The Canadian dollar had a huge rebound last week, as USD/CAD plunged some 460 points. The pair closed at 1.4117. This week’s highlight is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, inflation numbers were within expectations, but Unemployment Claims surged to their highest level in 11 months. The Canadian dollar improved after the BOC surprised the markets by not cutting interest rates, and strong retail sales also bolstered the currency. However, inflation numbers remained weak, as Core CPI posted a second straight decline.

Updates:

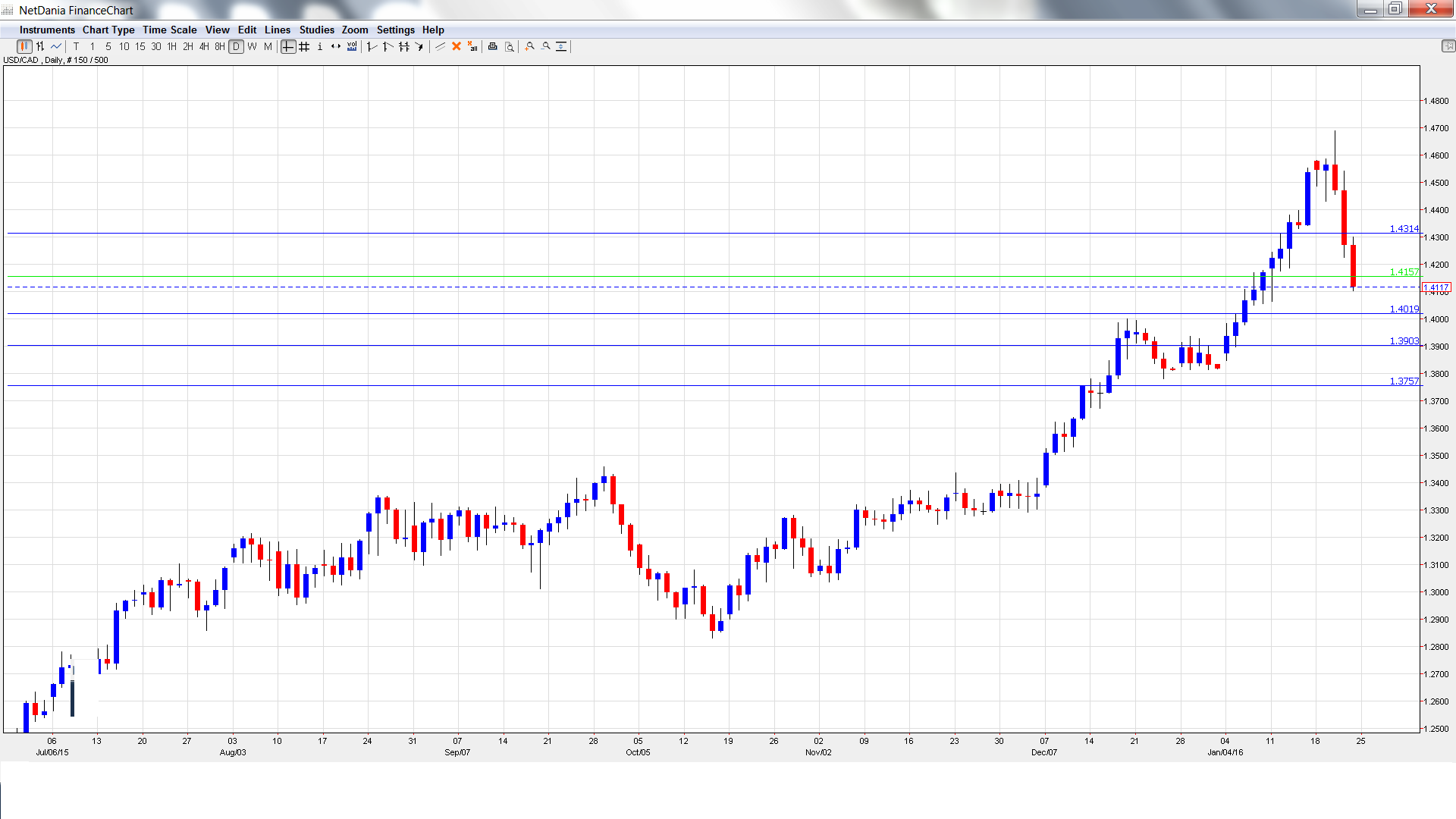

USD/CAD daily graph with support and resistance lines on it.

- GDP: Friday, 8:30. GDP is one of the most important economic indicators, and an unexpected reading can have a sharp impact on the movement of USD/CAD. In October, GDP posted a flat gain of 0.0%, shy of the forecast of 0.2%. Will the indicator push into positive territory in November?

- RMPI: Friday, 8:30. RMPI measures inflation in the manufacturing sector. The index slipped 4.0% in November, weaker than the estimate of -2.3%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.4579 and climbed to a high of 1.4690. The pair reversed directions and dropped to a low of 1.4103, breaking below support at 1.4159. USD/CAD closed the week at 1.4117.

Technical lines, from top to bottom

With USD/CAD posting sharp losses last week, we start at lower levels:

1.4480 was an important cushion in April 2000.

1.4310 is the next line of resistance.

1.4159 has switched to a resistance role following sharp losses by the pair.

1.4019 is providing support, just above the psychologically important 1.40 level.

The round number of 1.39 is next.

1.3757 is the final support level for now.

I am neutral on USD/CAD

After huge losses in recent weeks, the Canadian dollar reversed directions. Speculation about a March rate hike in the US has dampened following weak inflation and employment numbers. Still, the US economy continues to outperform the Canadian economy, and investors have not shown much appetite in 2016 for minor currencies like the Canadian dollar.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.