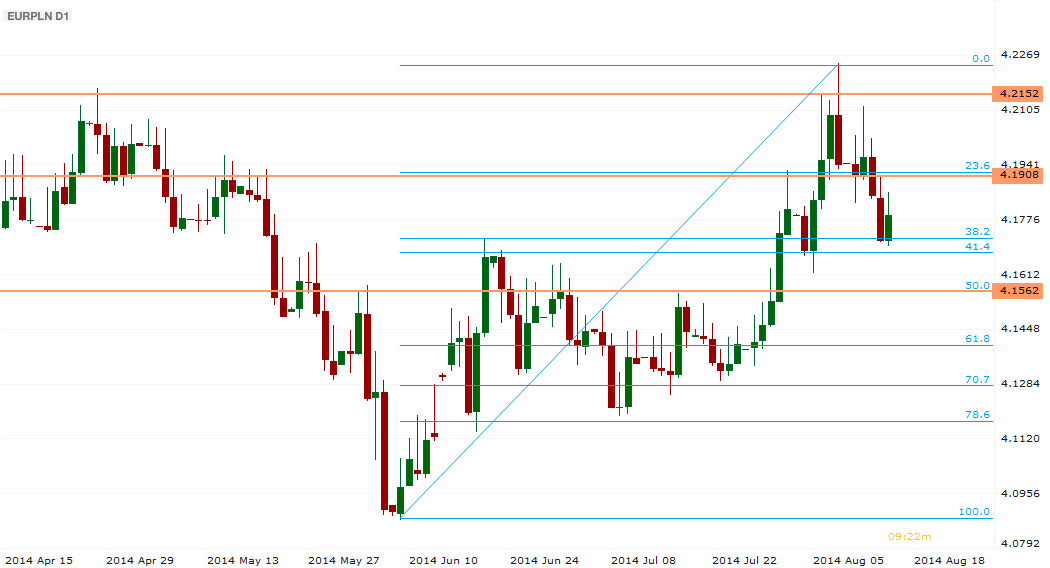

Polish Zloty (EUR/PLN) – Deflation strikes Poland

It has been a tough week for the Polish Zloty. It was affected not only by the still uncertain situation in Ukraine, but also by local macro data. The CPI reading for July (yearly basis) showed -0,2% which means the economy is experiencing deflation. Will the MPC react? It should have reacted some time ago since with the current economic growth, deflation was just a matter of time. Still, it is not expected to last long. Yet again, the central bank might decide to take action despite the fact interest rates were expected to remain unchanged till the end of the year. On the other hand, GDP grew by a solid 3,2% in the second quarter (slightly below the forecasted 3,3% increase). In this environment, the Zloty regained some ground it has been losing for the last couple of weeks.As we see on the chart, the EUR/PLN was unable to break 4.2150 (April highs) last week although Euro bulls tried really hard. The market turned around and it is heading towards the 4.17 area (41.4% retracement level of the last upward move). This level should be a strong support and if broken the EUR/PLN will target 4.16. The closest resistance is at 4.19 and if broken, the market should head back towards the 4.2150 highs.

