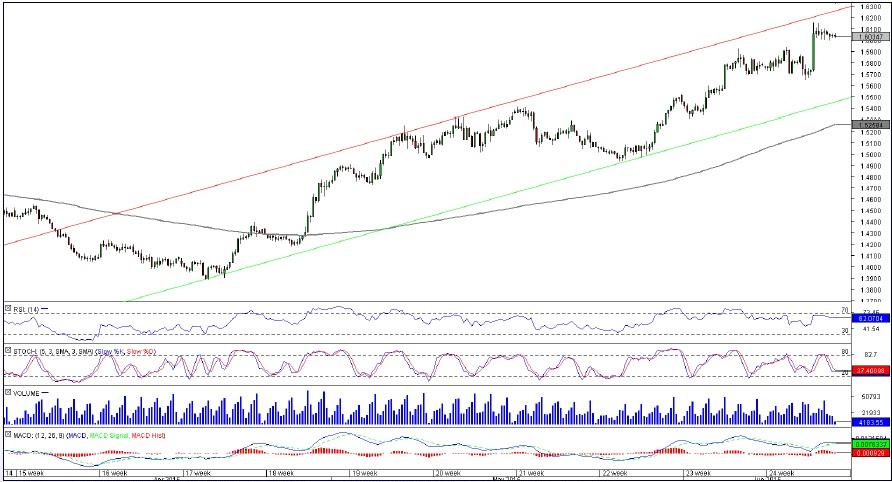

Comment: For the past two months the currency pair has been distinctly bullish, and there are good arguments in favour of the Euro appreciating further. The main reasons for a positive outlook are that the indicators are mostly pointing upwards, and there is a well-defined upward-sloping channel.

However, EUR/NZD is facing a critical resistance area around 1.6278, represented by the upper edge of the pattern and some of the late-2014 highs. This implies weakness in the short-term, but can also turn out to be the longer-term top. These concerns are reflected in the sentiment of the market participants. Right now 70% of open positions are short.

USD/DKK 4H Chart: Channel Down

Comment: Although USD/DKK is currently trading within the boundaries of a high-quality bearish channel, we should be wary of the fact that the US Dollar is currently undergoing a downward correction. This significantly increases the upside risks.

Still, there is some downward potential left. The 38.2% Fibonacci retracement of the May 2014—Mar 2015 rally is at 6.44, and we might descend down to the 50% retracement at 6.23 before the upper boundary of the patter is broken. In the meantime, the SWFX traders appear to be confident that the Greenback is going to outperform the Danish Krone: as many as 74% of open positions are long.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

USD/JPY off lows, stays pressured near 142.50 ahead of BoJ policy decision

USD/JPY has bounced off lows but remains pressured near 142.50 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.