Good Morning Traders,

As of this writing 4:30 AM EST, here’s what we see:

US Dollar: Down at 99.370 the US Dollar is down 375 ticks and trading at 99.370.

Energies: December Crude is up at 42.04.

Financials: The Dec 30 year bond is up 17 ticks and trading at 154.12.

Indices: The Dec S&P 500 emini ES contract is up 24 ticks and trading at 2085.50.

Gold: The December gold contract is trading up at 1074.80. Gold is 61 ticks higher than its close.

Initial Conclusion

This is a not a correlated market. The dollar is down- and crude is up+ which is normal but the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading up which is not correlated. Gold is trading up which is correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded higher. As of this writing all of Europe is trading lower.

Possible Challenges To Traders Today

- Unemployment Claims are out at 8:30 AM EST. This is major.

- Philly Fed Manufacturing Index is out at 10 AM EST. This is major.

- CB Leading Index m/m is out at 10 AM EST. This is major.

- Nat Gas Storage is out at 10:30 AM EST. This could move the Nat Gas markets.

- FOMC Member Lockhart Speaks at 12:30 PM EST. This is major.

Currencies

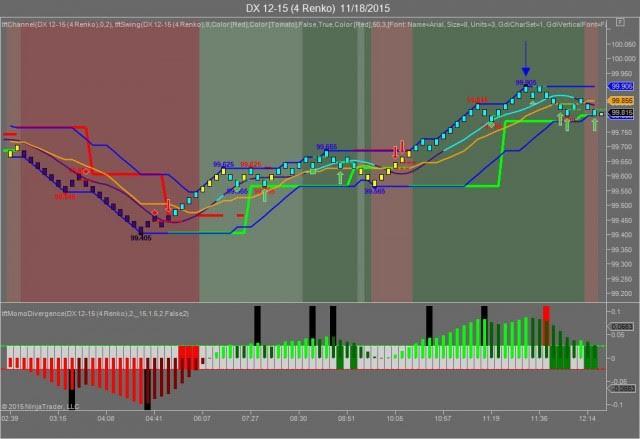

Yesterday the Swiss Franc made it’s move at around 11:30 AM EST after the economic news was reported. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at around 11:30 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 11:30 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted about 15 ticks on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus the $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was to the downside as Crude and Gold were trading higher and usually this is a downside signal. The markets however had other ideas as the Dow gained 248 points and the other indices gained as well. Today we aren’t dealing with a correlated market and our bias is neutral.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday at 2 PM EST everyone on TV was dissecting the Fed Meeting Minutes from October to determine if whether or not the Fed will raise rates next month. Every analyst to a person said “yes” the Fed will raise however the Meeting Minutes were quite vague on this. Instead they gave the same language they’ve been using for quite some time now; namely that the Fed will raise when conditions warrant a hike. Contrary to this we are suggesting that if the Fed raises it will happen in 2016, not 2015 and the reason is they’ll want an entire years worth of data and they can’t do that in December. Secondly Janet Yellen strikes me as a pragmatic person. I don’t think she’ll want to do anything in December that will curtail Holiday spending and raising rates at such a time will do that. Lastly the Fed doesn’t want to be accused of being the Grinch at Christmas time and throw a monkey wrench into 2015 GDP which raising rates can do. Lastly we need to analyze who’s behind the market upswing when interest rates are hiked; it’s the Smart Money at work again…

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

USD/JPY trades below two-week top set on Thursday; looks to BoJ for fresh impetus

USD/JPY trades with a positive bias below the 143.00 mark as traders await the BoJ policy update before placing fresh directional bets. In the meantime, data published this Friday showed that Japan's Core CPI rose to a 10-month high in August and reaffirmed bets that the BoJ will hike interest rates again in 2024.

AUD/USD strengthens above 0.6800 on RBA-Fed policy divergence, eyes on PBoC rate decision

The AUD/USD pair trades on a stronger note near 0.6810 during the early Asian session on Friday. The uptick of the pair is bolstered by the softer US Dollar amid the prospects of further rate cuts by the US Federal Reserve this year. Later on Friday, the Fed’s Patrick Harker is set to speak.

Gold price holds steady near record peak amid bets for more Fed rate cuts

Gold price hovers near the all-time peak touched earlier this week amid a bearish USD and rising bets for more upcoming rate cuts by the Fed. Moreover, concerns about an economic downturn in the US and China further underpin the safe-haven XAU/USD.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.