The last week has seen the Australian dollar fall very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200. This has resulted in a new multi-year low near 0.7850 in the last couple of days. Since that time, it has been able to consolidate a little and find some support around 0.7900 which has stopped the rot. A couple of weeks ago it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. A few weeks ago it drifted lower to a then multi-year low near 0.8030 before rallying higher. That low has now been broken over the last week and the area around 0.8000 to 0.8050 may now provide some resistance.

The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650. Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

It seems a long way away now but the Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

Amid calls for the Reserve Bank of Australia to cut interest rates, it’s a good idea to be clear just what problem it might be trying to solve by doing it. After all, taking the wrong medicine can make the disease worse. One ailment that’s being talked about a lot these days is deflation. And there’s no doubt that deflation – falling prices – can be very bad news. Most economists expect a small rise in the consumer price index, to be reported by the Australian Bureau of Statistics on Wednesday. But NAB’s economics team expects a fall of 0.1 per cent for the December quarter thanks largely to falling petrol prices in the wake of slumping crude oil prices. But that’s not deflation, as NAB economists Ivan Colhoun and Peter Jolly were at pains to point out in a report on Tuesday, but “negative inflation” – a dip interrupting a rising trend in prices. “It’s an important distinction: deflation is a persistent trend of falling prices, leading to delays in spending, weaker economic growth, higher unemployment and further falls in prices,” they said. True deflation can be a symptom of chronic economic weakness, with prices falling amid a lack of demand, leading in turn to unemployment, falling investment – and even more deflation. That’s not what the economy is facing now. “We think the decline in oil is mostly supply-side driven rather than demand-driven,” they said.

(Daily chart / 4 hourly chart below)

AUD/USD January 27 at 22:00 GMT 0.7937 H: 0.7974 L: 0.7906

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is trading in a narrow range around 0.7940 after dropping sharply from back above the key 0.82 level down to a new multi-year low near 0.7850. Current range: trading right around 0.7950 at 0.7940.

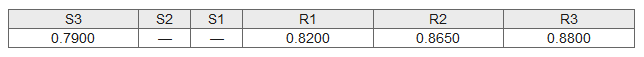

Further levels in both directions:

- Below: 0.7900.

- Above: 0.8200, 0.8650, and 0.8800.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.