EUR/JPY 4H Chart: Double Bottom

Comment: Notwithstanding formidability of 200-bar SMA at 138.80 that was impenetrable during almost a month started early May, EUR/JPY managed to surpass this level and now is attempting to consolidate above it. If the pair succeeds, we are likely to see a longawaited rally towards 140.09, the neck-line of the 211-bar long double bottom pattern; this may finally lead to the breakout that has been delayed for several weeks due to EUR/JPY inability to overcome the 200-bar SMA. However, market players are not so optimistic about the pair’s prospects – 50% of them hold long positions, while 50% are in favour of a bearish scenario.

AUD/CHF 4H Chart: Rising Wedge

Comment: AUD/CHF is paving the way towards a return to the 306-bar long rising wedge pattern it exited a day earlier. If the pair comes back to the formation, it will be a done primarily thanks to a strong support lent by the 200-bar SMA at 0.8359 that helped the pair to stop depreciation and acted as a prop for a current jump.

Considering the SWFX numbers, traders believe AUD/CHF will return to and prolong the pattern – almost 65% of all orders are placed to buy the instrument. Meanwhile, technical data sends mixed signals, being neutral for the short-term, warning of a possible decline in the medium-term and pointing to a strength in the long perspective.

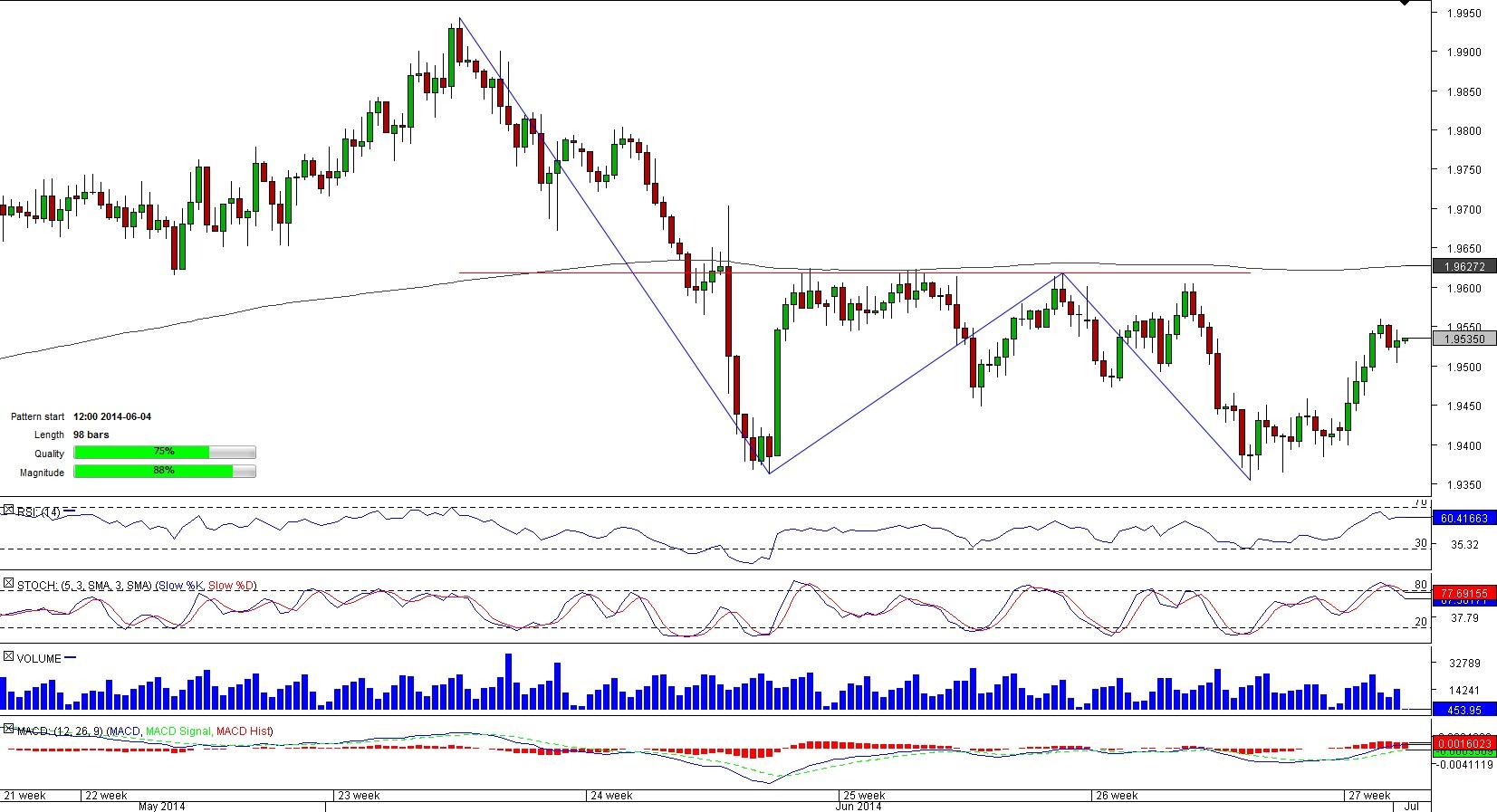

GBP/NZD 4H Chart: Double Bottom

Comment: GBP/NZD disappointed market participants by unexpectedly reversing its trend a day earlier thus moving farther from the double bottom pattern’s neck-line at 1.9618.

At the moment, the currency couple is sitting near the 50-bar SMA at 1.9502. Given that most traders have not lost faith in the pair – around 65% of them still believe the currency couple will appreciate in the hours to come – we may expect the instrument to bounce off its short-term SMA and reduce the distance from the neck-line thus confirming that a bullish breakout may be looming.

USD/RUB 4H Chart: Channel Down

Comment: More than a three-month retreat of the U.S. Dollar against the Russian Ruble now is developing inside a 89-bar long channel down pattern. The formation originated early June and pushed the pair to a five-month low of 33.54 a few days earlier.

Currently, USD/RUB is meandering just below the 50-bar SMA at 33.99 and according to the SWFX sentiment, the pair is unlikely to overcome this resistance. The SWFX data unveils almost 80% of market players are bearish on the pair, suggesting that the likelihood of the instrument extending its losing streak in the foreseeable future is high.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.