Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,140, and profit target at 1,980, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): bullish

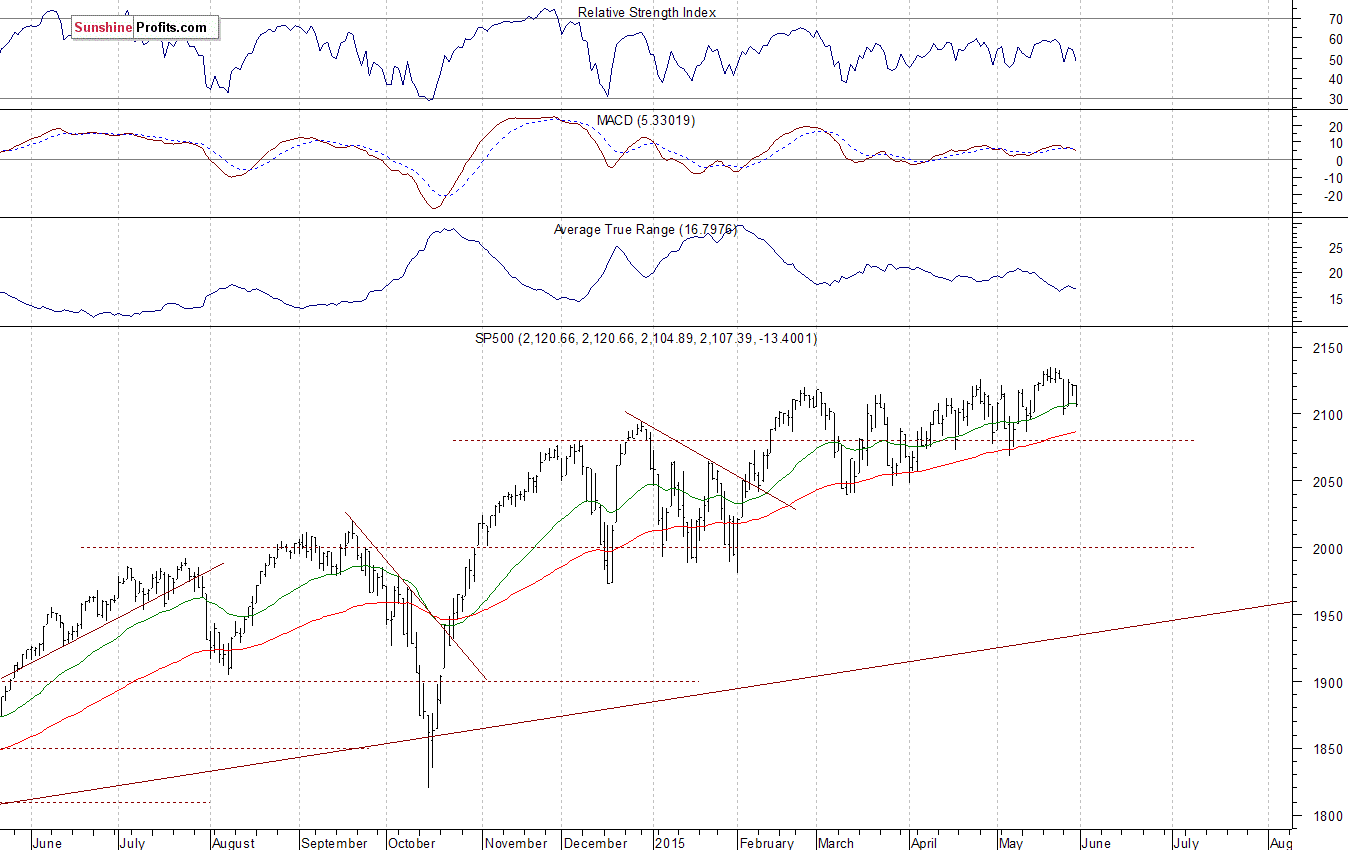

The U.S. stock market indexes lost 0.6% on Friday, as investors reacted to worse-than-expected quarterly GDP number release, among others. The S&P 500 index remains relatively close to its May 20 all-time high of 2,134.72, as it fluctuates along the level of 2,100. The nearest important level of resistance is at around 2,130-2,135, and support level is at 2,100. There have been no confirmed negative signals so far, however, we can see negative technical divergences:

