It has been a very bad start for financial markets into the New Year, across the globe, with particularly strong downtrends especially in equity markets and commodities. But what makes it unique, is not only the negative returns in major asset classes but, also the increased volatility, the uncertainty and lack of forward guidance from central banks, in particular the US FED.

If you are either an intraday trader or longer term investor and have been active in the financial markets since the beginning of the year, you might have experienced, lack of conviction, directionless markets, even choppy in some cases, sentiment changing rapidly from one extreme to the other, either from one day to the other or within hours, hard to catch shorter term trends and as Bloomberg described it, we are in a period of“unprecedented uncertainty”.

Let us identify, what is fundamentally driving prices, what is the catalyst that has been affecting the markets and this will aid us to understand what is happening and where to look for high probability trades.

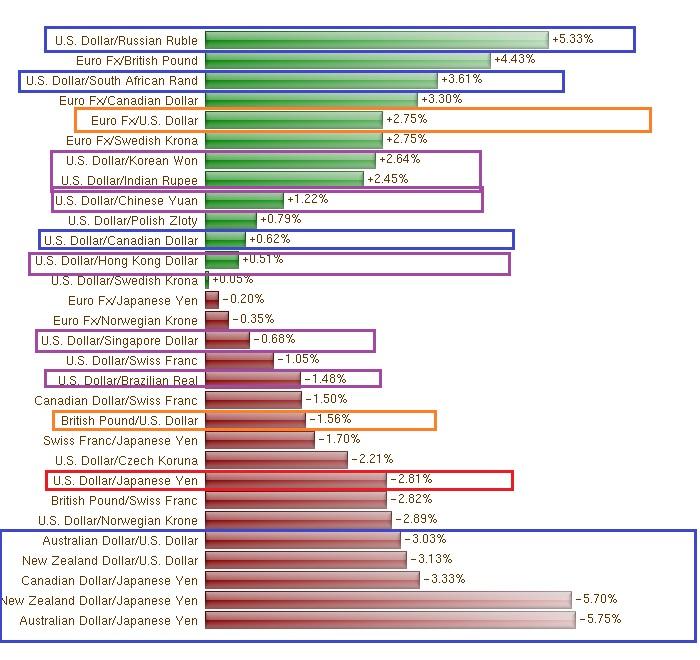

Please have a look at the chart below that shows you the YTD returns of all major currencies.

You will notice highlighted in the blue boxes that currencies from commodity producing countries like the Australian, New Zealand and Canadian Dollar, the South African Rand and the Russian Ruble, are the worst performers against the USD Dollar. Obviously, the big drop in commodities and in Crude Oil in particular has been driving GDP growth and revenues from Oil even lower, causing serious implications for the economies of those countries.

The drop in Oil cannot be attributed exclusively to production policy set by the Saudi’s or because of the Iranian Oil sold in the markets but also because of serious uncertainty regarding future growth in China. China has been devaluing its currency thus exporting deflation to the rest of the world, economic activity is seriously slowing down and that generates questions that cannot be answered at the moment.

1) Is the US FED going to switch monetary policy and shift to a more accommodative stance? Is the US economy so strong to diverge significantly against the rest of the world?

2) Is the economic slowdown in China going to affect Emerging markets, in particular across South East Asia and to what extent? Is this going to trigger a debt crisis and a strong demand for US Dollars?

That’s why as you can see in the YTD Returns table above, the US Dollar is performing better against EM currencies such as the Indian Rupee, the Korean Won and the Hong Kong Dollar.

Furthermore, the big drop in equity market across the globe in January and the strong “risk off” sentiment, caused a run for “safe haven” assets, thus we can see the Japanese Yen outperforming against commodity currencies and the US dollar. This kind of sentiment also helped the Euro to move higher against the USD, since it benefited from this climate and the risk aversion in the markets.

So, let’s put now all the catalysts that have been affecting the markets together and you will have a much clearer picture of what is happening and where to look for trading opportunities.

a) Crude Oil and Commodity trends affecting currencies

b) Concerns about Chinese Economic Activity

c) US FED Monetary Policy – Will they stick to the policy of normalizing rates or become more accommodative due to international conditions?

We don’t know where the bottom is for Oil and what are the Saudi’s and OPEC going to decide next, so we will not play that game. We also cannot fully be aware of the economic activity in China. We cannot fully determine how bad the situation is there and whether they will avoid a hard landing.

However, when it comes to the US FED we can speculate that it is not very likely inside a period of three months to change their mind and alter their monetary policy completely. In the semiannual Humphrey-Hawkins testimony this week, Yellen might adopt a softer tone and language and hint at risks derived from emerging markets and global growth concerns but, we think she will mention the temporary impact in the real economy and stick to the principle that the FOMC is data dependent.

