The Trend Trader helps to identify the current trend status of your favorite ETF markets. It not only helps us to stay on the right side of market direction, but also helps us avoid those without a trend. You can even use the grid as a spread matrix too - buying strength and selling weakness.

Pivot Point analysis is merely a tool and should be used with other technical indicators. It can be used to enter a trade, or exit a trade and when combined with average true range is a powerful money management tool. Once you enter a trade, you are no longer a trader, you are a risk manager and should monitor your trades on a weekly or daily basis depending on volatility. When you enter a trade assume you are wrong and let the market prove you are right. This will diminish the hubris and arrogance that is common to many traders. Please use these Pivot Points as a guide to better trading.

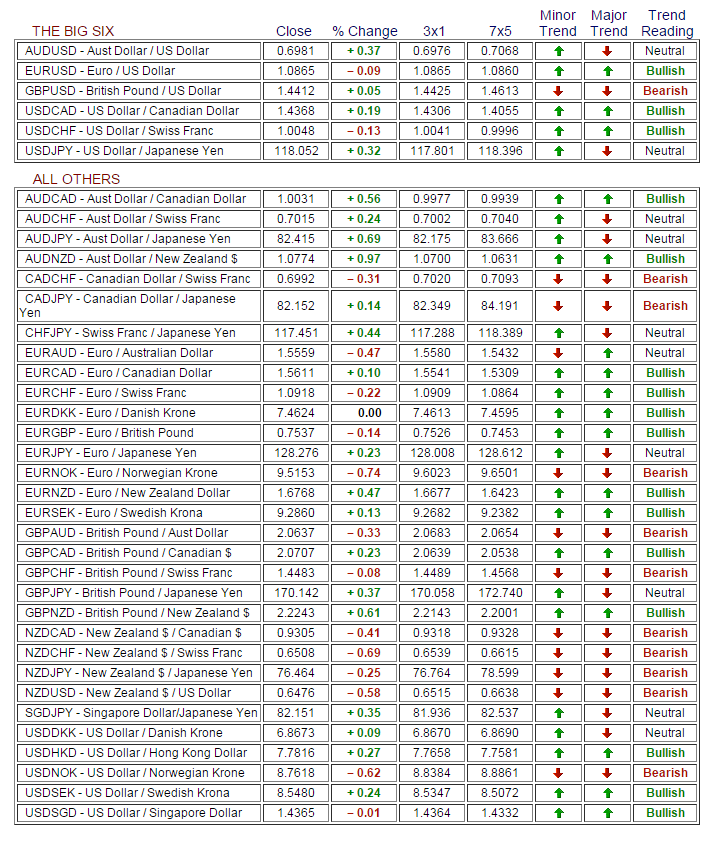

As you examine the work sheet, please note where there are two arrows confirming a trend. Be it long or short, a close must occur above or below two trend arrows to confirm a strong trend.

The short term trend is a three day moving average of the Daily Pivot. The long term trend is the Weekly Pivot. So we are comparing a short term moving average with a long term simple weekly average.

Remember, the 3x1 is a moving average of the Daily Pivot. If you are daytrading and the price of your commodity or financial instrument trades through the 3x1, you may want to stop and reverse.

Rules:

Price > than 3x1 and 7x5...Buy

Price < than 3x1and 7x5... Sell

Price > above 3x1 but < 7x5...minor buy

Price < below 3x1 but > 7x5...minor sell.

If you choose to ignore these guidelines, you will be a counter trend trader. There is usually more risk associated with trading against the trend.

You can use the grid as a spread matrix too - buying strength and selling weakness.

Pattern Trapper reports are compiled from sources believed to be reliable, but their accuracy cannot be guaranteed. There is substantial risk of loss in futures trading. There is no warranty, express or implied, in regards to the fitness of this information for any particular purpose. Past performance is not a guarantee of future results. All materials are copyright © 2009 by Bob Hunt. No part of these resources may be reproduced, stored or transmitted without the prior written permission of the copyright holder.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for 0.7000 kicks in

AUD/USD finally cleared the key 0.6800 barrier, up for the fourth session in a row on the back of the persistent downward momentum in the Greenback in the wake of the Fed’s rate cut.

EUR/USD maintains its constructive tone and targets 1.1200

EUR/USD managed to add to Wednesday’s gains and climbed to the area of weekly tops around 1.1180 following further weakness in the US Dollar as investors continued to factor in the likelihood of extra rate cuts in the next few months.

Gold maintains the upward pressure near $2,600

Following a pullback in the early American session, Gold regains its traction and trades decisively higher on the day at around $2,580. The 10-year US Treasury bond yield retreats toward 3.7%, supporting XAU/USD in the Fed aftermath.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

BoE expected to keep interest rate unchanged at 5% as price pressures persist

After a close call in August, the Bank of England’s September interest rate decision is keenly awaited for fresh cues on the bank’s future policy action and the pace of its bond sales.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.