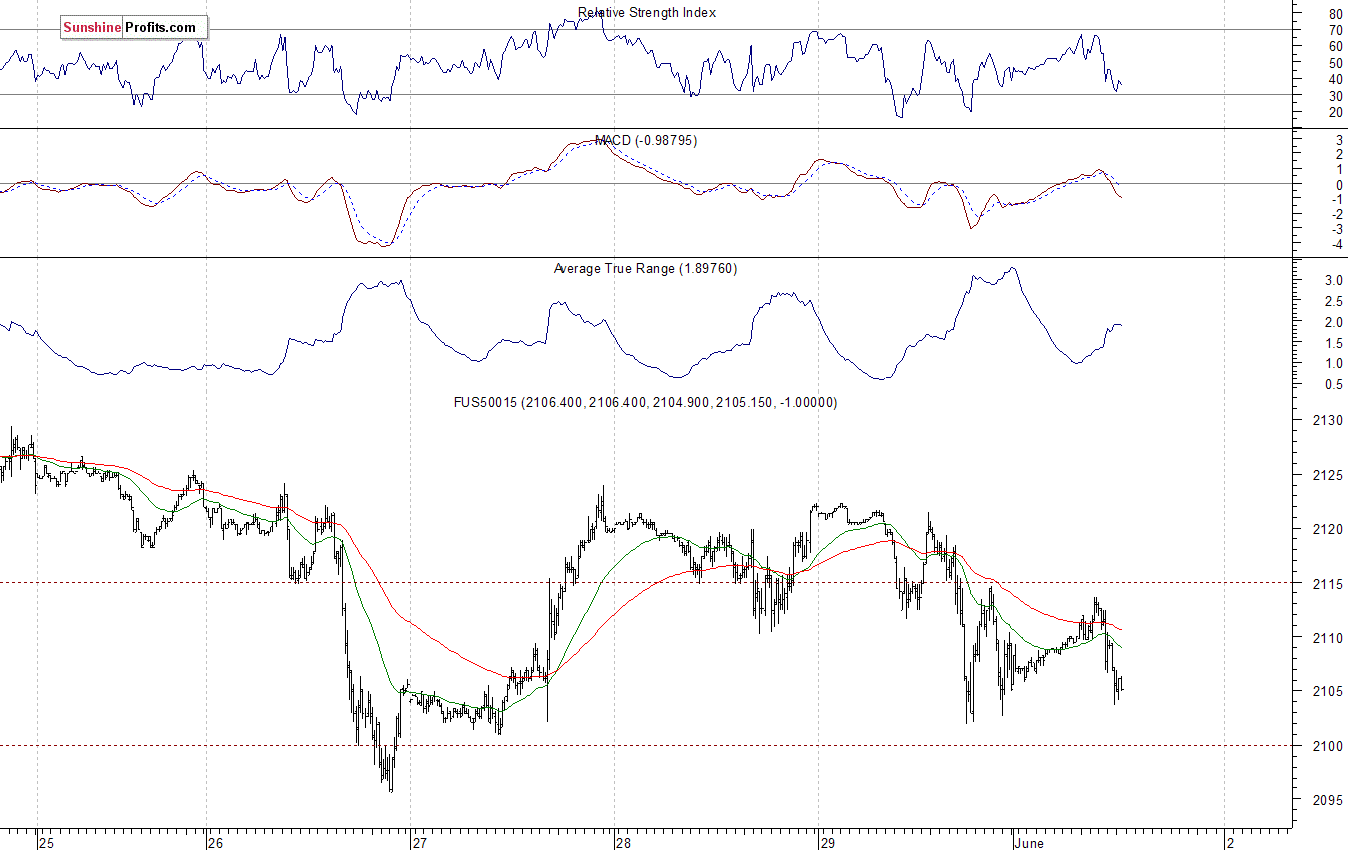

Expectations before the opening of today's trading session are virtually flat, with index futures currently up 0.1%. The main European stock market indexes have lost 0.1-0.5% so far. Investors will now wait for some economic data announcements: Personal Income, Personal Spending, PCE - Prices Core number at 8:30 a.m., ISM Index, Construction Spending at 10:00 a.m. The S&P 500 futures contract (CFD) trades within an intraday consolidation, following Friday's move down. The nearest important level of resistance is at around 2,110-2,115, marked by local highs. On the other hand, support level is at 2,100, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) fluctuates along the level of 4,500, following recent decline. The nearest important level of resistance is at around 4,530, and support level is at 4,495-4,500, marked by local lows, as we can see on the 15-minute chart:

Concluding, the broad stock market extended its short-term consolidation on Friday, as the S&P 500 index got closer to the level of 2,100 again. There have been no confirmed negative signals so far. However, we continue to maintain our speculative short position (2,098.27, S&P 500 index), as we expect a downward correction or an uptrend reversal.

Stop-loss is at 2,140, and potential profit target is at 1,980. You can trade S&P 500 index using futures contracts (S&P 500 futures contract - SP, E-mini S&P 500 futures contract - ES) or an ETF like the SPDR S&P 500 ETF - SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

USD/JPY drops toward 142.00 ahead of BoJ policy decision

USD/JPY has turned south, approaching 142.00 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold price treads water below record peak, awaits Fedspeak

Gold price hovers below the all-time peak touched earlier this week amid a bearish US Dollar and rising bets for more upcoming rate cuts by the Fed. Concerns over an economic downturn in China keep the safe-haven Gold price afloat. Fedspeak remains on tap.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.