This Week's Highlights

Sharp slump in German business sentiment

Sterling awaits BOE inflation report

FX Market Overview

I am sure I am not alone in feeling a part of my childhood has disappeared with the sad death of Robin Williams. I doubt the world will ever see a faster, more intelligent or funnier comedian. Robin Williams, on stage was like a tornado emitting belly laughs. RIP and Nanoo Nanoo Robin.

Monday lacked..........now what is that word..........everything. That's the word. There were too few reasons to trade on Monday so the 97% of the forex market involved in speculation was largely absent and that left rates free to wander lonely as a cloud.

This morning's swathe of inflation data from across the Eurozone enlivened things a little but a sharp drop in German business confidence was the real kick in the pants for the Euro. Add to that increased tensions in the Middle East and in Ukraine and there were enough reasons for traders to remain nervous. And we have seen some of that nervousness translate into an old school flight to quality with the strengthening of the US Dollar and the weakening of the Euro.

Monday did produce some Sterling-positive data in the report from the Council of Mortgage Lenders. They reflected another rise in mortgages in spite of the more stringent 'affordability' measures introduced over the last few months. Sterling strengthened marginally but remains twitchy ahead of Wednesday's Bank of England inflation report.

Overnight news included a report showing Australian house prices rose 10.1% in the 3 months to July compared to the same period in 2013. That's positive for the Aussie economy and reduces the chance of an interest rate cut as some analysts have been suspecting. The Australian Dollar strengthened a tad on the news.

Aside from all this, one of the saddest items any man could receive as a gift as gone on sale in Japan. The Kahei Oyasumi Bra; which translates as Floral Goodnight Bra, sounds like a very nice item until you realise it is designed for men; men with moobs or, to use the correct tile, Man Boobs. May you never be a recipient.

Currency - GBP/Australian Dollar

Some slightly more encouraging housing data has eased the pressure on the Reserve Bank of Australia. So their mooted plan to cut interest rates can be put on hold for now but the Australian economy is still in transition from its reliance on mining production and exports. That has left the Sterling – Australian Dollar at mid-point in its current trading range. There is psychological support for the Pound around A$1.80 and more substantive buying interest around A$1.79. The Aussie Dollar is clearly very attractive to buyers around A$1.82 and the channel top at A$1.84. It is hard to see any kind of break outside these ranges at the moment but Wednesday's BOE inflation report may well have some influence on that.

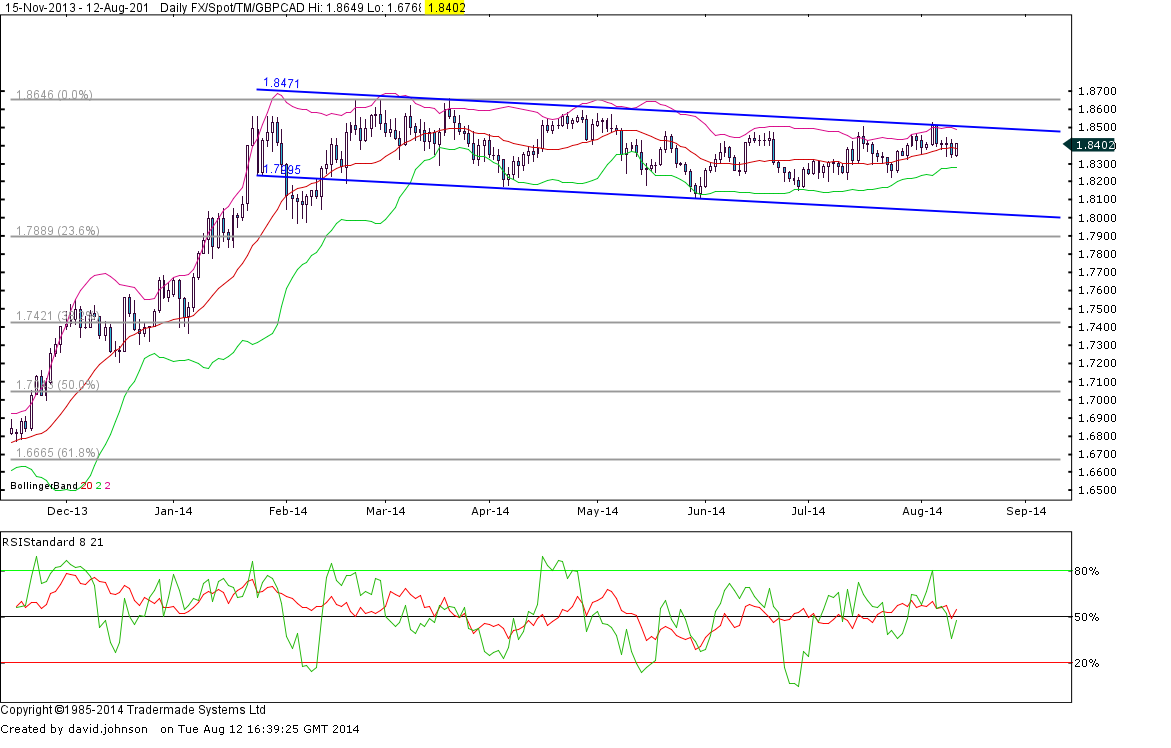

Currency - GBP/Canadian Dollar

We have seen the Pound test the top of the current trading range against the Canadian Dollar on a few occasions of late. C$1.85 is proving too hot to handle for Sterling buyers and they are selling their Pounds and buying Canadian Dollars art that level. There are also Sterling buyers out there who are happy to buy the Pound at anything below C$1.82. So we remain in the channel that has contained this pair for the whole of 2014. When we do break out – and we will at some stage; we will see a 5 cents movement above or below this channel. I suspect C$1.90 will be seen before we see C$1.75 again.

