Daily Forecast - 02 December 2015

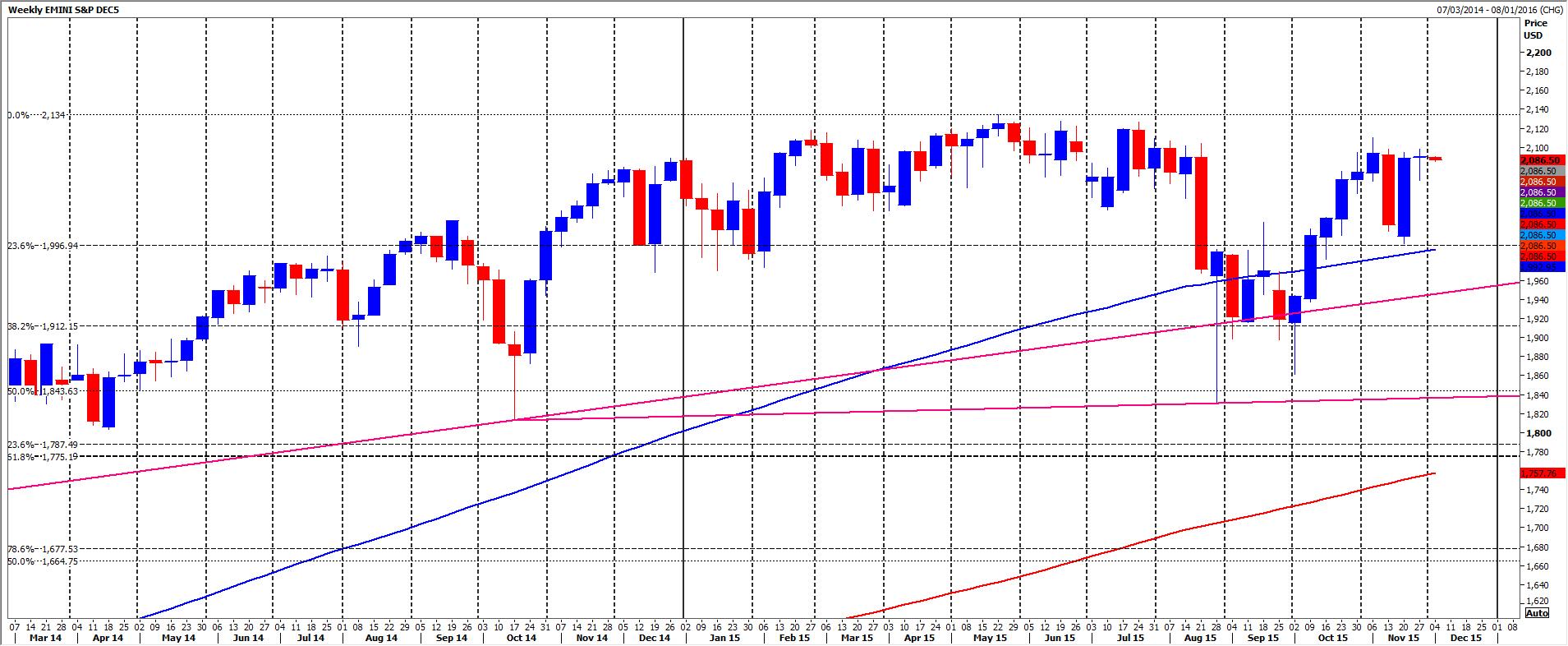

S&P December contract

Emini S&P will need to hold above 2093/94 to maintain gains & re-target 2097/98. On further gains this week look for August highs at 2104/07. If we continue higher look for a selling opportunity at trend line resistance & November highs at 2109/10. Try shorts with stops above 2114. A break above here would be a buy signal however to target 2120 & July highs at 2126.

Failure to hold 2093/94 targets support at 2088/87, but below here strong support at 2079/78 is a buying opportunity with stops below 2072.

Emini Dow Jones December contract

Emini Dow Jones hold above 17830/840 but strong resistance at 17880/890 remains the main challenge for bulls this week. Shorts again need stops above November highs at 17906. A break higher however is a buy signal despite overbought conditions & targets 18020, 18055 & July highs at 18075. If we continue higher look for 18108/112 then June highs at 18165/179.

First support at 17775/770 again today but below here risks a slide to better support at 17695/685. On a break lower look for 17640/630 & perhaps as far as a buying opportunity at 17575/565. Longs need stops below 17515.

Dax December contract

Dax will need to hold above 11250/240 to keep bulls in control of the 2 month recovery & re-target 11360/370. We need a sustained break above here to build on strong 2 week gains & re-target 11430/440. Despite severely overbought conditions a break higher cannot be ruled out & targets 11464 then 11480/485. This could hold a rally today but above here look for 11530/535.

First support at 11250/240 is the most important of the day. Longs need stops below 11200. A break lower is a short term sell signal in overbought conditions & targets quite good support at 11070/060. A bounce from here is likely on the first test at least, perhaps as far as 11230/240 for a selling opportunity. However be ready to sell a break below 11045 to target a good buying opportunity at 10940/930.

E Mini Nasdaq December contract

Emini Nasdaq not much to stop a retest of the year's high at 4727/29 now. This is the most important level of the day of course & a high for the day always possible in severely overbought conditions. A break & close (preferably 2 days) above here however finally provides some direction & targets levels not seen for over 15.5 years: 4749/51 then 4775.

First support at 4706/03 but below 4700 risks a slide to 4692/90. If we continue lower look for support at 4685/84.

Eurostoxx December contract

EuroStoxx first support at 3475/3470 is the most important of the day once again. A break below 3460 is a short term sell signal & targets 3450 then good support at 3434/30 which should hold the downside today.

Above 3495 is more positive & re-targets 3525 then minor resistance at 3530/32. If we continue higher look for 2 month trend line resistance & much stronger 11 month trend line resistance at 3555/65. This area is the main challenge for bulls this week.

Ftse December contract

FTSE closed above last week's high 6400/05 but strong 5 month trend line resistance at 6425/30 is the main challenge for bulls today. Watch for a high for the day here. It is only a break above November highs at 6438 that is a buy signal again to target October highs at 6467/68. We should struggle here but further gains at 6490.

Although a close near the high of the day is a positive signal, we are severely overbought so there is a risk of profit taking today. Failure to beat strong 5 month trend line resistance at 6425/30 targets 6409/06 then first support at 6396/93. If we continue lower look for better support at 6379/76. Longs need stops below 6365. Look for the next target & support at 6348/45. Try longs with stops below 6330.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.