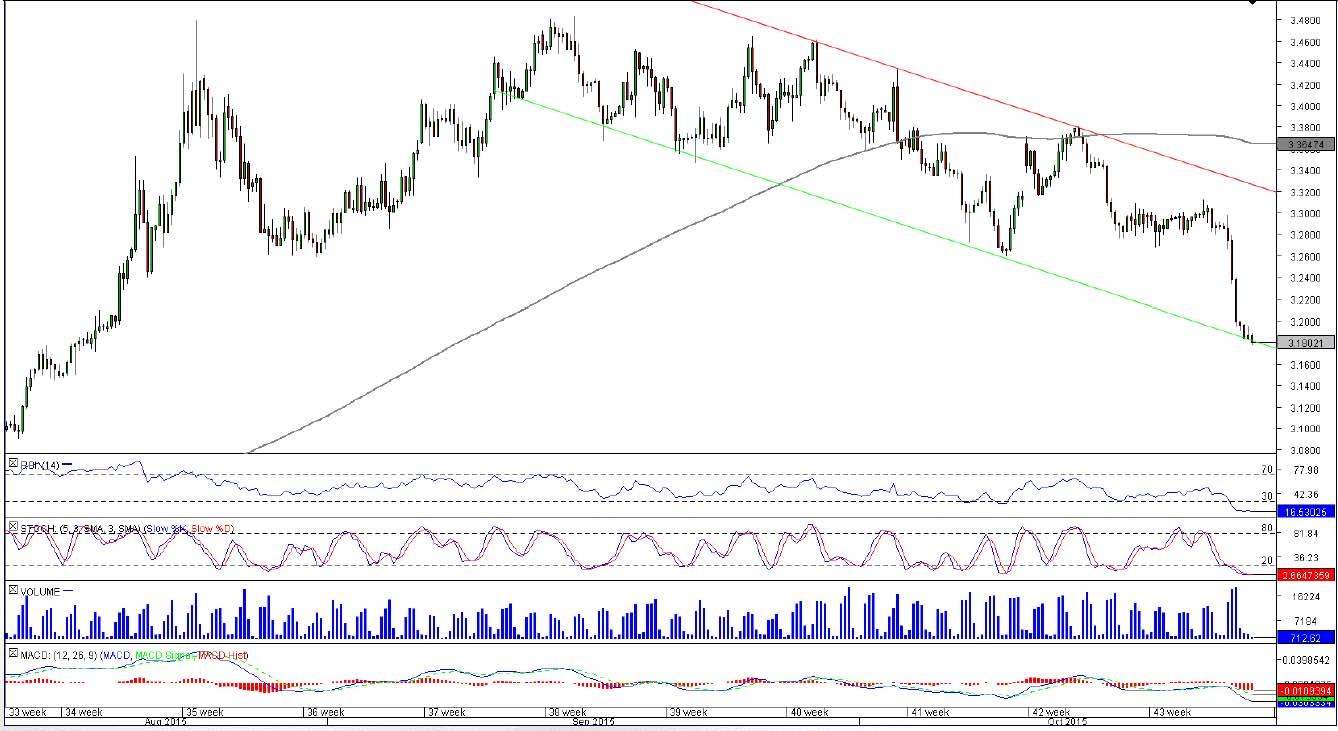

EUR/TRY 4H Chart: Channel Down

Comment: Despite a massive sell-off amid Draghi’s press conference yesterday, EUR/TRY managed to stay within the boundaries of the channel. At the moment the currency pair is trading right at the lower trend-line, meaning we should see a rally in the near term. The bullish correction is likely to result in a test of the monthly S1 at 3.2739, but the recovery may extend up to the falling trend-line without threatening the overall negative outlook. Even if the price closes above 3.3158, there is a cluster of resistances around 3.37 (Oct 14 high, monthly PP, 200-period SMA) that the pair should have trouble eroding. Our main target is the August low at 3.02.

GBP/JPY 4H Chart: Channel Up

Comment: There is a bullish channel emerging in the hourly chart of GBP/JPY. In the short run, however, the pair may face difficulties advancing beyond 186.40, where the rising resistance line merges with the monthly R1. Accordingly, we expect a decline back to 184.20 or possibly to 183.50 before the bulls regain control of the market. A close above 186.40 will imply further recovery, potentially up to the September high at 188.40. At the same time, if the pair breaches support at 183.50, the price will be expected to keep sliding lower until it hits 180.50, namely the last month’s minimum. The SWFX traders’ sentiment is strongly bullish: 70% of positions are long.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

USD/JPY trades below two-week top set on Thursday; looks to BoJ for fresh impetus

USD/JPY trades with a positive bias below the 143.00 mark as traders await the BoJ policy update before placing fresh directional bets. In the meantime, data published this Friday showed that Japan's Core CPI rose to a 10-month high in August and reaffirmed bets that the BoJ will hike interest rates again in 2024.

AUD/USD strengthens above 0.6800 on RBA-Fed policy divergence, eyes on PBoC rate decision

The AUD/USD pair trades on a stronger note near 0.6810 during the early Asian session on Friday. The uptick of the pair is bolstered by the softer US Dollar amid the prospects of further rate cuts by the US Federal Reserve this year. Later on Friday, the Fed’s Patrick Harker is set to speak.

Gold price holds steady near record peak amid bets for more Fed rate cuts

Gold price hovers near the all-time peak touched earlier this week amid a bearish USD and rising bets for more upcoming rate cuts by the Fed. Moreover, concerns about an economic downturn in the US and China further underpin the safe-haven XAU/USD.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.