Pic.1 EUR/PLN D1 Chart

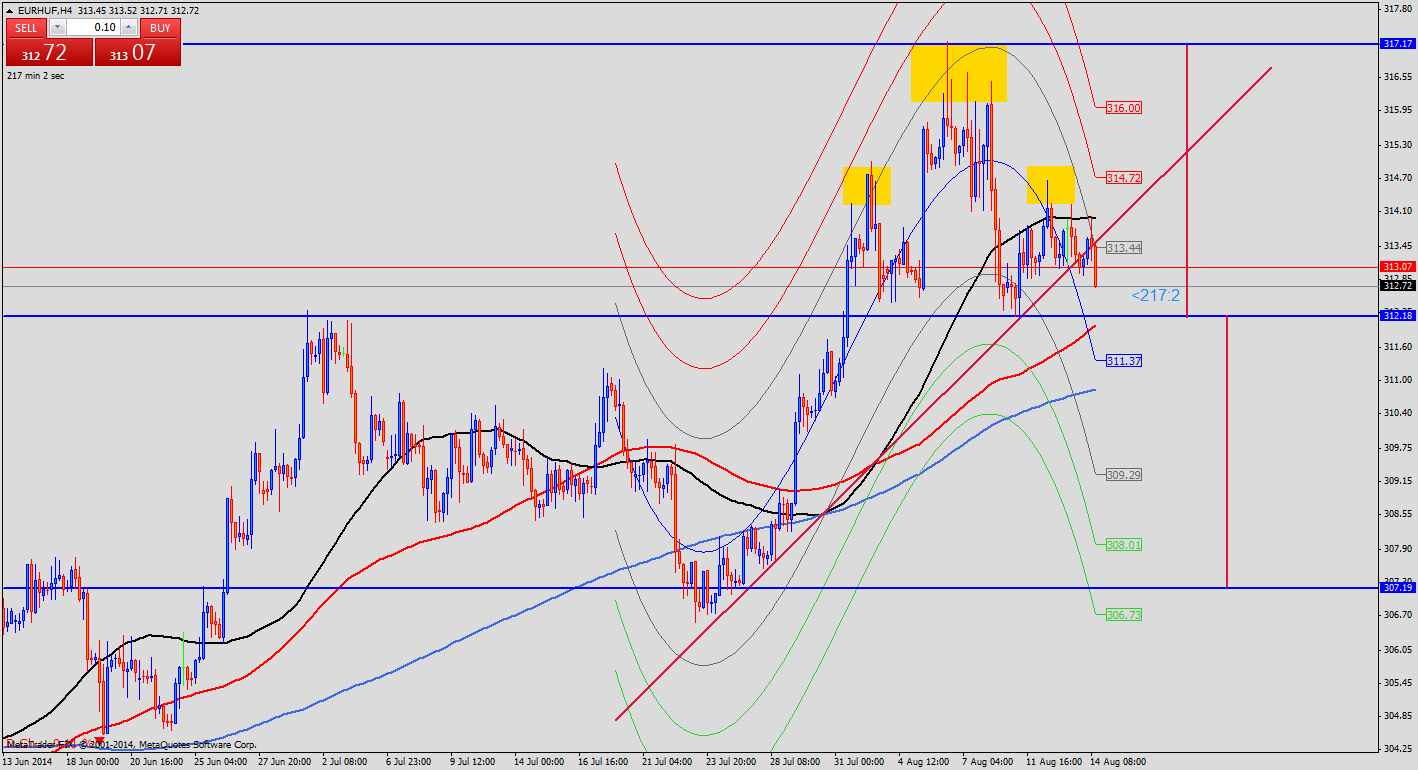

Hungarian Forint (EUR/HUF) – Good news with small correction

This week begins with small moves on the EURHUF chart as hardly anything happened on the chart until Thursday. First of all inflation data brought some volatility for the Forint pairs as Hungary's consumer price index rose 0.1 percent (y/y) in July. After three months this is the first time when the data is back to positive territory. Good news for the Forint! What is more, the “big fish” is just coming now, the Hungarian GDP data. Output of the economy grew by 3.9% (y/y) in second quarter of 2014. It was only the first estimate so the publication does not include the factors behind the growth. Anyway this value pushed the Forint bulls to 1 month high as EURHUF dropped to 310. Unfortunately the conflict between Russia and Ukraine is the biggest external factor weighing on the forint, and the central bank’s communication isn’t helping either. In this case we cannot be sure about that the Hungarian currency can keep this strenght thoroughout August.Technical analysis displays a recognizable head and shoulders chart pattern with a 307 target. We can see the upward trend broke and under the 312 levels more pullbacks could coming.

Pic.2 EUR/HUF H4 Chart

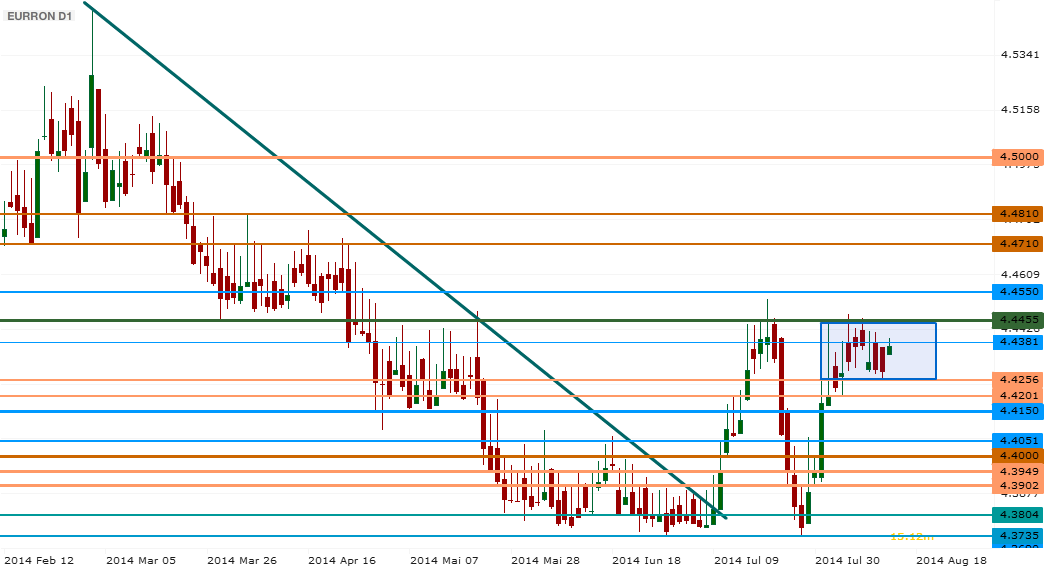

Romanian Leu (EUR/RON) – The Leu withstands depreciation fundamental pressure

The Romanian Leu appears to be in the center of a field of forces very comfortable with the vicinity of 4.45, but not decided to push on the upside. The National Bank view faforing a weaker RON is helped by a CPI reading that brought the y/y advance to a meager 0,95% while in July prices fell by 0.05% versus June. The trade dynamics also have been one of faster imports and a bit slower outbound trade, with a score of 9.2% to 5.4% June 14/June 13. And the GDP declined by 0.2% in Q2 vs. Q1 sending the country in a very surprising “technical” recession – that is however estimated to be brief, with the annual GDP target set above 2%. The currency is however favored by its traditional status of a calmer field especially with the continued worries over Ukraine, and compares positively to the trends in Hungary over the medium term. As the market digest even more the current stream of data, and the NBR rate cut to 3.25% earlier this month, the RON may go through a period of small relative strength, possibly pushing EURRON below 4.42 next week. But one should not be carried away with enthusiasm, and keep in mind that some speculators and the NBR would be happy with a weaker RON.In the technical perspective, the 200 points consolidation pattern below 4.4455 stands as an upper bound in the larger picture of the 4.3735 - 4.4455 lateral design. Is there enough strength to break on the upside? Not for now apparently. A move below 4.4256 may easily lead to a test of 4.4150 and then 4.40. However in the longer term we feel that a break of the 4.4455 boundary is probable, leading to a push higher towards (at least) 4.4710.

Pic. 3 EUR/RON D1 Chart

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.