Currency - GBP/Euro

The Pound is fighting a long hard battle to try to get to €1.28 but it has failed to get there until now. The upward trend is established though and, with a fall in German manufacturing confidence and trouble in Ukraine, there is every chance we will see further weakness in the euro. €1.2740 and €1.28 will prove tough to break but, if we do see the Pound above that level, further progress towards the channel top at €1.34 is a real possibility.

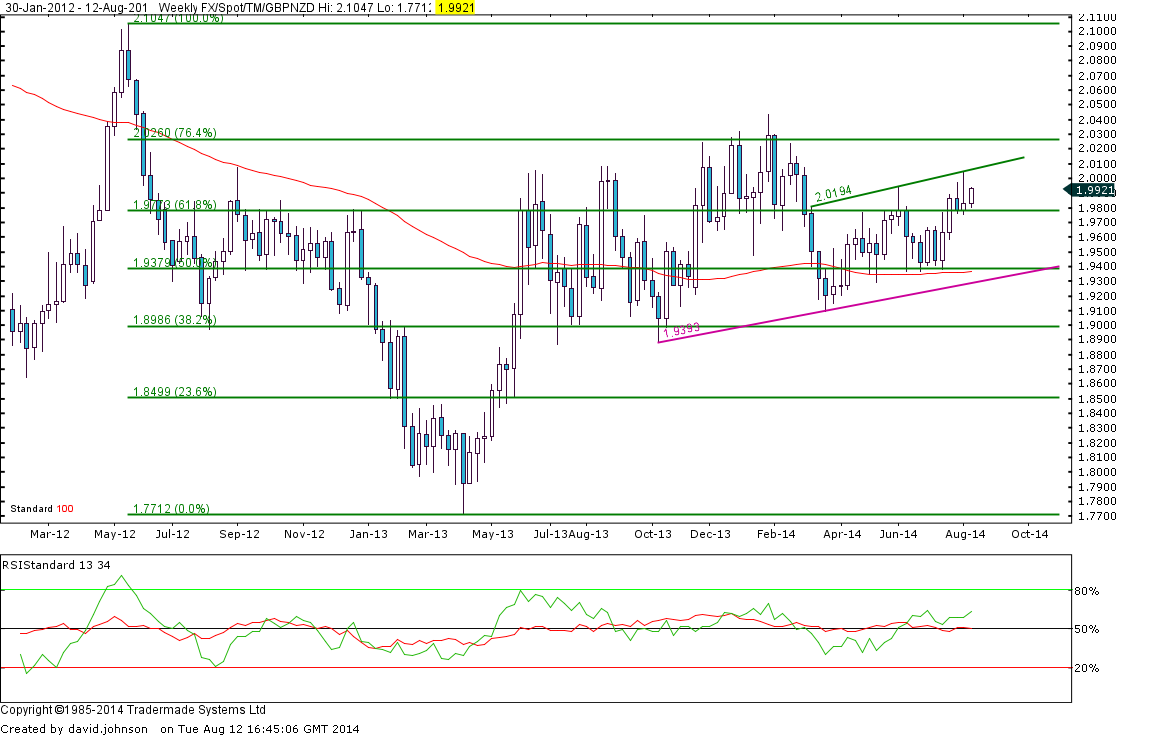

Currency - GBP/New Zealand Dollar

With the NZ interest rate rises now side-lined, we are starting to see some weakness in the New Zealand Dollar. Sterling, by way of contrast, is still gaining in popularity as the UK economy shows further signs of growth. Nevertheless, we are seeing NZD buyers happy to do so around NZ$2.00 to the Pound. That is more psychological than technical but there are a number of resistance levels between there and NZ$2.03. It appears that the upward trend; though weak, is still intact and it would appear that we will see another assault on NZ$2.03 in the weeks ahead. But don't be surprised if we see another sharp dip to NZ$1.94 before we get the big push to higher levels.

Currency - GBP/US Dollar

Sterling made good progress in moving from $1.48 to $1.72 in little over a year. There had to be some form of correction and the catalyst for that was rising tension in the Middle East and in eastern Ukraine. We haven't seen that flight to quality kind of USD strength in quite a while so it took many analysts by surprise. The Pound ought now to drop back to $1.66 or maybe even $1.63 before we see another rally but events far from the UK and US borders will be the determining factor there and who knows what may happen in those tense regions. Volatility is a cert and the outer edges of this exchange rate's trading range are $1.63 and $1.72. It's a reasonable range to work with for both buyers and sellers.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.