Fundamental Forecast for Japanese Yen: Bullish

Static Domestic Landscape Puts External Factors in Charge of the Yen

Year-End Flows May Drive Yen Recovery Amid Carry Trade Liquidation

Help Identify Critical Japanese Yen Turning Points with DailyFX SSI

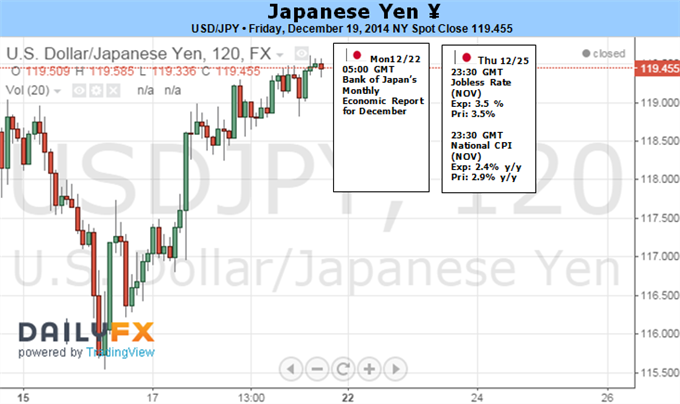

The outcome of Japan’s snap election passed without making much noise in the financial markets last week as expected. The LDP sailed to an easy victory and secured the super-majority it needed to ensure the continuity of “Abenomics”, at least through the near to medium term.

With the last Bank of Japan policy meeting of the year also behind them, investors have been left with external forces as the foremost driver of Japanese Yen price action. Seasonal capital flows stand out as the most potent potential driver on this front and may drive the unit higher in the final weeks of 2014.

Swelling risk appetite – embodied by a relentless push upward by US share prices – was a defining feature of the macro landscape over the past year. This seemed to reflect a response to Fed monetary policy: the steady QE tapering process defined a clear window in which policymakers would not withdraw stimulus.

The landscape probably won’t look as rosy in 2015. While the precise timing of liftoff for the Fed policy rate is a matter of debate, the commencement of stimulus withdrawal at some point in the year ahead seems to be a given. The prospect of higher borrowing costs may fuel liquidation of exposure reliant on cheap QE-based funding as market participants lock in year-end performance ahead of tougher times ahead.

For currency markets, such a scenario may take the form of an exodus from carry trades, which are usually funded in terms of the perennially low-yielding Japanese unit. That would imply a wave of covering on short-Yen positions, pushing prices higher.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.