The Euro holds positive near-term tone off fresh low at strong 1.3789 support, as the price stabilizes above 1.38 higher base, supported by daily 20SMA / Tenkan-sen line. Recovery attempts are so far limited at initial 1.3850 barrier, also 50% retracement of 1.3904/1.3789 fall and ahead of more significant 1.3860, weekly highs / last Friday’s low and Fibonacci 61.8% retracement of 1.3904/1.3789. Sustained break here that also requires to fill Monday’s gap, is required to bring bulls fully in play for eventual attempt at 1.3904, 11 Apr high and possible attack at key 1.3965 high. Hourly structure is positive, while neutral tone prevails on 4-hour studies. Break above initial barriers and near-term congestion tops is required to revive 4-hour bulls and avert risk of re-visiting 1.3800 and more important 1.3789, loss of which will be bearish.

Res: 1.3850; 1.3860; 1.3904; 1.3946

Sup: 1.3824; 1.3800; 1.3789; 1.3760

GBPUSD

Cable eventually broke above multi-month congestion tops at 1.6820 and trades at levels last time seen in 2009. However, marginal break higher requires today’s close above 1.6820, to confirm bullish resumption of the bull-leg from 1.4812, July 2013 low and open 1.6877, November 2009 peak and 1.6900 in extension. Sustained break higher is required to shift focus towards psychological 1.7000 barrier and key longer-term resistance at 1.7041, August 2009 peak. Overall picture remains bullish and keeps the upside favored, with corrective dips to face initial support at 1.6780 higher base. Key near-term support lies at 1.67 base and only break here would sideline near-term bulls.

Res: 1.6836; 1.6877; 1.6900; 1.6950

Sup: 1.6780; 1.6768; 1.6750; 1.6725

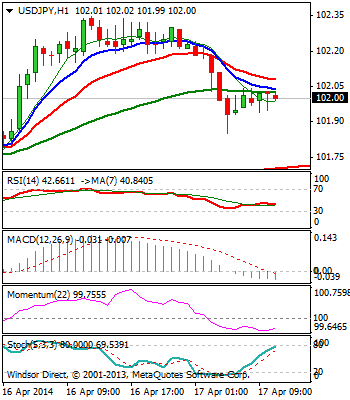

USDJPY

Acceleration above near-term congestion top at 102.00 failed to clear 102.38, Fibonacci 38.2% retracement of 104.11/101.31 descend and daily Ichimoku cloud top, as rally stalled here. Subsequent return to the levels below 102 handle, now support, retraced 50% of larger 100.74/102.35 ascend, would signal false break and risk further weakness, if the price slides below 101.70, Fibonacci 61.8% retracement / bull-trendline drawn off 101.31 low. Negative hourly studies support such scenario. However, positive tone, persisting on 4-hour chart, would keep the upside favored if the price stabilizes above 102 handle and renewed attempt higher breaks above 102.38, minimum requirement to confirm bear-term base at 101.31 and allow for stronger recovery. Strong resistance and breakpoint lies at 103 zone, Fibonacci 61.8% retracement of 104.11/101.31 descend / daily Ichimoku cloud top, where possible stronger rallies should be capped , as larger picture bears remain in play.

Res: 102.38; 102.71; 103.00; 103.29

Sup: 101.85; 101.70; 101.50; 101.31

AUDUSD

The pair trades in near-term consolidative mode after corrective attempt off fresh low at 0.9331, 50% retracement of 0.9204/0.9460 upleg, stays capped under psychological 0.9400 barrier. Near-term technicals are neutral, with break of 0.94 barrier required to confirm higher base and re-open fresh high at 0.9460. Otherwise, the downside would remain at risk in the near-term, with loss of 0.9331 temporary support, expected to trigger fresh extension of corrective pullback from 0.9460, towards 0.9300 breakpoint, Fibonacci 61.8% retracement / previous peaks of 28 Mar / 01 Apr, loss of which to sideline near-term bulls in favor of stronger correction.

Res: 0.9400; 0.9424; 0.9460; 0.9500

Sup: 0.9351; 0.9331; 0.9300; 0.9253

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.