She could also sound upbeat on the prospects of the US economy, as despite the fact that the last NFP report showed a “sticky” wage growth, there was an unexpected decline in the Unemployment rate, together with a pick up in the participation rate. Thus, an interest rate hike in March cannot completely be ruled out!

When it comes to the European Central Bank and the Bank of Japan, we have a stronger conviction and expectation regarding the future. Both the Euro and the Yen have been helped by the risk aversion trends and strengthened in the last few weeks.

But both Central Banks have currently large QE programs in place and BoJ recently introduced negative interest rates in a bid to stimulate the economy and help reach their inflation targets.

On the other hand, Mario Draghi has clearly expressed his willingness to take further action and be even more accommodative in March, since it is clear that the troubled Eurozone economy fails to reach its growth and inflation targets.

In fact, last week, Germany’s Bund yields dropped further, extending their biggest monthly drop since 2012, signaling that a an ECB rate cut in March is very likely.

Hence, despite the fact that both Euro and Yen were benefited by the risk aversion trends and the run to “safe havens”, because of the accommodative monetary policy and the drop in yields, we are looking to sell the Euro against the USD at appropriate levels and similarly buy the USD against the Yen.

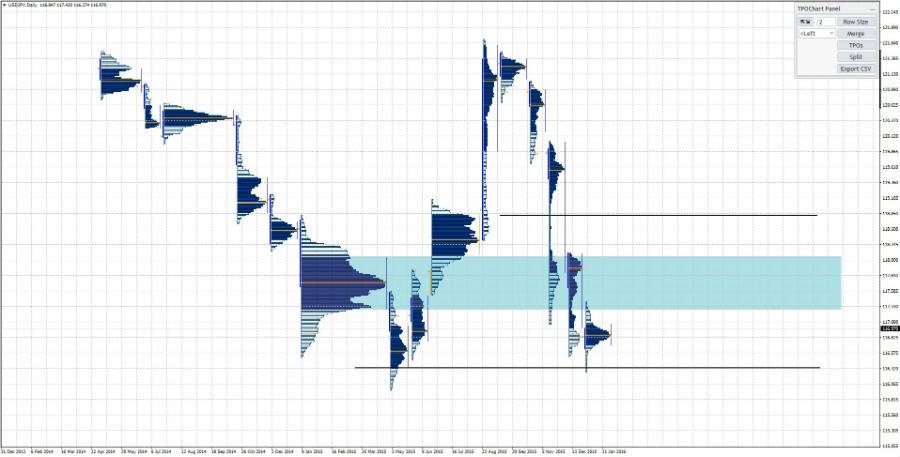

The USDJPY is a trickier trade since it is very sensitive to risk trends and global fears.

If you are willing to accept riskier (but highlyrewarding!) trades you could start looking for a long just above the 117 level with a stop just below 116. Otherwise, we will be looking to clear first the High Volume Node and buy above 118.

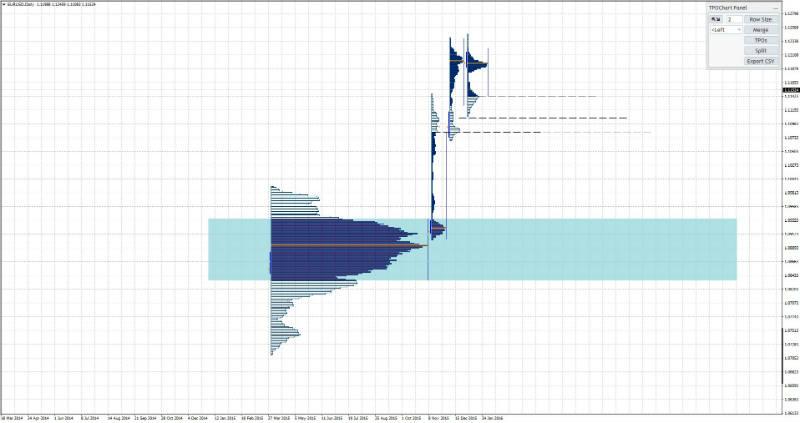

The EURUSD broke higher in an initiative move away from the High Volume Node but you can see the very thin volumes as we approach the 1.1250 area a sign that buyers lose interest in that levels, unless there is another strong catalyst.

We would like to be contrarians and fade this move dueto “dovish” monetary policy. But please take into consideration that this willbe very sensitive to Yellen’s semiannual testimony this week. Ideally, we would be looking for a consolidation, a horizontal move around these levels and trade the potential breakout to the downside when it happens.

No matter what action you decide to take and what ever your trading plan is please keep in mind this: “It doesn’t matter how often you win or lose but how much you lose, when you lose and how much you win, when you win”.

Thank you!

Fotis Papatheofanous MBA

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.