Another hourly resistance can be found at 19.15 (10/09/2014 high).

In the long-term, the underlying downtrend and the potential declining triangle underway since August 2013 favour a bearish bias despite the major support area between 18.64 (30/05/2014 low) and 18.23 (28/06/2013 low). Another support can be found at 14.64 (05/02/2010 low). A key resistance lies at 21.58 (10/07/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.