The Australian dollar has enjoyed a surge higher in the last 24 hours moving from its consolidation zone just below 0.73 up to a two week high above the previous key level at 0.74. The 0.74 level has kicked in as resistance and has sent the AUD/USD back under where it is presently trading. Over the last month the AUD/USD has fallen sharply which culminated in a new six year low near 0.7200 towards the end of last week. It has spent the last week trading right around the key 0.73 level after enjoying some support from around 0.7260. before its recent surge higher. For the best part of the last few weeks the AUD/USD has traded in a narrow range between 0.74 and 0.75 with the former providing reasonable support and the latter providing stiff resistance during this time. It had been relying upon support at 0.74 and testing this level however this has now been broken and the AUD/USD has been consolidating around the 0.73 level for the last week or so. Back at the end of June the Australia dollar was starting to feel some selling pressure from the 0.77 level and it had its eyes firmly focused on the long term support level at 0.76.

In the first half of June the Australian dollar surged higher from below 0.77 up to a three week high, however it ran straight into resistance at the key 0.7850 level, which has performed this role several times this year. Throughout this time it also spent most of its time trading quite steady around the 0.7750 level whilst receiving solid support from 0.77. Over the last couple of months the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion.

Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150. For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels.

(Daily chart / 4 hourly chart below)

AUD/USD August 4 at 23:40 GMT 0.7380 H: 0.7428 L: 0.7263

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the Australian dollar is easing back below 0.74 after surging higher to above 0.74. Current range: trading right around 0.7380.

Further levels in both directions:

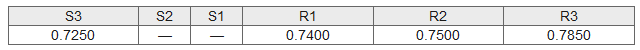

- Below: 0.7250

- Above: 0.7400, 0.7500, and 0.7850.

Recommended Content

Editors’ Picks

USD/JPY off lows, stays pressured near 142.50 ahead of BoJ policy decision

USD/JPY has bounced off lows but remains pressured near 142.50 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.