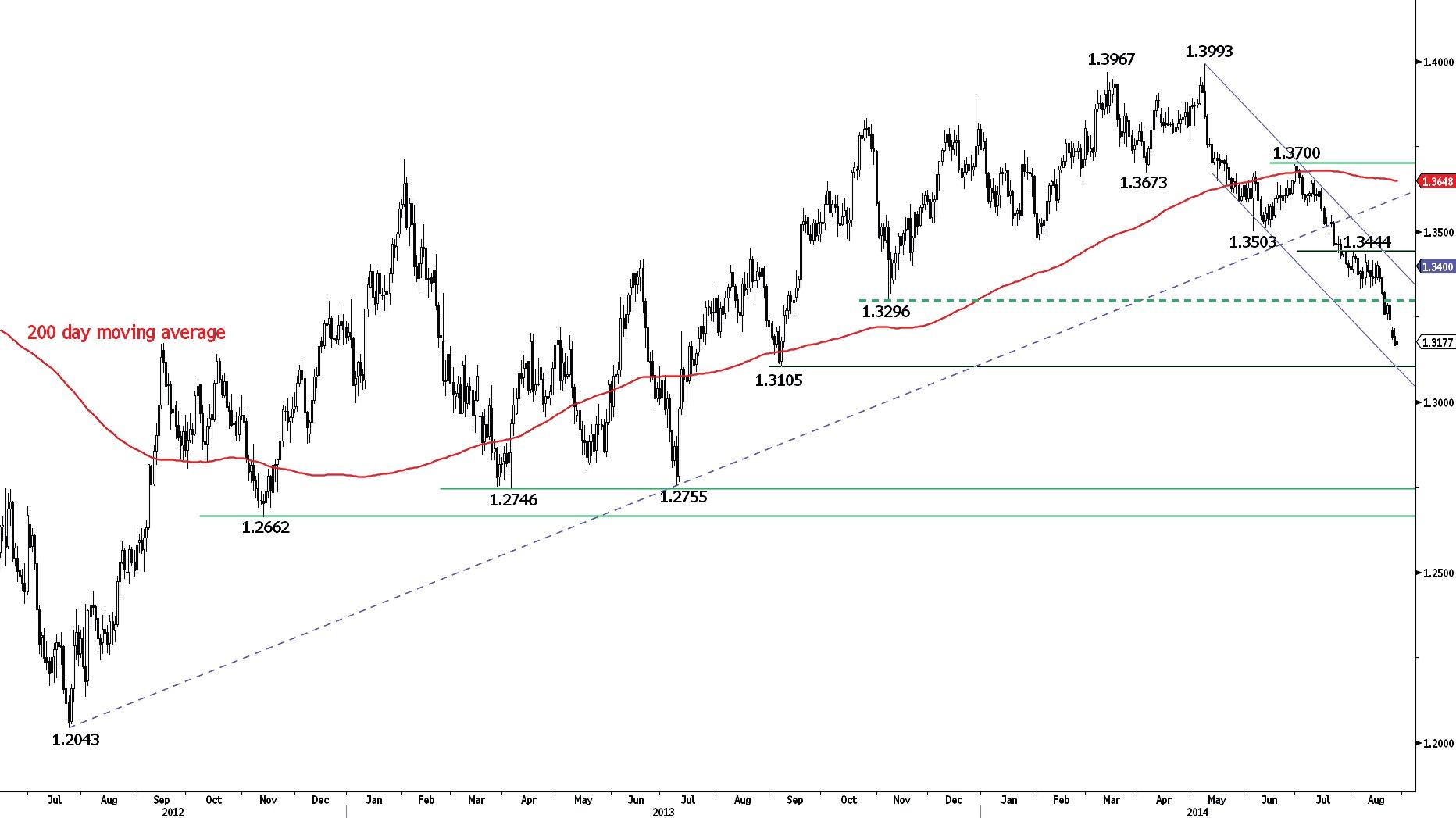

EUR/USD

Remains weak

EUR/USD made new lows yesterday, confirming persistent selling pressures. The technical structure is negative as long as prices remain below the hourly resistance at 1.3297 (22/08/2014 high). A first hourly resistance lies at 1.3220 (25/08/2014 low). A key support stands at 1.3105.

In the longer term, EUR/USD is in a succession of lower highs and lower lows since May 2014. A long-term decline towards the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) is favoured. However, in the shorter term, monitor the key support at 1.3105 (06/09/2013 low) given the general oversold conditions. A key resistance lies at 1.3444 (28/07/2014 high).

Await fresh signal.

