The US and Switzerland have a respectable trade relationship, but nothing out of the ordinary. About 10% of US exports, totaling £35.3 billion are destined for Switzerland and about 8% of Swiss exports, totaling £47 billion are destined for US markets. The top US exports to Switzerland are precious metals, pharmaceutical products, arts and antiques, medical equipment and Aircraft . Agricultural products include tobacco, soybean, tree nuts, wine and beer. As far as Swiss exports to the US, top products include pharmaceuticals, optic and medical instruments, clocks, watches and machinery. Agricultural products included snack foods, chocolate, cheese and coffee.

Switzerland ranks 14/15 as an export/import partner; a healthy trade no doubt, but there’s nothing critical or strategic in the mix. In fact, a stronger US Dollar would make Swiss consumer staple and discretionary products more price competitive in the US market. On the other hand, aircraft orders, for example Boeing products, span years from the date of the order to physical delivery and usually currency hedged; hence, a strengthening US Dollar will have little effect in Swiss markets. Specifically, the US and Switzerland do not have a competitive nor strategic trade partnership.

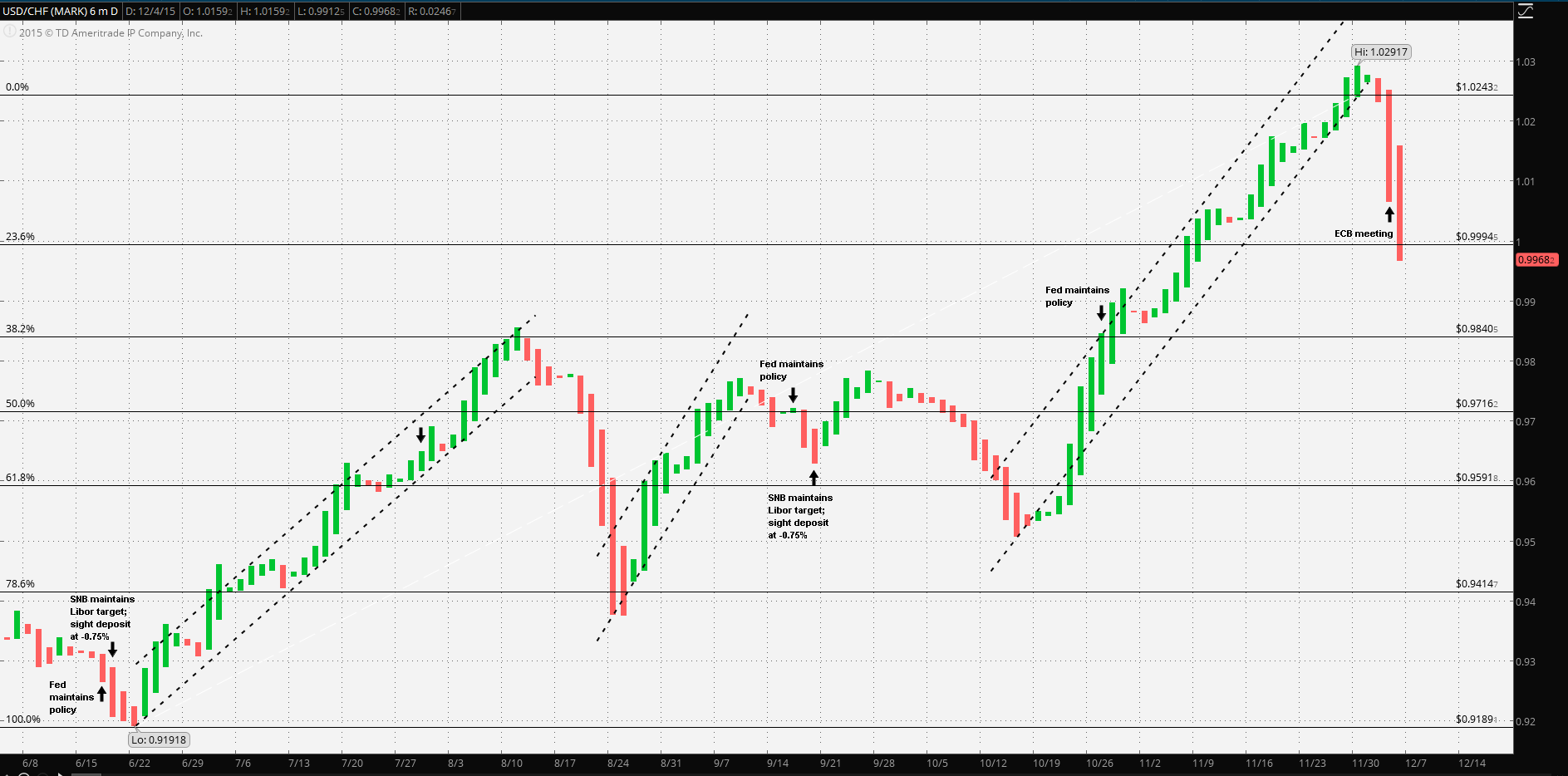

Switzerland is legendary for being an asset ‘safe haven’. As such, its reputation contributes to unwanted capital inflows, driving yields lower and strengthening the Franc well beyond what the SNB considers acceptable. As an aside, Switzerland does not stand alone as a wealth safe-haven. Denmark, committed to its ERM II agreement has fought of ‘waves’ of capital inflows in early 2015. Danmarks Nationalbank has accumulated record foreign currency reserves in its efforts to keep the Krone pegged to the Euro and within its ±2.5% range. Sweden, an EU member and Norway, a member of the European Free Trade Association have also experienced capital inflows. On 3 December, the ECB announced a 10 basis point reduction on overnight deposits, -0.30%, expand its asset purchase program beyond €60 billion monthly (no specifics yet) and to reinvest dividends earned from its purchased asset portfolio; hence a weaker Euro, stronger Franc.

What might have the greatest impact on those safe haven nations, although indirectly, is the announced plans to purchase “...euro-denominated marketable debt instruments issued by regional and local governments located in the euro area in the list of assets that are eligible for regular purchases by the respective national central banks ...” An interesting example of what might result from a lack of liquidity is that of Sweden’s Riksbank asset purchase program. The lack of liquidity, surprisingly, drove yields higher, creating demand and strengthening the Krona (refer to Bloomberg link below). The point is that even the less than expected ECB action announced at the 3 December press conference will most certainly create market demand for the specified assets, further reducing fixed income market liquidity with the possibility of an unexpected result. In particular, after the initial market reaction, the Euro exchange rates may, in short order, return to the pre 3 December rates. (N.B.: The unexpected reaction in the Swedish fixed income market may actually serve as a scaled down model which demonstrates that market liquidity has boundaries limiting the effectiveness of asset purchases). In any event, in order to preserve trade balance parity, the ECB action will require those export economies of non-Eurozone and non-EU nations, e.g. Switzerland, to react so that their efforts, to date, will not be undone.

Hence, it’s reasonable to expect that without any significant or strategic nor competitive connection in the Switzerland-US trade relationship, the fact the SNB will act determinedly to weaken the Franc and the expected effectiveness of the additional ECB QE measures, it’s unlikely that the Franc will continue to strengthen against the US Dollar.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.