Jan US ISM came yesterday unchanged in the contraction territory below 50 at 48.2 as it has been in December versus 48 expected.

US PCE which is the Fed's favorite gauge of inflation rose by 0.6% year on year in December, after increasing by 0.5% in November with no monthly change of US consumer spending figure which accounts for 70% of US GDP versus 0.1% expected, after soaring by 0.5% in November, while the personal income rose by 0.3% in December as the same as November versus 0.2% expected.

The Fed's vice president Stanley Fischer said after the session that the next Fed's step is still unclear amid the global uncertainty adding that it is too difficult to gauge the impact on the U.S. economy from recent turmoil in financial markets and uncertainty over China.

His comments supported the Gold further and lowered the future rates of S&P 500, as they assured the Fed's worries and also uncertainty which can delay the next Fed's tightening step.

The FOMC has already indicated last week the current need for waiting and see for assessing the global economic slowdown and the financial development implications for the labor market, the inflation, and for the balance of risks to the outlook.

The RBA's decision which usually comes on the first Tuesday of each month has been followed by statement from RBA's Chief Governor Glenn Stevens saying that the global economy is continuing to grow but at slightly slower pace than earlier expected causing pressure on commodities and energy prices making it appropriate for monetary policy to continue to be accommodative.

His comments left the door opened for more easing steps to be taken and did not also give higher appreciation of the inflation which rose by 1.7% yearly in the fourth quarter of last year saying that was partly caused by declining prices for oil and some utilities, but underlying measures of inflation are also low at about 2%, with growth in labor costs continuing to be quite subdued as well, and inflation restrained elsewhere in the world, consumer price inflation is likely to remain low over the next year or two.

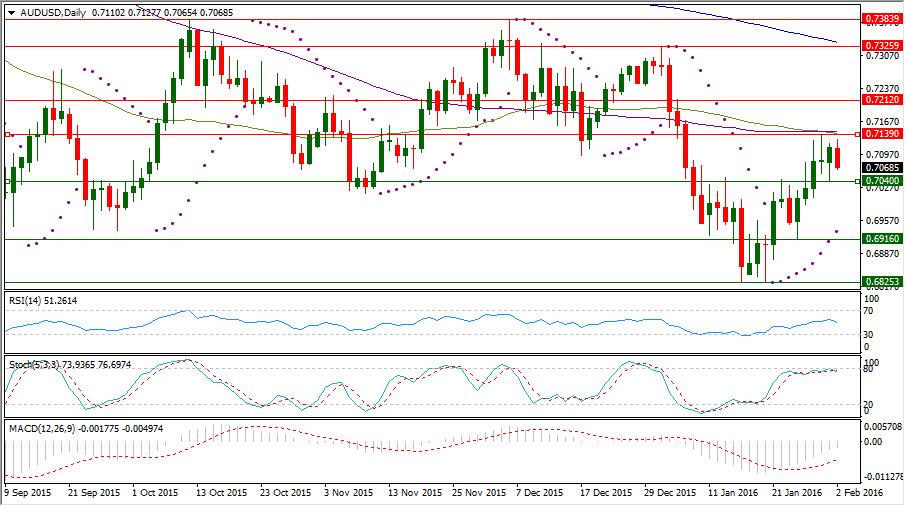

Instrument in Focus: AUDUSD

AUDUSD could rise in the beginning of today Asian session supported by the improvement in the Chinese equities market to be traded near 0.7120 but it came under pressure to fall to 0.7070, after the RBA's decision to maintain the interest rate unchanged as it has been since last May. 5 at 2%.

AUDUSD daily Parabolic SAR (step 0.02, maximum 0.2) is now its ninth day of being below the trading rate reading today 0.6934.