GBP/USD

Trying to bounce.

GBP/USD made an intraday bullish reversal (hammer) on Monday. Coupled with the key support at 1.6460 and the oversold conditions, a short-term rebound is likely. An initial resistance lies at 1.6601 (21/08/2014 high). Other resistances can be found at 1.6679 (see also the declining trendline) and 1.6739. An hourly support lies at 1.6501 (25/08/2014 low).

In the longer term, the break of the key support at 1.6693 (29/05/2014 low, see also the 200 day moving average) invalidates the positive outlook caused by the previous 4-year highs. However, the lack of medium-term bearish reversal pattern and the short-term oversold conditions do not call for an outright bearish view. A key support stands at 1.6460 (24/03/2014 low).

Buy stop 2 units at 1.6611, Obj: Close 1 unit at 1.6883, remaining at 1.7165, Stop: 1.6527.

USD/JPY

Digesting its recent rise.

USD/JPY has failed to hold above the key resistance at 104.13, suggesting a weakening short-term buying interest. A break of the hourly support at 103.50 (22/08/2014 low) would confirm a deterioration of the short-term technical structure. Another support lies at 102.91 (intraday low). A resistance now stands at 104.49 (25/08/2014 high).

A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. The break to the upside out of the consolidation phase between 100.76 (04/02/2014 low) and 103.02 favours a resumption of the underlying bullish trend. Strong resistances can be found at 105.44 (02/01/2014 high) and 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Pushing above the strong resistance at 0.9156.

USD/CHF has broken the strong resistance at 0.9156. The short-term technical structure is positive as long as the hourly support at 0.9138 (26/08/2014 low) holds. Another support stands at 0.9104 (22/08/2014 low).

From a longer term perspective, the recent technical improvements call for the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. A key resistance stands at 0.9250 (07/11/2013 high).

Await fresh signal.

USD/CAD

Weakening.

USD/CAD has broken the hourly support at 1.0928 after having breached the resistance at 1.0986. The resulting false breakout favours further short-term weakness towards the support at 1.0861 (15/08/2014 low, see also the 38.2% retracement). A resistance now stands at 1.0998 (26/08/2014 high). Another support lies 1.0797.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

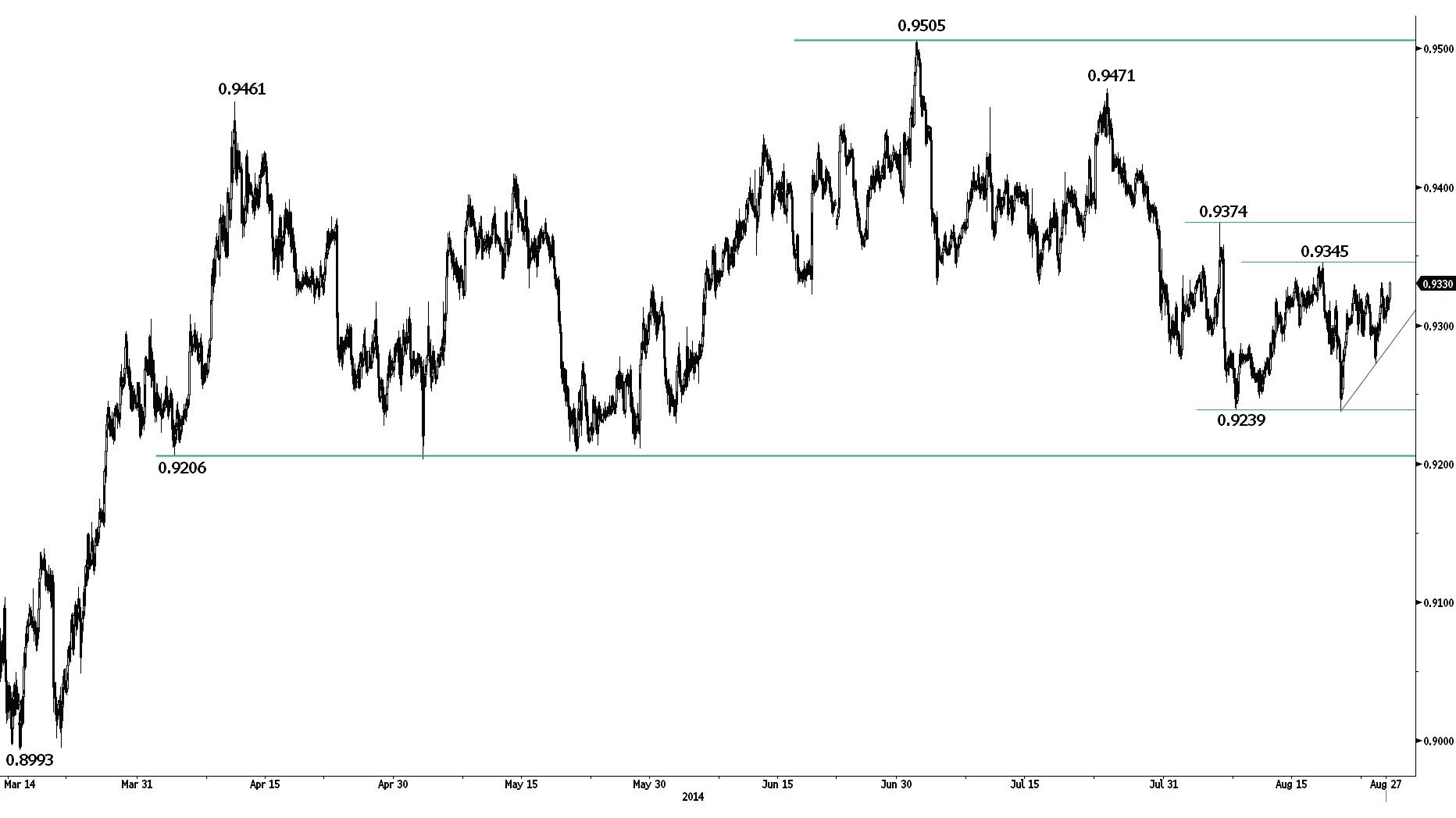

AUD/USD

Monitor the resistance at 0.9345.

AUD/USD made an intraday bullish reversal (hammer) last Thursday, confirming significant buying interest near the support at 0.9239. Monitor the resistance at 0.9345, as a break would validate a short-term double-bottom formation with a target at 0.9450. Another resistance lies at 0.9374. An hourly support can be found at 0.9272 (26/08/2014 low).

In the longer term, prices are consolidating within the range defined by the key support at 0.9206 (see also the 200 day moving average) and the key resistance at 0.9461 (10/04/2014 high)/0.9505. The current succession of lower highs since early July 2014 favours a bearish bias.

Await fresh signal.

GBP/JPY

The declining trendline has held thus far.

GBP/JPY is bouncing near the support implied by the 200 day moving average (see also the long-term rising trendline). A resistance area is given by the declining trendline (around 173.04) and 173.51. An hourly support can be found at 171.63 (22/08/2014 low).

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support at 169.51 (11/04/2014 low) holds.

Await fresh signal.

EUR/JPY

Monitor the support at 136.77.

EUR/JPY has failed to break the resistance at 138.03 and is now challenging the hourly support at 136.77 (15/08/2014 low). Another hourly support lies at 136.37 (12/08/2014 low). An hourly resistance can now be found at 137.42 (26/08/2014 high).

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. The recent successful test of the key support at 136.23 (04/02/2014 low) favours further sideways moves. A strong resistance lies at 140.09 (09/06/2014 high).

Await fresh signal.

EUR/GBP

Challenging its short-term rising trendline.

EUR/GBP has weakened after its successful test of the key resistance at 0.8034. The hourly support implied by the rising trendline is challenged. Another support lies at 0.7916. An initial resistance can be found at 0.7984 (intraday high).

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

EUR/CHF

Persistent selling pressures in place.

EUR/CHF has made new lows, confirming persistent short-term selling pressures. Supports stand at 1.2063 (10/12/2012 low) and 1.2030 (28/11/2012 low). Hourly resistances can be found at 1.2093 (26/08/2014 high) and 1.2121 (15/08/2014 high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

GOLD (in USD)

Unimpressive bounce thus far.

Gold is bouncing near the low of its symmetrical triangle (around 1272). The hourly resistance at 1292 (21/08/2014 high) has held thus far. Another hourly resistance can be found at 1304 (intraday high), whereas another support lies at 1258 (17/06/2014 low).

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured.

Await fresh signal.

SILVER (in USD)

Moving sideways.

Silver has thus far successfully tested its support at 19.32. However, the short-term technical structure is negative as long as prices remain below the resistance at 19.72 (see also the declining channel). Another support can be found at 18.99 (10/06/2014 low), whereas another resistance stands at 20.18 (08/08/2014 high).

In the long-term, the trend is negative, as can be seen by the long-term succession of lower highs since the April 2011 peak. However, a strong support area stands between 18.84 (31/12/2013 low) and 18.23 (28/06/2013 low). A key resistance lies at 22.18 (24/02/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.