AUDUSD daily RSI-14 is referring now to existence in its neutral area reading now 51.261 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having its main line now in the neutral region but close to the overbought area above 80 reading now 73.936 and also its signal line which is referring to 76.697, after failing to get over 0.7139

Important levels: Daily SMA50 @ 0.7141, Daily SMA100 @ 0.7145 and Daily SMA200 @ 0.7333

S&R:

S1: 0.7040

S2: 0.6916

S3: 0.6825

R1: 0.7139

R2: 0.7212

R3: 0.7359

AUDUSD Daily Chart:

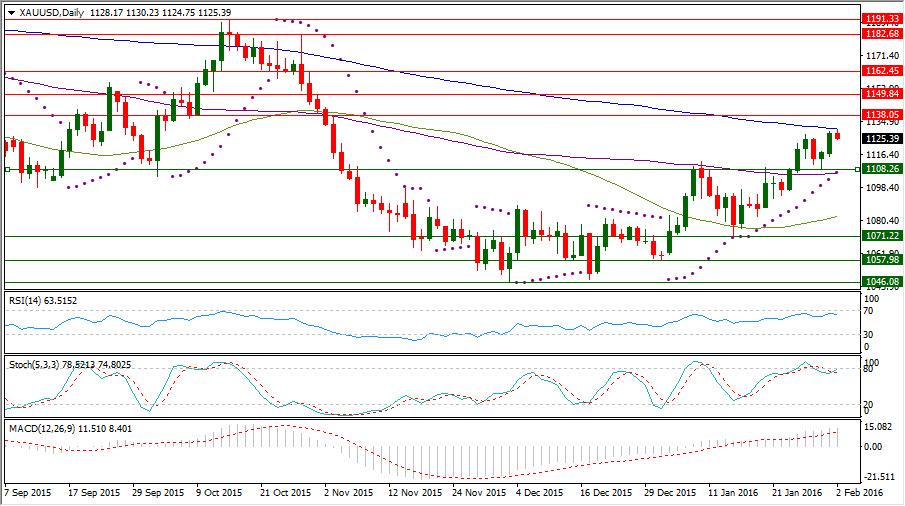

Commodities: Gold

The gold kept its creeping up to reach $1130.23 supported by lower interest rate outlook in US to be in important meeting now with it daily SMA200.

The gold could gather momentum, after getting over its daily SMA100 following surpassing $1112.75 which capped it on last Nov. 4.

$1071.22 could help the gold previously to bounce up again above its daily SMA50 forming a floor at $1057.98 which drove the gold to start being above its daily Parabolic SAR (step 0.02, maximum 0.2) for 22 consecutive days reading today $1106.56.

XAUUSD daily RSI-14 is referring now to existence in its neutral area reading 63.515, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral region but close to the overbought area above 80 reading 78.521 and leading its signal line which is reading now 74.802.

Important levels: Daily SMA50 @ $1082.33, Daily SMA100 @ $1106.11 and Daily SMA200 @ $1130.91

S&R:

S1: $1108.26

S2: $1071.22

S3: $1057.98

R1: $1138.05

R2: $1149.84

R3: $1162.45

XAUUSD Daily chart:

Hot instrument: SP-MAR16

SP-MAR16 came under pressure following Fischer's comments to fall below 1920, after facing difficulty to get higher than 1940 yesterday.

SP-Mar16 daily RSI is reading now 47.638 in its neutral region, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line into the overbought area above 80 reading 85.510, while its signal line is still unable to enter the overbought area to continue to be in the neutral region but close to the overbought area reading now 78.737.

SP-Mar16 daily Parabolic SAR (step 0.02, maximum 0.2) is referring today to 1844.24 in its eighth day of being below the trading rate, after rising extension last Friday reached 1902 on last Jan. 22.

Important levels: Daily SMA50 @ 1991.85, Daily SMA100 @ 2001.71 and Daily SMA200 @ 2035.55

S&R:

S1: 1864.50

S2: 1851.25

S3: 1836.25

R1: 1946.25

R2: 1964.50

R3: 2016.50

SP-MAR16 Daily chart:

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.